|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

据密码分析师Maartunn称,来自3-5岁乐队的8,511 BTC在最后一天移动了链上。

![在比特币的[BTC]价格上涨中,长期持有人开始移动硬币。 在比特币的[BTC]价格上涨中,长期持有人开始移动硬币。](/uploads/2025/05/22/cryptocurrencies-news/articles/bitcoin-btc-price-surge-term-holders-starting-move-coins/682e8a1f3faed_middle_800_480.webp)

Long-term Bitcoin [BTC] holders are starting to move their coins amid the cryptocurrency's price surge, data from blockchain analytics firm CryptoQuant showed.

区块链分析公司CryptoQuant的数据显示,由于加密货币的价格飙升,长期比特币[BTC]持有人开始移动硬币。

Over the last day, 8,511 BTC from the 3-5 year age band moved on-chain. The latest move marked the 22nd instance this year in which over 5k BTC from this cohort has been reactivated.

在最后一天,来自3-5岁乐队的8,511 BTC移动了链。最新举动标志着今年第22个实例,该实例已重新激活该队列的5K BTC。

Source: CryptoQuant

资料来源:加密

The reactivation led to a rise in the 90-day Coin Days Destroyed (CDD). This suggests that, as Bitcoin's price climbs, older coins are being redistributed, potentially reaching new market participants.

重新激活导致90天的硬币日被破坏(CDD)。这表明,随着比特币的价格上涨,重新分配了较旧的硬币,可能会吸引新的市场参与者。

In the past day, CDD spiked from 5 million to 29 million, signaling fresh demand. Additionally, average dormancy fell from 42 to 33, indicating that new buyers are actively entering the market.

在过去的一天中,CDD从500万到2900万,这表明了新的需求。此外,平均休眠量从42下降到33个,表明新买家正在积极进入市场。

Source: CryptoQuant

资料来源:加密

According to CryptQuant analyst Maartunn, the latest movement of old Bitcoin appears to have originated from Grayscale, which transferred the BTC to newly created addresses.

据密码分析师Maartunn称,旧比特币的最新动作似乎起源于灰度,将BTC转移到新创建的地址。

However, it remains uncertain whether this volume reflects actual ownership changes or an internal adjustment.

但是,尚不确定该卷是反映实际所有权变化还是内部调整。

Historically, Grayscale's ETF flows have sometimes been negative, and these movements may be linked to upcoming or recent outflows.

从历史上看,灰度的ETF流量有时是负面的,这些运动可能与即将发生的或最近的流出有关。

Still, Exchange Netflow data suggests this transfer is likely an internal reshuffling, meaning the reactivated BTC has not been deposited into exchanges.

尽管如此,Exchange NetFlow数据表明,这种转移可能是内部改组,这意味着重新激活的BTC尚未存放到交换中。

Source: CryptoQuant

资料来源:加密

Exchange Netflow shows that Bitcoin has recorded three consecutive days of negative value. A sustained period of negative netflow indicates markets are seeing more withdrawals than deposits, which is usually a bullish signal.

Exchange Netflow显示,比特币连续三天记录了负值。持续的负网络持续时期表明,市场的提款比存款更多,这通常是看涨的信号。

Looking at CDD, it currently sits at 23.8 million, a decline from 29 million. This marked a 6 million drop over the last day. A drop here suggests that large holders have started to reduce their expenditure after the recent surge.

从CDD看,目前处于2380万,从2900万美元下降。这标志着最后一天下降了600万。这里的一滴水表明,在最近的激增后,大型持有人已经开始减少支出。

This is often interpreted as bullish, as long-term holders are starting to take a step back in the market.

这通常被解释为看涨,因为长期持有人开始退后一步。

Impact on BTC

对BTC的影响

While the movement of old coins can raise concerns, this recent transfer was not directly deposited into the exchanges.

尽管旧硬币的运动可能引起人们的关注,但这种最近的转移并未直接存放在交易所中。

The reactivated Bitcoin remains in private wallets, meaning it has not negatively affected price action. Accumulators still dominate the market, reinforcing a bullish outlook.

重新激活的比特币仍留在私人钱包中,这意味着它没有对价格行动产生负面影响。累加器仍然主导着市场,增强了看涨的前景。

However, if Grayscale decides to sell these coins, it could trigger outflows and push BTC down to $104K. On the other hand, if current conditions persist, Bitcoin's uptrend is likely to continue, potentially surpassing $107K and reaching $108K.

但是,如果Grayscale决定出售这些硬币,它可能会触发流出,并将BTC降至104K美元。另一方面,如果当前状况持续存在,比特币的上升趋势可能会持续下去,可能超过107,000美元,达到108,000美元。

Bitcoin price movements for the past 72 hours. Credit: Benzinga

过去72小时的比特币价格变动。学分:苯金加

Despite the crypto behemoth's resilience, a substantial shift in the 3-5 year old band could herald a change in the market dynamic. A sustained period of coin movements from this band, especially if channeled into exchanges, might exert downward pressure on BTC.

尽管加密庞然大物的韧性具有弹性,但3-5岁乐队的实质转变仍可以预示市场动态的变化。从该频段进行的硬币运动持续的时期,尤其是在交换中,可能会对BTC施加向下压力。

Conversely, if the large-scale coin movements continue without impacting the exchanges, it bodes well for Bitcoin's continued ascent.

相反,如果大规模的硬币动作继续而没有影响交流,则它对比特币的持续上升效果很好。

Stay tuned to Benzinga for more crypto coverage.

请继续关注Benzinga,以获取更多加密货币。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

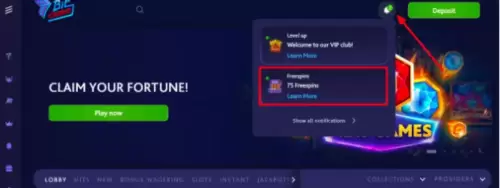

- 7bit赌场是2025年最好的加密赌场

- 2025-05-22 17:10:15

- 找到合适的加密赌场可能是一个挑战,尤其是对于寻求安全和有意义的游戏体验的玩家。

-

-

-

-

- 比特币超过了以前的历史最高水平,超过了100,000美元

- 2025-05-22 17:00:13

- 全球最大的加密货币触及109,760.08美元,持续1.1%,至108,117美元。

-

- AI代理部门以戏剧性的速度增长

- 2025-05-22 17:00:13

- 该行业的总市值在过去24小时内攀升了近3%,截至2025年5月21日,该行业的总资本化达到了108.7亿美元。

-

-

- 澄清我早期参与运动项目

- 2025-05-22 16:55:13

- 最近,Coindesk发表了一篇文章,描述了我早期参与运动项目。该推文的目的是澄清事实。

-