|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

周二,投资者从美国现货比特币交易所交易基金(ETF)撤回了3.26亿美元,这是最大的单日流出

Investors pulled $326 million from U.S. spot Bitcoin exchange-traded funds (ETFs) on Tuesday, marking the largest single-day outflow since March 11, data from DeFi informant showed. The latest pullback comes as traders digest the implications of President Trump's new tariffs and escalating tensions between the U.S. and its trade partners.

DEFI知情人士的数据显示,投资者在周二从美国现货比特币交易所交易基金(ETF)筹集了3.26亿美元,这是3月11日以来最大的单日流出。最新的回调是随着交易者消化特朗普总统的新关税的影响以及美国与其贸易伙伴之间的紧张局势的含义。

The implementation of the tariffs, such as the 104% duty on Chinese imports, has created uncertainty in global markets, pushing investors to de-risk their portfolios. Among the ETFs, BlackRock (NYSE:BLK)'s IBIT was hit hardest, with $253 million being withdrawn from the fund. This marks the third-worst day for the fund since its launch.

关税的实施,例如中国进口的104%税,在全球市场上产生了不确定性,促使投资者降低其投资组合。在ETF中,BlackRock(NYSE:BLK)的IBIT受到了最大的打击,2.53亿美元被撤回了基金。这标志着自启动以来该基金的第三天。

The outflows continue a negative streak for Bitcoin ETFs, which have now seen withdrawals for four consecutive days. These losses coincided with a drop in Bitcoin's price to $75,100, reaching its lowest point in five months. Analysts attribute the outflows to a combination of risk aversion and the broader market's reaction to Trump's tariffs.

外流继续对比特币ETF进行负面连胜,现在已经连续四天撤离了。这些损失与比特币的价格下跌至75,100美元,五个月内达到了最低点。分析师将流出归因于风险规避和更广泛的市场对特朗普关税的反应。

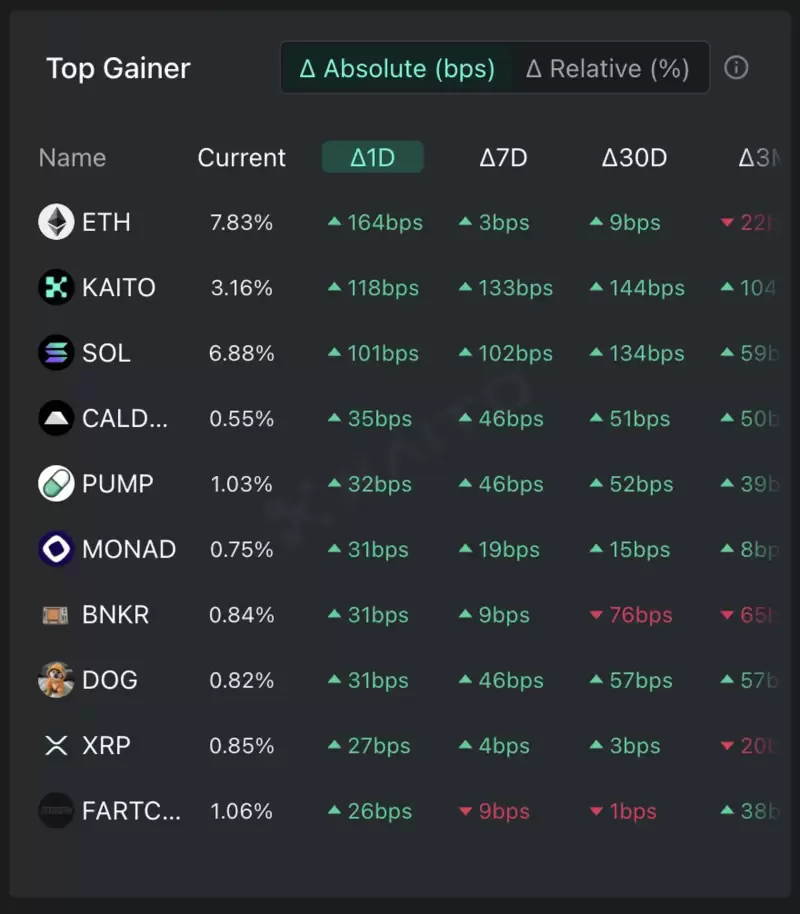

Bitcoin ETFs were not the only assets facing losses, as Ethereum's spot ETFs also saw outflows on Tuesday, with $3.3 million pulled from the funds. The largest decline came from Fidelity's Ethereum fund, contributing to Ethereum's overall struggles. The price of Ethereum fell below $1,450, continuing a downward trend that has seen the asset lose value compared to Bitcoin over the past five years. The ETH/BTC ratio dropped to a five-year low, reflecting the ongoing weakness in Ethereum's price relative to Bitcoin.

比特币ETF并不是唯一面临损失的资产,因为以太坊的现货ETF在星期二也看到了外流,从资金中撤出了330万美元。最大的下降来自富达的以太坊基金,这导致了以太坊的整体斗争。以太坊的价格低于1,450美元,继续下降趋势,与过去五年相比,与比特币相比,资产损失了。 ETH/BTC的比率下降到五年低点,反映了以太坊价格相对于比特币的持续弱点。

However, Ethereum's layer-2 networks, such as Arbitrum and Optimism, have seen an increase in activity and value locked on-chain, providing some growth despite the stagnation on the mainnet. Additionally, Ethereum's transaction fees dropped to their lowest level since August 2024, indicating reduced congestion on the network.

但是,以太坊的第2层网络(例如仲裁和乐观)已经看到了活动和价值锁定在链上的增加,尽管主网上停滞了,但仍提供了一些增长。此外,以太坊的交易费用降至2024年8月以来的最低水平,表明网络上的拥堵减少了。

In a contrasting move, 21Shares announced the launch of a fully backed Dogecoin exchange-traded product (ETP) on Switzerland's SIX Swiss Exchange. The Dogecoin ETP, launched in partnership with the Dogecoin Foundation, marks a significant step for the meme-inspired cryptocurrency as it receives more institutional attention. The ETP will trade on the SIX Swiss Exchange from Wednesday under the ticker DEFI.

相反的举动,21shares宣布在瑞士的六个瑞士交易所上推出了完全支持的Dogecoin交换产品(ETP)。 Dogecoin ETP与Dogecoin Foundation合作发起,标志着模因启发的加密货币的重要一步,因为它受到了更多的机构关注。 ETP将从周三的股票DEFI下进行六瑞士交易所进行交易。

Dogecoin has been gaining recognition despite the challenges faced by Bitcoin and Ethereum. This launch comes as cryptocurrencies continue to evolve, and institutional investors are increasingly seeking exposure to the market through innovative financial products. As the implications of the tariff war unfold and global markets react, investors will be closely watching Bitcoin's performance and Ethereum's challenges in this uncertain environment.

尽管比特币和以太坊面临着挑战,但Dogecoin仍在获得认可。随着加密货币的不断发展,这一发布会发生,机构投资者越来越多地通过创新的金融产品寻求向市场的敞口。随着关税战争的影响和全球市场的反应,投资者将在这个不确定的环境中密切关注比特币的绩效和以太坊的挑战。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

-

-

-

-

- 如果下一个要炸毁的模因硬币已经在您的雷达上

- 2025-04-27 17:55:13

- 像Bonk和Slerf这样的模因硬币一直证明幽默,炒作和时机是实现可观收益的关键要素。

-

- 下周的亮点

- 2025-04-27 17:50:12

- 本文从4月28日至5月4日预览了业内值得注意的事件,涵盖了新的比特币期货,OKX支付钱包的推出和诸如

-

- 您可能没有注意到,但是雪崩的C链最近再次流行。

- 2025-04-27 17:50:12

- 虽然大多数生态系统的TVL正在缓慢下降,并且市场主题挤满了AI,Restaking和Meme,但C链却悄悄地反弹了这一趋势

-

- 稳定币正在经历指数级增长,位报告其2024年交易量超过Visa的交易量

- 2025-04-27 17:45:12

- 一些专家断言,Stablecoins正在经历指数增长,迅速成为过去二十年中最重要的金融创新之一。