|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

title: Bitcoin Briefly Touches $85,000, Reclaiming Its 200-Day SMA

Mar 15, 2025 at 03:30 am

Bitcoin briefly touched $85,000 on Tuesday before paring gains to $84,500. The move comes after the apex coin traded at or below the key technical level.

Bitcoin price rose above key technical level 200-day SMA during U.S. market hours on Tuesday after briefly touching $85,000.

Bitcoin (BTC) price rose above key technical level 200-day SMA during U.S. market hours on Tuesday after briefly touching $85,000.

Bitcoin recovered above 200-day SMA during U.S. market hours on Tuesday.

Apex coin briefly touched $85,000 before paring gains.

World’s largest cryptocurrency gained over 5% in the past 24 hours.

Bitcoin price rose above key technical level 200-day SMA during U.S. market hours on Tuesday after briefly touching $85,000.

The move comes after the apex coin traded at or below the key technical level for five consecutive sessions.

A sustained move above the 200-day SMA is often seen as a bullish signal, while dipping below the level with firm conviction typically signals increased downside risk.

Latest Videos

The world’s largest cryptocurrency gained over 5% in the past 24 hours, lifting the overall digital asset market capitalization by 2.2% to $2.8 trillion, according to CoinGecko data. Ethereum’s native token (ETH) and Ripple’s XRP token (XRP) also rose by more than 5% alongside Bitcoin.

Chainlink (LINK) and Sui (SUI) led gains among major cryptocurrencies, surging over 10% in the past day.

Bitcoin’s rally coincided with a broader recovery in risk assets as appetite returned to traditional markets.

Adding to the optimism, news emerged that a bill to be introduced in Congress aims to formalize President Donald Trump’s executive order establishing a U.S. Strategic Bitcoin Reserve.

The legislation would prevent future administrations from dismantling the reserve and the U.S. Digital Asset Stockpile through executive action if passed.

On Stocktwits, retail sentiment around the apex cryptocurrency remained in ‘neutral’ territory, accompanied by ‘high' levels of retail chatter.

One user pointed out that Bitcoin’s previous market cycles have seen deeper lows during periods of extreme fear, suggesting the asset has matured.

Another predicted that the recent dip below $80,000 was the final shakeout before Bitcoin’s next major rally.

The apex cryptocurrency has gained approximately 19% over the past year. Despite Tuesday’s rally, Bitcoin’s price remains 22% below its all-time high of nearly $109,000 in January.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: XRP Price Surges, Outpacing Bitcoin, Ethereum On Middle East Expansion, SEC Speculation – Retail Remains Bullish

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

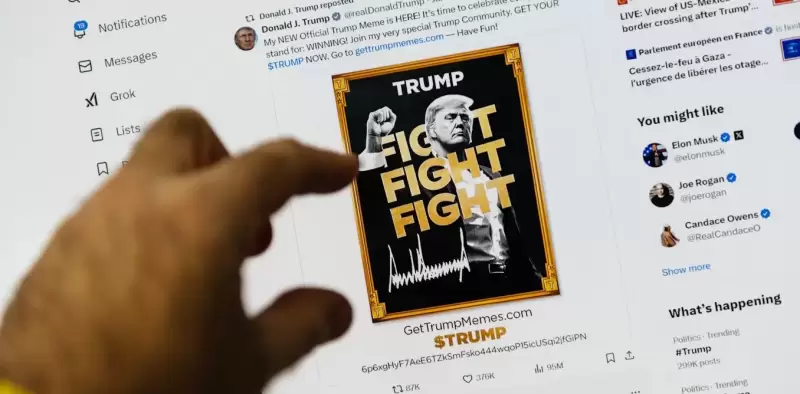

- Launched three days before the inauguration of Donald Trump, the crypto $ Trump, without concrete utility, nevertheless experienced a spectacular outbreak.

- Apr 28, 2025 at 01:35 am

- What if political notoriety became a sound and stumbling currency? It is the bet, provocative and potentially lucrative, that Donald Trump made by launching his cryptocurrency, soberly baptized $ Trumpon January 17, 2025, three days before his official return to the White House.

-

-

- Pi Network Named Official Sponsor of Consensus 2025: Analyst Gave His Price Prediction

- Apr 28, 2025 at 01:30 am

- In a major announcement, Pi Network was officially named as an Official Sponsor of Consensus 2025, one of the largest and most prestigious blockchain and cryptocurrency conferences globally.

-

-

-

- If You Missed Solana's Explosive Breakout, There May Still Be Time to Catch the Next Big Opportunity—Lightchain AI

- Apr 28, 2025 at 01:20 am

- With the crypto presale already raising $19.5 million, Lightchain AI is attracting early believers who see its long-term potential to rival previous market leaders.

-

-