|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

根据Crypto Analyst Chartfreedom在最近关于X的帖子中的说法,比特币成功打破了期待已久的100,000美元的里程碑

Crypto analyst ChartFreedom has shared his insights on Bitcoin's recent performance and the fundamental factors driving its resilience above the $100,000 milestone. According to ChartFreedom, despite a lack of speculative hype, Bitcoin has achieved this pricing feat due to several institutional and technical developments.

加密分析师ChartFreedom分享了他对比特币最近的表现以及使其韧性高于100,000美元里程碑的基本因素的见解。根据ChartFreedom的说法,尽管缺乏投机性的炒作,但由于几个机构和技术发展,比特币仍达到了这一定价壮举。

ChartFreedom, known for his X insights, highlighted the role of strong fundamentals in Bitcoin's ascent. These include a noticeable increase in institutional interest throughout 2023, evident in institutions like BlackRock applying for spot Bitcoin ETF approval.

Chartfreedom以其X Insights而闻名,他强调了强大的基础知识在比特币上升中的作用。其中包括整个2023年的机构利益的明显增加,这在诸如贝莱德这样的机构申请了现货比特币ETF批准中很明显。

ChartFreedom noted, "As we saw last year, the narrative quickly shifted when institutions began making a noticeable presence in the crypto space."

Chartfreedom指出:“正如我们去年所看到的那样,当机构开始在加密货币空间中显着存在时,叙述很快就发生了变化。”

ChartFreedom pointed out that this interest has translated into increased ETF (exchange-traded fund) inflows, another factor that has been incrementally pushing the asset upwards.

ChartFreedom指出,这种兴趣已转化为ETF(交易所交易基金)流入的增加,这是另一个因素逐步将资产向上推动的因素。

ChartFreedom stated, "We've seen a strong narrative around ETF approvals and the potential for institutional money to pour in more rapidly with this development."

ChartFreedom说:“我们已经看到了围绕ETF批准的强烈叙述,以及机构资金随着这一发展而更快地涌入的潜力。”

ChartFreedom also touched upon the tightening supply dynamic, which has been a key focus for analysts. This dynamic, largely driven by the halvings in Bitcoin's mining rewards, have steadily reduced the rate at which new BTC is entering circulation.

ChartFreedom还谈到了收紧的供应动态,这是分析师的重点。这种动态,在很大程度上是由比特币采矿奖励的过度驱动的,稳步降低了新BTC进入循环的速度。

ChartFreedom explained, "Bitcoin's supply is tightening due to halvings, which decrease the rate at which new BTC is added to the total supply. This dynamic has been a key focus for analysts throughout 2023."

ChartFreedom解释说:“由于过度的过份,比特币的供应正在收紧,这降低了将新的BTC添加到总供应中的速度。这种动态一直是2023年分析师的重点。”

ChartFreedom noted that this has created a scenario where the demand is outpacing the supply, a factor that typically leads to price increases in any market.

ChartFreedom指出,这创造了一种场景,需求超过了供应,这通常会导致任何市场的价格上涨。

ChartFreedom said, "We've seen the demand outpace the supply, a factor that usually leads to price increases in any market."

Chartfreedom说:“我们已经看到需求超过供应,这通常会导致任何市场的价格上涨。”

ChartFreedom added that another interesting observation is the lack of any significant correction after Bitcoin crossed the $100,000 threshold.

ChartFreedom补充说,另一个有趣的观察结果是,在比特币越过100,000美元的门槛之后,缺乏任何明显的校正。

ChartFreedom said, "It's worth noting that BTC didn't see any significant correction after breaking through the $100,000 resistance. This could indicate that traders are now treating it more as a long-term store of value rather than a short-term trade, especially after the market reacted quite strongly to the news of BlackRock's Bitcoin ETF application."

ChartFreedom说:“值得注意的是,BTC突破了100,000美元的电阻后没有看到任何重大的纠正。这可能表明,交易者现在将其更为将其视为长期价值存储,而不是短期交易,尤其是在市场对BlackRock的Bitchcoin Bitfoin ETF应用程序的反应强烈反应。”

ChartFreedom noted that this could also indicate a growing maturity in the market, and possibly a new era of price stability at elevated levels.

ChartFreedom指出,这也可能表明市场上的成熟度越来越大,并且可能是价格稳定的新时代。

ChartFreedom concluded by discussing the crucial crossroads ahead for Bitcoin's price action. After reaching the historic $100,000 mark, driven largely by strong fundamental factors, the market now watches closely for the next major trigger.

Chartfreedom结束了结论,讨论了比特币的价格行动的关键十字路口。在达到历史悠久的100,000美元大关之后,主要是由强大的基本因素驱动的,现在,市场紧密关注下一个主要的触发因素。

ChartFreedom said, "Crucial crossroads for #Bitcoin as we observe the next major trigger. #BTC has managed to hold above $100,000 without showing signs of a significant correction yet. A fresh wave of strong, bullish developments could push #Bitcoin to new all-time highs.”

Chartfreedom说:“当我们观察到下一个主要的触发器时,#BitCoin的关键十字路口。#BTC设法持有超过100,000美元的股份,而没有显示出重大纠正的迹象。新鲜的强烈,看涨的发展可能会将#BitCoin推向新的历史高点。”

ChartFreedom noted that this move would sustain the current momentum and accelerate the rally. However, if the market enters a period of uncertainty or lacks any major bullish narratives, then Bitcoin could begin to consolidate.

ChartFreedom指出,这一举动将维持当前的势头并加速集会。但是,如果市场进入不确定性时期或缺乏任何主要看涨叙述,那么比特币就可以开始合并。

ChartFreedom said, "In this case, we might see price action drift into a range between $90,000 and $80,000, marking a phase of adjustment. Use caution during such times, as traders might misinterpret the consolidation as a trend reversal."

Chartfreedom说:“在这种情况下,我们可能会看到价格行动陷入了90,000美元至80,000美元之间的范围,这标志着调整阶段。在此期间,请谨慎行事,因为交易者可能会误解巩固为趋势逆转。”

ChartFreedom concluded by discussing a strategy rooted in trend-following, with a particular focus on buying into shallow dips rather than waiting for deeper corrections.

ChartFreedom通过讨论一种植根于趋势关注的策略的结论,特别着眼于购买浅蘸酱而不是等待更深层的校正。

ChartFreedom said, "The 23.6% Fibonacci retracement level, around $101,588, has recently acted as a reliable benchmark for identifying dip-buying opportunities."

Chartfreedom说:“斐波那契回撤水平为23.6%,约为101,588美元,最近是确定销售机会的可靠基准。”

Chart said that in strong uptrends, flexibility is crucial. When prices are climbing with conviction, waiting for a deep pullback might cause traders to miss out on significant gains. Adapting to market conditions and capitalizing on the strength of the trend can offer better chances to expand profits.

图表说,在强大的上升趋势中,灵活性至关重要。当价格被定罪攀升时,等待深刻的回调可能会导致交易者错过巨大的收益。适应市场状况并利用趋势的实力可以为扩大利润提供更好的机会。

Chart said, "We want to be responsive and capitalize on the strength of the trend. This approach has served me well, and I'm sticking with it for now."

图表说:“我们希望响应迅速并利用趋势的实力。这种方法对我有好处,我现在坚持下去。”

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- Ether(ETH)从关键支持水平反弹,以10,000美元的突破恢复了此案

- 2025-05-12 09:20:13

- Ether从关键的抛物线和三角支持水平反弹,以10,000美元的突破恢复了此案。

-

-

-

-

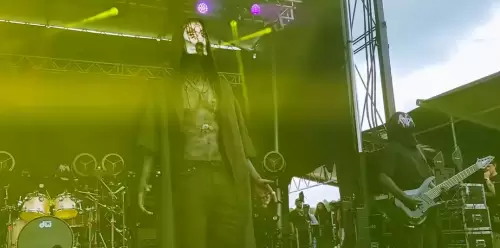

- 睡眠代币除了播放音乐外还创造了整个体验

- 2025-05-12 09:10:15

- 睡眠代币除了播放音乐外还创造了整个体验。他们的忠实粉丝群在2024年1月被突然的Instagram失踪所震撼

-

-

- 区块链终于进入其“使用或放弃”时代了吗?

- 2025-05-12 09:05:12

- 经过多年的疯狂猜测,潮汐已经转变。主要资金重新定位和技术内部人员剥离蒸发器件的真实工具

-