|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset manager VanEck has launched its first tokenized fund, the VanEck Treasury Fund (VBILL), in partnership with tokenization platform Securitize.

The fund provides qualified investors with access to U.S. Treasury-backed yield in a blockchain-native structure, offering investors the benefits of real-time settlement and 24/7 liquidity.

In this initial launch phase, VBILL will be available on Solana, Avalanche, Ethereum, and BNB Chain. It is touted as a blockchain-based alternative to traditional money market funds. The fund targets institutional and qualified investors, with a minimum investment of $100,000 for most chains and $1 million on Ethereum.

Securitize Infrastructure and Wormhole Interoperability Power VBILL’s Reach

The launch is powered by Securitize’s full-stack tokenization platform, which covers token issuance, fund administration, and broker-dealer services.

This end-to-end infrastructure enables VBILL to function as a fully compliant and programmable financial product with enhanced liquidity and transparency.

To facilitate cross-chain interoperability, VBILL utilizes Wormhole, the leading blockchain bridge connecting traditional and decentralized finance. Wormhole enables the nearly instant transfer of VBILL tokens between the four launch chains. This enhances asset mobility and supports broader adoption.

🚨 New launch: Securitize x VanEck – Bringing Treasuries On-Chain

Today, we’re proud to announce the launch of $VBILL, @vaneck_us’s first tokenized fund, issued via Securitize and backed by short-term U.S. Treasuries.

Now live across @avax, @Ethereum, @Solana, and for the first… pic.twitter.com/eO1YhDlWdV

— Securitize (@Securitize) May 13, 2025

On-Chain Cash Management for Institutions

VBILL will serve a diverse range of financial use cases, from institutional treasuries to market makers and crypto-native funds seeking on-chain yield opportunities. The fund supports on-chain USDC subscriptions, with atomic liquidity integration via Agora’s AUSD stablecoin.

According to VanEck, the goal is to bring the benefits of blockchain, such as transparency, programmability, and 24/7 accessibility, to traditional asset management products like Treasury funds.

Notably, the fund’s assets are in the custody of State Street Bank and Trust Company. Also, RedStone Oracles provide daily net asset value calculations. VBILL is structured under the laws of the British Virgin Islands.

Tokenization Trend Accelerating

Notably, VanEck joins a select group of major financial institutions, including BlackRock and Apollo, partnering with Securitize to bring real-world assets on-chain. Securitize boasts over $3.9 billion in tokenized securities on its platform.

According to Wormhole Foundation co-founder Dan Reecer, VanEck’s entry into tokenized U.S. Treasuries marks another significant moment in the ongoing institutional adoption of on-chain finance. He adds that tokenization is playing a pivotal role in transforming capital markets.

Significantly, the global tokenization market is poised to reach an astounding $2 trillion by the end of this decade. Products like VBILL are aiming to capture a substantial share of this booming market. Additionally, other prominent names like Goldman Sachs have also announced their plans to join the tokenization market.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do proper research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

免責事項:info@kdj.com

提供される情報は取引に関するアドバイスではありません。 kdj.com は、この記事で提供される情報に基づいて行われた投資に対して一切の責任を負いません。暗号通貨は変動性が高いため、十分な調査を行った上で慎重に投資することを強くお勧めします。

このウェブサイトで使用されているコンテンツが著作権を侵害していると思われる場合は、直ちに当社 (info@kdj.com) までご連絡ください。速やかに削除させていただきます。

-

-

-

-

-

-

-

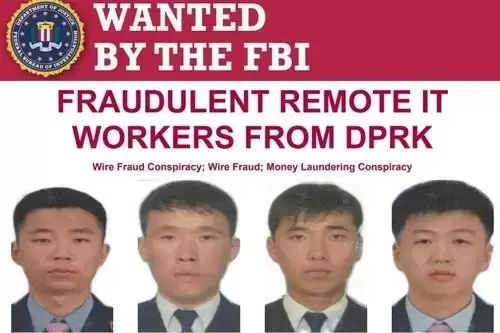

- 圧力下の平壌:米国の起訴と北朝鮮の俳優を見る

- 2025-07-04 08:30:12

- 北朝鮮に対する最新の米国の起訴と、平壌の戦略について明らかにしたことを解読します。

-

-