|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密货币新闻

Bitcoin (BTC) Options Signal Bullish Bias as SPX Options Skew Reflects Greater Downside Risk

2025/01/07 20:00

Bitcoin Deribit-listed options show a bullish bias, while S&P 500 options reflect greater downside risk.

After a turbulent 2024, mainstream financial markets are setting the stage for a new year. While inflation remains stubbornly high and a recession still looms, risk-taking has picked up across financial markets in the past two months.

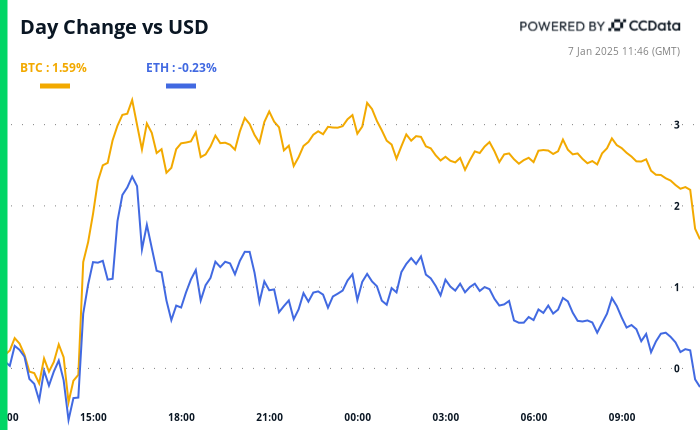

In the crypto markets, BTC is looking to secure a foothold above $100,000, while ETH breached the $3,800 level during morning trade in Asia.

The broader stock market, meanwhile, has a history of providing risk-on/off cues to risk assets, including BTC. So, what are the options markets saying about the S&P 500 and how could that impact bitcoin?

According to Cboe data, the SPX options skew now reflects greater downside risk than it did a year ago.

The defensive positioning in stocks perhaps stems from concerns that President-elect Donald Trump's Jan. 20 inauguration could be a "sell-the-news" event.

"Broadly speaking, we see some cracks in the data and think that Trump’s inauguration later this month has a decent chance of being a ‘sell the news’ event after nearly three months of unbridled economic optimism across most sectors," Bruce J Clark, head of rates America at Informa Connect, said on LinkedIn.

That raises the question: How will BTC react?

After all, expectations of regulatory clarity under Trump have already seen the cryptocurrency rally to over $100,000 from $70,000 in just two months. A Jan. 20 broader market sell-off could pull down the dollar index and the bond yields, potentially supporting BTC.

For now, there are several factors supporting BTC.

For instance, the $400 billion in liquidity sucked out of the system in the final two weeks of 2024 is likely to return, greasing asset prices, according to the LondonCryptoClub newsletter. Plus, some of the capital flows from China could find a home in cryptocurrencies.

Bitcoin is again trading at a premium on Coinbase, reflecting stronger Stateside demand while miners are expected to cut back on sales.

"The Net Unrealized Profit and Loss (NUPL) for miners remains very positive, hovering around 0.5, suggesting that miners are still in a strong position, with substantial unrealized profits and a preference to hold onto their BTC at this stage," analysts at Bitfinex told CoinDesk.

In the broader market, some traders are dabbling with December 2025 ETH calls at strikes as high as $11,000. Ether is currently trading below $4,000. Over 70 of the top 100 coins by market value were up on a 24-hour basis at press time. Need more evidence of risk-on?

That said, keep an eye on the bond market rout, which is fast spreading outside the U.S. Early today, the Japanese 10-year bond yield rose to a 13-year high while its 30-year British counterpart was on the verge of hitting the highest since the late 1990s. That can suck the wind out of risk assets. Stay alert!

What to Watch

Token Events

Conferences:

Token Talk

By Shaurya MalwaEthereum co-founder Vitalik Buterin has offloaded a stash of memecoins sent to him by various communities to fund a charity, on-chain data shows.

In the past two days, Buterin has sold $940,900 worth of lesser-known memecoins for the USDC stablecoin and ether. The NEIRO, ESTEE, MARVIN, EBULL, MSTR, and TERMINUS tokens brought in at least $57,000 worth of USDC, while other tokens were sold for less than $40,000.

Just over $916,000 was whisked away to a multisign wallet, likely tied to the charity Kanro, according to SpotOnChain.

Communities often send tokens to Buterin mainly to gain exposure and leverage his influence in the crypto space.

But Buterin’s known philanthropy also plays a role. Communities send tokens expecting him to donate them, indirectly supporting charity. Back in October, Buterin said he would donate any tokens sent to him to charitable causes, though he added that he didn’t support the act.

I appreciate all the memecoins that donate portions of their supply directly to charity.(eg. I saw ebull sent a bunch to various groups last month)Anything that gets sent to me gets donated to charity too (thanks moodeng! The 10B from today is going to anti-airborne…

“Anything that gets sent to me

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 睡眠代币的可怕金属:仪式性的兴起摇滚明星

- 2025-09-27 22:04:31

- 睡眠代币独特的金属,令人毛骨悚然的戏剧和流行敏感性的混合,将它们推向了图表的顶部,并吸引了一个虔诚的粉丝群。

-

- BlockChainFX:这是下一个二人吗?

- 2025-09-27 22:00:54

- Blockchainfx预售正在引起海浪。这是加密交易中的下一个大事吗?深入了解其潜力,并了解为什么投资者感到兴奋。

-

- 订购Token的Binance列表点燃加密集会:交易者需要知道什么

- 2025-09-27 22:00:26

- 深入研究了秩序的融资清单,分析交易策略,市场含义和未来潜力之后的秩序激增。

-

- 以太坊ETF感受到热量:投资者作为批准的批准退出吗?

- 2025-09-27 22:00:13

- 以太坊ETF看到投资者在价格下跌中退出,但是批准的潜力可能会改变游戏规则。 ETH的下一步是什么?

-

- 加密赛和模因硬币:寻找下一个100倍的机会

- 2025-09-27 22:00:03

- 厌倦了错过模因硬币爆炸?深入进入加密货币的世界,其中Maxi Doge和Bullzilla等项目为100倍增长提供了潜力。

-

- Cardano(ADA)价格预测:看涨场景和市场动态

- 2025-09-27 22:00:00

- 探索Cardano(ADA)的潜力,市场地位和未来价格预测,并且在不断发展的加密景观中。现在是合适的投资时间吗?

-

- PI网络,加密创新,新时代:将课程绘制到分散的未来

- 2025-09-27 21:56:52

- PI Network处于加密创新的最前沿,率先着眼于一个新时代,其专注于可访问性,社区和现实世界实用程序。

-

- Pepe硬币,模因和Altcoins:导航加密炒作火车

- 2025-09-27 21:51:05

- 探索模因硬币和Altcoins的最新趋势,重点是Pepe Coin的市场动态以及基于公用事业的替代方案的兴起。

-