|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

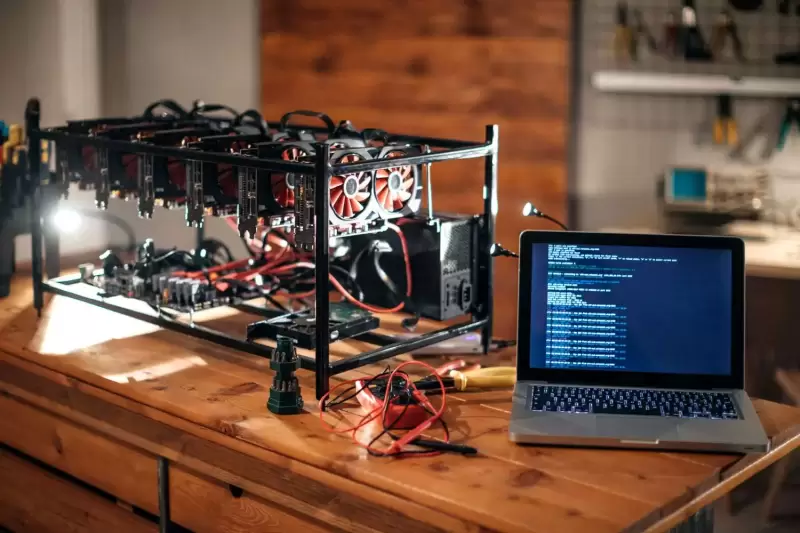

Cryptocurrency News Articles

Long-Term Bitcoin Holders Continue Accumulating, Adding 635K BTC Since January

Apr 27, 2025 at 09:00 am

Statistical data from the Satoshi Club indicates that Bitcoin holders who have kept their BTC for longer than 155 days have maintained their buying pattern throughout 2025. These long-term investors have purchased 635,000 BTC since January.

Data from the Satoshi Club indicates that Bitcoin holders who have kept their BTC for longer than 155 days have maintained their buying pattern throughout 2025.

These long-term investors have purchased 635,000 BTC since January.

The current BTC circulating supply shows 13.75 million coins, representing 65%, are under long-term holder control. Bitcoin holders display growing confidence that BTC will persist as a big asset, thanks to maintained accumulation patterns amid the worldwide market sentiment changes and monetary instability.

On the other hand, short-term holders reduced their positions by 460,000 BTC. The 460,000 BTC have been released by short-term holders who bought Bitcoin during the past 155 days.

The market data shows how fresh investors opted to reduce their exposure through strategic price-dependent risk-management activities, as well as getting shaken out by price swings.

Historical data shows that the medium-term BTC price direction relies heavily on the holding behavior gap between short-term and long-term investors since continued accumulation by long-term holders produces bullish market conditions.

Bitcoin Resistance Zone Builds Above $95K

The 2.6 million Bitcoins that were acquired when prices exceeded $95,000 are struggling against market losses. A significant amount of supply exists near this present trade point.

Holders who need to sell their Bitcoin to break even might increase market supply after price appreciation, yet the upside potential remains limited because strong new buyers should step in to absorb the supply.

Future Outlook

Under current market conditions, investors face a traditional conflict between investing long-term and others taking short-term profits. A breakout and sustained performance above the $95K-$98K price zone could motivate an uptrending wave of momentum for Bitcoin.

The future market behavior depends on how strong the accumulation phase remains while profit-taking resistance stays suppressed.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

-

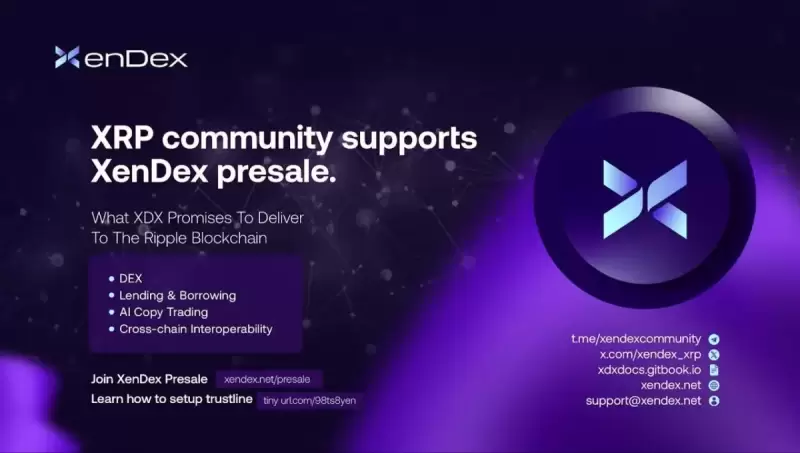

- The altcoin market experienced an intense week, with several most promising meme cryptocurrencies recording impressive gains.

- Apr 28, 2025 at 05:20 am

- Projects focused on digital communities, viral memes and artificial intelligence led the gains, attracting the attention of investors looking for new opportunities

-

-