|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Thumzup Recently Filed a Shelf Registration Statement to Raise Up to $500 Million

May 13, 2025 at 10:22 pm

TZUP Currently Holds 19.106 BTC with a Market Value of Approximately $2.0 Million

Thumzup Media Corporation (Nasdaq: TZUP) announced the expansion of its capital strategy with a Bitcoin (BTC)-backed credit facility from Coinbase Prime (Nasdaq: COIN).

As part of its broader BTC Reserve Strategy, which was previously disclosed in December 2024, Thumzup is now planning to hold up to 90% of its liquid assets in Bitcoin.

The company currently holds 19.106 BTC, valued at approximately $2.0 million as of May 12, 2025. Thumzup is utilizing Coinbase Prime as its custodian and prime broker.

“We are proud to expand our relationship with Coinbase through their Bitcoin-collateralized lending program as part of our broader strategic approach to capital management,” said Robert Steele, CEO of Thumzup.

“We believe that Coinbase's addition to the S&P 500 marks a significant milestone for the entire crypto industry—Coinbase's trailblazing journey brought BTC and other tokens into the mainstream. We are also pleased to see Coinbase expanding its offerings to include products and services that can be leveraged by companies like Thumzup.”

The company is planning to accelerate its Bitcoin acquisition strategy. It is also pivoting its capital structure to be less reliant on equity.

The company's Board of Directors previously authorized Thumzup to hold up to 90% of its liquid assets in Bitcoin, and it plans to keep a minimum of 10% of its liquid assets in U.S. dollars in a fully disclosed money market account to ensure that it can meet its operational needs.

The company further highlighted that it is focused on maximizing shareholder value.

“With a clean cap structure, we believe Thumzup is optimally positioned to accelerate its BTC Acquisition Strategy and create significant shareholder value,” Steele concluded.

About Thumzup®

Thumzup Media Corporation (Nasdaq: TZUP) is democratizing the multi-billion dollar social media branding and marketing industry. Its flagship product, the Thumzup platform, utilizes a robust programmatic advertiser dashboard coupled with a consumer-facing App to enable individuals to get paid cash for posting about participating advertisers on major social media outlets through the Thumzup App. The easy-to-use dashboard allows advertisers to programmatically customize their campaigns. Cash payments are made to App users/creators through PayPal and other digital payment systems.

The Thumzup app is available for download on the App Store and Google Play.

Thumzup was featured on CBS Los Angeles and in KTLA.

This press release contains certain "forward-looking statements" within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These include, without limitation, statements about its potential growth, impacts on the advertising industry, plans for potential uplisting, and planned expansion. These statements are identified by the use of the words "could," "believe," "anticipate," "intend," "estimate," "expect," "may," "continue," "predict," "potential," "project" and similar expressions that are intended to identify forward-looking statements. All forward-looking statements speak only as of the date of this press release. You should not place undue reliance on these forward-looking statements. Although the Company believes that its plans, objectives, expectations and intentions reflected in or suggested by the forward-looking statements are reasonable, it can give no assurances that these plans, objectives, expectations or intentions will be achieved.

Forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from historical experience and present expectations or projections. Actual results may differ materially from those in the forward-looking statements and the trading price for our common stock may fluctuate significantly.

Forward-looking statements also are affected by the risk factors described in the Company's filings with the U.S. Securities and Exchange Commission (the "SEC"), including in the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. Investors and security holders are urged to read these documents free of charge on the SEC's web site at: http://www.sec.gov. Except as required by law, the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- Web3 ai Just Clocked $500,000 Raised in 24 Hours From Whales Ahead of Exchange Debut. Could This Be Crypto's Next Bittensor or Render?

- May 14, 2025 at 06:20 am

- That’s the question traders are asking as the Polkadot (DOT) price today shows signs of reversal from a falling wedge breakout and Litecoin bulls eye a $120 target

-

-

-

-

-

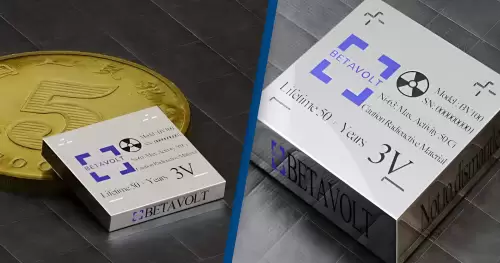

- Introducing the World's First Nuclear Battery, Smaller Than a Coin and Lasting for 100 Years

- May 14, 2025 at 06:10 am

- In a leap that could change the future of energy storage forever, China has unveiled a nuclear battery smaller than a coin—capable of operating for decades without a single recharge.

-

- Bitcoin (BTC) Price Acceleration Is Unfolding Alongside a Major Expansion in Stablecoin Liquidity

- May 14, 2025 at 06:05 am

- Bitcoin's recent price acceleration is unfolding alongside a major expansion in stablecoin liquidity, marked by a $6 billion rise in Tether's (USDT) market capitalization over the last 20 days.

-

-