|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

最近的X帖子强调了比特币采矿景观的重要观察结果,主要是散布丝带指标,该指标显示矿机活动增加了8%

A recent X post from @DegenMindBank highlights an interesting observation in Bitcoin's mining landscape. The post showcases the Hash Ribbon indicator, which measures the intensity of miner activity.

@DegenMindBank最近的X帖子突出了比特币采矿景观的一个有趣的观察。该帖子展示了散列带指示器,该指示器测量了矿物活性的强度。

According to the chart, we can see that miner activity, denoted by the red bars, often reaches its lowest point (capitalization) ahead of price bottoms. Conversely, periods of sustained miner recovery, signaled by the 30-day MA (green line) cutting through the 60-day MA (blue line), tend to precede strong rallies in Bitcoin's price.

根据图表,我们可以看到,用红色条表示的矿工活动通常在价格最低点之前达到其最低点(资本化)。相反,持续的矿工恢复时期由30天的MA(绿线)削减了60天的MA(蓝线),往往以比特币的价格进行强烈集会。

This year alone, there have been some interesting happenings in Bitcoin’s mining sphere. Back in February, the crypto behemoth’s mining difficulty attained an all-time high of 114.7 trillion following a 5.6% upward adjustment. This surge reflects the increasing hash rate of the network, which in turn signifies a heightened level of competition among miners.

仅今年,比特币的采矿领域就发生了一些有趣的事情。早在2月,加密庞然大物的采矿难度在向上调整后5.6%后达到了114.7万亿的历史最高点。这种激增反映了网络的哈希速率提高,这反过来又表示矿工之间的竞争水平提高。

Moreover, a month later, the Hash Ribon indicator flashed its first buy signal in eight months, which signals the end of the miner capitulation phase. Generally speaking, such signals have preceded big price rallies. Interestingly enough, this did occur, with Bitcoin around $80k during that time, and even dropping below $76k at one point. Granted, a lot of factors can be attributed to this, but it’s worth noting nevertheless.

此外,一个月后,哈希(Hash Ribon)指标在八个月内闪烁了其第一买信号,这标志着矿工投降阶段的结束。一般而言,此类信号之前已经进行了巨大的价格集会。有趣的是,这确实发生了,在此期间,比特币约为$ 80K,甚至在某一时刻下跌了76万美元。当然,很多因素可以归因于此,但值得注意的是。

Then again, a few weeks ago in April, it was reported that Bitcoin’s mining difficulty was poised for its steepest downward adjustment since December 2022, with estimates from Blockware Solutions placing the expected decrease at around 6%. This adjustment is a routine occurrence in the Bitcoin network, usually taking place approximately every 1440 blocks, which translates to roughly two weeks. The readjustment is influenced by the fluctuations in the network’s hash rate, which in turn reflects the collective computing power employed by miners to solve complex mathematical problems and validate transactions on the blockchain.

再说一次,几周前的四月,据报道,比特币的采矿难度已被策略以来自2022年12月以来的最大下降调整,估计块软件解决方案的预期下降约为6%。这种调整是比特币网络中的常规发生,通常发生大约每1440个块,大约两周。调整受网络哈希速率波动的影响,这反过来反映了矿工在解决复杂数学问题并验证区块链上的交易中使用的集体计算能力。

The Hash Ribbon is a technical analysis tool that tracks Bitcoin's mining activity by comparing the 30-day and 60-day moving averages (MAs) of the network's hash rate. A cross of the 30-day MA below the 60-day MA, like the recent signal in March, is often interpreted as a sign of miner capitulation.

哈希色带是一种技术分析工具,它通过比较网络哈希速率的30天和60天移动平均(MAS)来跟踪比特币的采矿活动。像3月的最近信号一样,在60天MA以下30天MA的交叉通常被解释为矿工投降的标志。

Miner capitulation occurs when mining becomes largely unprofitable, leading to a shutdown of operations by a segment of miners. Conversely, a cross of the 30-day MA above the 60-day MA, like the last time it happened in December 2021, is viewed as an indicator of miner recovery and is typically associated with a bullish trend for Bitcoin.

当采矿在很大程度上无利可图时,会发生矿工投降,从而导致一群矿工的运营关闭。相反,像2021年12月的上次发生的60天MA上方30天MA的交叉被视为矿工恢复的指标,通常与比特币的看涨趋势有关。

The recent chart shows that the 30-day MA has increased by 8% since the last difficulty drop, which may indicate a recovery in miner activity after a period of capitulation. However, the chart also shows that the 30-day MA still needs to cross above the 60-day MA for a more complete trend confirmation.

最近的图表显示,自上次难度下降以来,30天的MA增长了8%,这可能表明经过一段时间后的矿工活动恢复。但是,该图表还表明,30天的MA仍需要超过60天的MA,以进行更完整的趋势确认。

The chart from Degen Mind Bank suggests that the Hash Ribon has a history of identifying miner capitulation (red bars) and recovery phases, which are often linked to price bottoms and tops.

Degen Mind Bank的图表表明,Hash Ribon具有识别矿工投降(红色条)和恢复阶段的历史,这些阶段通常与价格最低点和顶部有关。

The current chart shows that the 30-day MA (green line) is slowly increasing from the recent lows of the Hash Ribon in March, which signals the miners are slowly recovering. Moreover, the chart shows that the五日 MA has pulled away from the 60-day MA (blue line), which could indicate that the 30-day MA will soon cross above the 60-day MA.

当前的图表显示,3月的最近的Hash Ribon的最低点,30天的MA(绿线)正在缓慢增加,这标志着矿工正在缓慢恢复。此外,图表显示,MA已从60天的MA(蓝线)中退出,这可能表明30天的MA很快将超过60天的MA。

If the 30-day MA manages to cut through the 60-day MA, it will be the first time since December 2021 that the technical indicator has flashed a buy signal.

如果30天的MA设法削减了60天的MA,则将是自2021年12月以来技术指标闪烁购买信号的第一次。

The last time the indicator flashed a buy signal, it took about five months for the 30-day MA to cross above the 60-day MA. If this pattern repeats itself, then the 30-day MA could cut through the 60-day MA by May 2025.

上次指示器闪烁了买入信号时,30天的MA花了大约五个月的时间才能超过60天的MA。如果这种模式重复出现,那么30天的MA可以在2025年5月之前切开60天的MA。

The chart also shows that the recent period of miner capitulation began in August 2022, which coincides with the last major Bitcoin price bottom.

该图表还显示,最近的矿工投降时期始于2022年8月,这与最后一次主要的比特币价格最低点相吻合。

After reaching a low of $75k in March, the price of Bitcoin has stabilized and is currently trading at around $103k. Moreover, the chart shows that the Hash Ribon has successfully identified the last three major Bitcoin price tops and bottoms.

在3月的低点达到75,000美元之后,比特币的价格已经稳定下来,目前的交易价格约为103,000美元。此外,图表显示,哈希ribon已成功地确定了最后三个主要的比特币价格上价和底部。

As such, the Hash Ribon indicator could be a valuable tool for traders who are interested in identifying new trends in the Bitcoin market. However, it is important to note that this is just one technical analysis tool and should be used in conjunction with other forms of analysis before making any

因此,对于有兴趣确定比特币市场新趋势的交易者来说,哈希ribon指标可能是一个有价值的工具。但是,重要的是要注意,这只是一种技术分析工具,应与其他形式的分析一起使用,然后再进行任何形式

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 比特币,战争和稳定:驾驶地缘政治风暴

- 2025-06-19 04:25:12

- 在战争和地缘政治紧张局势中探索比特币的韧性,从网络战到市场反应以及寻求稳定的追求。

-

-

- 比特币供应紧缩:持有人霍德林,接下来会有100万美元的BTC吗?

- 2025-06-19 04:45:13

- 比特币的供应减少,坚定的持有人定罪和潜在的机构FOMO:这是历史性比特币挤压的完美秘诀吗?

-

- 鲸鱼的佩佩(Pepe)损失:即将发生的事情的迹象?

- 2025-06-19 04:45:13

- 一条主要的佩佩鲸鱼以350万美元的损失退出,但看涨的模式出现了。这是Meme Coin投资者的购买机会还是警告信号?

-

- Thorchain Community Call,6月21日:期待什么

- 2025-06-19 04:50:12

- 看看即将到来的索氏社区在6月21日的呼吁,重点是TC整合和符文在生态系统中的作用。

-

-

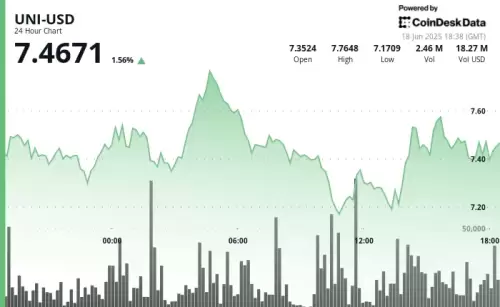

- UNISWAP(UNI)支持级别:导航复出

- 2025-06-19 05:00:13

- Uni从年度低点集会,测试支持水平。这是可持续的上升趋势,还是更广泛的采用将决定其命运?

-

- 比特币价格,竞争和预售:加密货币世界中有什么热?

- 2025-06-19 05:00:13

- 比特币的价格面临着来自Neo Pepe等创新的预售的竞争。发现趋势和见解塑造加密货币景观。

-

- 导航模因硬币躁狂症:投资野外西部的投资组合策略

- 2025-06-19 04:35:13

- 模因硬币正在爆炸,但是它们适合您的投资组合吗?我们分解了模因硬币市场中的趋势,机会和风险。