|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

XLM [Stellar] Price Prediction: XLM Breakout Rallies 8.5% as Binance Longs/Shorts Ratio Surges

Apr 26, 2025 at 08:14 pm

XLM price has finally emerged from its prolonged bearish channel, rising 8.5% in a single day to $0.2933. Due to this breakout, the XLM price rally has experienced a noteworthy increase.

![XLM [Stellar] Price Prediction: XLM Breakout Rallies 8.5% as Binance Longs/Shorts Ratio Surges XLM [Stellar] Price Prediction: XLM Breakout Rallies 8.5% as Binance Longs/Shorts Ratio Surges](/uploads/2025/04/27/cryptocurrencies-news/articles/xlm-stellar-price-prediction-xlm-breakout-rallies-binance-longsshorts-ratio-surges/middle_800_450.webp)

Stellar [XLM], which has fallen 65% since November 2024, has finally broken out of its prolonged bearish channel. Due to this breakout, the XLM price rally has seen a noteworthy increase, rising 8.5% in a single day to reach $0.2933.

With a total of $228.15 million, trading volumes increased by 18.64%, showing greater market engagement. Additionally, 65.37% of the top Binance traders had long positions, demonstrating belief in the XLM bullish tendency.

As XLM hovers over critical Stellar price support levels, the market is anticipating whether the asset can maintain momentum and challenge the next significant XLM resistance level.

XLM Price Rally Gains Momentum With Bullish Metrics

The recent Stellar price rally is backed by robust on-chain metrics and a substantial shift in trader sentiment. Data from Coinglass shows that the Binance XLMUSDT Long/Short ratio has soared to 1.89, with 65.37% of top traders favoring long positions. This signals a clear Stellar bullish trend and growing confidence in the asset’s near-term trajectory.

Additionally, $6.37 million worth of long positions are concentrated near key XLM price support around $0.2558. Outflows from exchanges, totaling $1.19 million, further suggest accumulation pressure, indicating a reduced selling risk and potential strength in sustaining the XLM price rally.

Critical Levels And Liquidation Maps Point To An Extended Stellar Price Rally

The XLM Exchange Liquidation Map reveals important clues about the ongoing XLM price rally. A significant cluster of leveraged long positions is located near the XLM price support at $0.2558, where a decisive move could trigger substantial liquidation.

Resistance is forming at around $0.295, the level at which the Stellar price increase may face immediate pressure. Approximately $6.37 million in long positions and $1.63 million in shorts are at risk near these critical levels, highlighting a delicate balance.

Technical analysis supports the bullish view, as XLM successfully broke above the descending channel pattern, paving the way for further gains.

If the XLM price holds steady above $0.275, historical behavior suggests a possible 30% climb toward the $0.375 XLM resistance level.

Traders are closely monitoring the support and resistance structure to validate the longevity of the Stellar bullish trend.

Technical Breakout Confirms Bullish Setup

The breakout from the multi-month descending channel has solidified confidence in the ongoing Stellar price rally. Daily candlestick closure above the key channel resistance reinforces the bullish market structure.

This technical setup is aligned with both spot inflow and outflow data, and strong activity in the derivatives market. Prolonged advances above $0.295 may open the door for additional increases, although keeping levels above $0.26 is still crucial to maintain the XLM price support.

If overall crypto conditions continue to be favorable, this combination of technical and on-chain signs suggests a long-lasting XLM bullish trend.

What’s Next: Is XLM Price Breakout Coming?

The current goal of the XLM price increase is a clear breakthrough above the $0.295 resistance level. If this level is successfully broken, a 30% upside could be possible, validating the next target at $0.375.

However, the bullish structure could be in jeopardy if the crucial Stellar price support around about $0.26 is not defended. Investors will be closely watching to see if the positive trend in XLM holds up over the next several sessions.

Stellar may establish itself as one of the best-performing altcoins in early 2025 if bullish sentiment persists, particularly as confidence about XLM’s ability to maintain higher market capitalization levels, currently at $9.05 billion with a fully diluted valuation (FDV) of $14.66 billion.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- XRP price fell as uncertainty set in the market following Donald Trump's announcement of reciprocal tariffs.

- Apr 28, 2025 at 01:50 am

- The news led to a general sell-off in digital assets, which had a negative impact on market sentiment, and thus the $2 price level has become an important support area for XRP traders and investors.

-

-

- Qubetics Interoperability Breaks the Mold—VeChain and AAVE Follow With Real Adoption Among Top Crypto Gems to Buy

- Apr 28, 2025 at 01:45 am

- This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page.

-

-

-

-

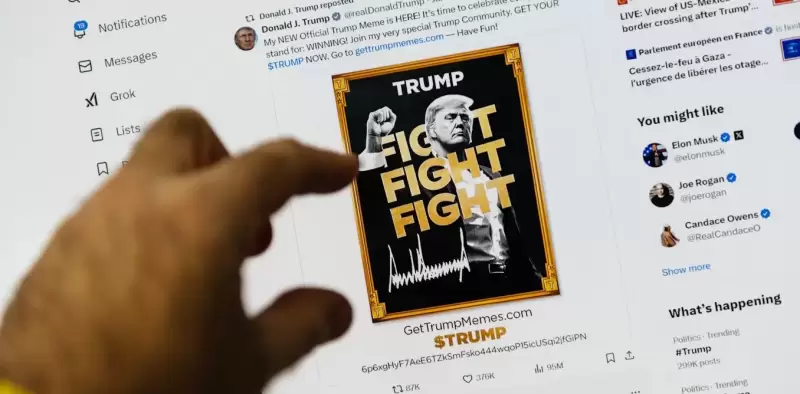

- Launched three days before the inauguration of Donald Trump, the crypto $ Trump, without concrete utility, nevertheless experienced a spectacular outbreak.

- Apr 28, 2025 at 01:35 am

- What if political notoriety became a sound and stumbling currency? It is the bet, provocative and potentially lucrative, that Donald Trump made by launching his cryptocurrency, soberly baptized $ Trumpon January 17, 2025, three days before his official return to the White House.

-