|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

随着该协议继续巩固其在 DeFi 中的地位,Aave (AAVE) 代币逆市上涨。在将 Lido 添加到其 V3 产品后,AAVE 保持了绿色发展。

Aave (AAVE) tokens rallied against the market trend on Monday as the protocol continues to solidify its position in decentralized finance (DeFi). AAVE remained in the green after Lido was added to its V3 products.

随着该协议继续巩固其在去中心化金融(DeFi)领域的地位,Aave(AAVE)代币周一逆市上涨。 Lido 添加到其 V3 产品后,AAVE 仍保持绿色状态。

Lido (LDO) extended its influence as the top Ethereum staking protocol. Recently, Lido extended its partnership with Aave, one of the key sources of decentralized liquidity.

Lido(LDO)扩大了其作为顶级以太坊质押协议的影响力。最近,Lido 扩大了与 Aave 的合作关系,Aave 是去中心化流动性的主要来源之一。

Aave protocol added a new V3 market for LDO tokens, drawing in more than $200M in the first two days after the launch.

Aave 协议为 LDO 代币增加了一个新的 V3 市场,推出后的前两天就吸引了超过 2 亿美元的资金。

The Aave V3 market is a fully decentralized liquidity pool, where anyone can join as a supplier, borrower, or liquidator. The new V3 market would allow LDO holders to extract value from stETH as lenders, while borrowers can access the asset after posting a collateral. V3 also allows one-block borrowing, also known as a flash loan.

Aave V3 市场是一个完全去中心化的流动性池,任何人都可以作为供应商、借款人或清算人加入。新的 V3 市场将允许 LDO 持有者作为贷方从 stETH 中提取价值,而借款人可以在提供抵押品后访问该资产。 V3 还允许一次性借贷,也称为闪贷。

Lido has worked with Aave vaults before, accruing significant wstETH liquidity. The newly launched Lido V3 market is the first isolated product with tailored liquidity and interest rate parameters.

Lido 之前曾与 Aave 金库合作,积累了大量 wstETH 流动性。新推出的Lido V3市场是首款具有定制流动性和利率参数的隔离产品。

The Lido V3 market on @aave has been live for 48 hours and just surpassed $200m in market size 👻

@aave 上的 Lido V3 市场已上线 48 小时,市场规模刚刚超过 2 亿美元👻

Here's what you need to know 👇 pic.twitter.com/aNSGxsq2fy

这是您需要了解的内容👇 pic.twitter.com/aNSGxsq2fy

— Lido (@LidoFinance) July 31, 2024

— 丽都 (@LidoFinance) 2024 年 7 月 31 日

Aave to offer new liquidity for holders of wstETH

Aave 将为 wstETH 持有者提供新的流动性

Aave offered a specialized V3 market, tailored to the needs of Lido and its wrapped ETH tokens. The vaults will be able to carry stETH and wstETH easily, allowing fine-tuning of collaterals and borrowing rates. Holders of wstETH will be able to post the asset as collateral and receive unlocked ETH tokens for additional DeFi tasks. In the future, Aave may make other tokens available to borrow against wstETH.

Aave 提供了专门的 V3 市场,专为满足 Lido 及其包装的 ETH 代币的需求而量身定制。金库将能够轻松携带 stETH 和 wstETH,从而允许对抵押品和借款利率进行微调。 wstETH 的持有者将能够将资产作为抵押品,并接收解锁的 ETH 代币以执行其他 DeFi 任务。未来,Aave 可能会推出其他代币以 wstETH 进行借贷。

The special vaults will also rely on DeFi Saver, a tool to automate collaterals and avoid liquidations. With the help of DeFi Saver, stakers will be able to open and close positions in a single transaction, to minimize risk.

特殊金库还将依赖 DeFi Saver,这是一种自动化抵押品并避免清算的工具。在 DeFi Saver 的帮助下,质押者将能够在单笔交易中开仓和平仓,以最大限度地降低风险。

Lido allows the creation of two tokens based on ETH. The stETH asset is the main liquid staking token. Holders can then choose to turn it into wstETH, which is staked and held for a predetermined period. The wstETH tokens are not locked, but are specifically created to be used within other DeFi protocols such as Uniswap or MakerDAO.

Lido 允许创建两种基于 ETH 的代币。 stETH 资产是主要的流动性质押代币。然后,持有者可以选择将其转换为 wstETH,并在预定期限内进行质押和持有。 wstETH 代币没有被锁定,而是专门为在 Uniswap 或 MakerDAO 等其他 DeFi 协议中使用而创建的。

The wrapped version of stETH exists on multiple L2 protocols, making the token rather difficult to un-stake and bridge back.

stETH 的包装版本存在于多个 L2 协议上,这使得该代币很难取消质押和桥接。

Aave revives expectations of price growth

Aave 重振价格增长预期

The Aave protocol continues to line up among the biggest fee producers in DeFi. At the same time, the AAVE token is considered undervalued, awaiting a breakout after years of stagnation.

Aave 协议继续跻身 DeFi 最大的费用产生者之列。与此同时,AAVE 代币被认为被低估,在多年的停滞后等待突破。

So far, AAVE has performed short-term rallies, though far from its peak above $600. With the revival of DeFi, all eyes are on Aave for making a return. The protocol already produces more than $7.49M in weekly fees, often surpassing MakerDAO.

到目前为止,AAVE 已出现短期反弹,但距离 600 美元以上的峰值还很远。随着 DeFi 的复兴,所有人的目光都集中在 Aave 的回报上。该协议已产生超过 749 万美元的每周费用,通常超过 MakerDAO。

AAVE traded at a one-month high at $114.73, with the highest trading volumes for the past four weeks. The token had a 40% jump in the past week while blue-chip tokens were bleeding. The token keeps gaining attention for an even bigger potential breakout.

AAVE 交易价格创一个月新高至 114.73 美元,创过去四周最高交易量。过去一周,该代币上涨了 40%,而蓝筹代币却在大幅下跌。该代币因更大的潜在突破而不断受到关注。

The Aave protocol also aggressively grew its value locked. Since the start of 2024, total value in Aave vaults has expanded by more than 100% to $12.79B. The Aave protocol is now spread across 12 chains and is the third-most influential DeFi app.

Aave 协议还积极增加其锁定价值。自 2024 年初以来,Aave 金库的总价值已增长 100% 以上,达到 $12.79B。 Aave 协议现已遍布 12 条链,是第三大影响力的 DeFi 应用程序。

Despite the growing value of the lending protocol, AAVE tokens are still ranked outside the top 50 in terms of market capitalization. Aave value locked surpasses all of DeFi on the Solana chain, leading potential traders to see the AAVE token as undervalued. AAVE is also a high-float token with no upcoming unlocks. Additionally, AAVE has been underperforming against ETH over the years, suggesting the trend may reverse soon.

尽管借贷协议的价值不断增长,但 AAVE 代币的市值仍排在前 50 名之外。 Aave 锁定的价值超过了 Solana 链上的所有 DeFi,导致潜在交易者认为 AAVE 代币被低估。 AAVE 也是一种高流通量代币,不会立即解锁。此外,多年来 AAVE 相对 ETH 的表现一直不佳,表明这一趋势可能很快就会逆转。

Moreover, the GHO stablecoin is expanding its supply with the potential to further boost liquidity in the Aave ecosystem. GHO recently crossed 102M tokens minted. The stablecoin increased its supply and activity in Q2, with minting outpacing the burning of tokens and accelerating in July.

此外,GHO 稳定币正在扩大供应,有可能进一步提高 Aave 生态系统的流动性。 GHO 最近铸造的代币数量突破了 1.02 亿。该稳定币在第二季度增加了供应和活动,铸造速度超过了代币销毁速度,并在 7 月份加速。

GHO also aims to become a multi-chain asset. In addition to AAVE, the stablecoin has moved to Balancer, MakerDAO, Uniswap and other protocols. The Maverick and Balancer DEX had the bulk of GHO volumes in the past month. Nearly 2,000 participants injected liquidity to mint GHO, using the Flash Mint Facilitator feature.

GHO 还旨在成为一种多链资产。除了AAVE之外,稳定币还转移到了Balancer、MakerDAO、Uniswap等协议。过去一个月,Maverick 和 Balancer DEX 占据了大部分 GHO 交易量。近 2,000 名参与者使用 Flash Mint Facilitator 功能为铸造 GHO 注入了流动性。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- 以太坊,玛加科因财务和通货膨胀:加密投资者重点的转变

- 2025-07-02 10:30:12

- 以太坊和雪崩表现出冷却的迹象,因为玛加科因金融获得了吸引力。在市场谨慎的情况下,投资者正在探索以叙事驱动的新机会。

-

-

-

- USDC采矿与云采矿:2025年解锁每日奖励

- 2025-07-02 09:15:12

- 探索2025年USDC采矿和云采矿的兴起,重点关注DRML矿工等平台,这些平台可提供每日奖励和可访问的加密货币收益。

-

- XRP,云采矿和2025市场:纽约人的拍摄

- 2025-07-02 08:30:12

- 探索XRP在云采矿和2025市场中的作用。查找Hashj和DRML矿工等平台如何改变游戏,从而提供稳定性和轻松。

-

-

-

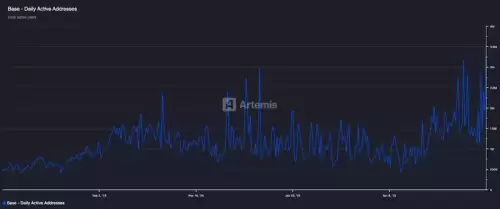

- 基地的链叙事:Bitmart研究深度潜水

- 2025-07-02 08:50:12

- BITMART研究分析了Base的爆炸性增长,不断发展的叙述以及机构一致性,突显了其在弥合传统金融和Web3中的作用。