|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Raydium (RAY) Surges 10% as the Platform Launches Its New Meme Coin Launchpad, Targeting Pump.fun's Market

Apr 17, 2025 at 09:50 pm

In an exciting development within the cryptocurrency ecosystem, Raydium (RAY) saw a significant 10% surge on Wednesday, as the platform announced the launch of its new meme coin launchpad, LaunchLab. This innovative step puts Raydium in direct competition with Pump.fun, which also recently unveiled its decentralized exchange (DEX), PumpSwap. The move has the potential to reshape the meme coin space and attract new projects looking for a platform to kickstart their journey.

Raydium (RAY) experienced a 10% surge on Wednesday as the platform announced the launch of its new meme coin launchpad, LaunchLab, putting it in direct competition with Pump.fun, which also recently unveiled its decentralized exchange (DEX), PumpSwap.

What Happened: Raydium, a powerful decentralized exchange and automated market maker for the Solana blockchain, is introducing LaunchLab to provide meme coin projects with the tools and resources to launch, market, and expand their tokens.

This step puts Raydium in the running with Pump.fun, a popular meme coin launchpad and incubator platform, which recently expanded its offerings with the launch of PumpSwap.

LaunchLab will offer meme coin projects the opportunity to launch on Raydium, leveraging its deep liquidity pools and the high-speed Solana network. This integration aims to facilitate seamless user experiences and rapid token distribution for optimal launch success.

Following the announcement, RAY token, Raydium’s native token, experienced a 10% surge within a few hours.

Why It's Important: The launch of LaunchLab is a significant development in the cryptocurrency space, especially with the surging popularity of meme coins and community-driven tokens.

Raydium’s entry into the meme coin launchpad market also challenges Pump.fun, which had become a prominent platform for meme coin projects.

However, Pump.fun is venturing into the DEX market with PumpSwap, which operates in the meme coin space, offering users the chance to trade meme-inspired tokens with minimal fees and optimal efficiency.

This rivalry highlights the growing demand for platforms that cater specifically to community-driven cryptocurrencies, which have become a defining force in the cryptocurrency sphere.

As meme coins become an increasingly significant sector of the crypto market, competition between such platforms could benefit investors and developers seeking a supportive ecosystem for their projects.

Meanwhile, Ethereum (ETH) encountered headwinds on Thursday as concerns over its data availability roadmap began to weigh on the price.

ETH price dipped just below the $1,600 mark, showing a 1% decrease. According to a new report from Binance Research, Ethereum’s current challenges regarding data availability may hinder its potential for value accrual.

A Bottleneck in the Data Availability Roadmap:

The report delves into Ethereum’s technical difficulties in achieving high throughput and efficient data availability, despite its integration of Proof of Stake (PoS) in Ethereum 2.0.

The shard chains, designed to increase Ethereum’s scalability, are still facing significant technical hurdles, which could pose risks to its growth trajectory, especially with the emergence of newer, faster blockchains.

While Ethereum has made progress in reducing transaction fees and increasing throughput, it remains a bottleneck compared to newer chains like Solana and Aptos, which boast even lower fees and higher transaction speeds.

ETH Price Faces Further Decline:

This news comes as Ethereum’s price has begun to decline after failing to break through the critical $1,800 resistance level. A further decrease could see the price testing the next support level at $1,500.

However, if Ethereum manages to surmount the $1,800 barrier and sustain gains above $2,000, it could pave the way for a rally towards the all-time high of $4,800.

Key Levels for ETH:

* Critical Resistance: $1,800

* Key Support: $1,500

* All-Time High: $4,800 (reached in 2021)

As Ethereum faces technical challenges and market uncertainty, its ability to overcome these hurdles will be crucial for unlocking its full potential for value creation in the cryptocurrency market.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- XRP price fell as uncertainty set in the market following Donald Trump's announcement of reciprocal tariffs.

- Apr 28, 2025 at 01:50 am

- The news led to a general sell-off in digital assets, which had a negative impact on market sentiment, and thus the $2 price level has become an important support area for XRP traders and investors.

-

-

- Qubetics Interoperability Breaks the Mold—VeChain and AAVE Follow With Real Adoption Among Top Crypto Gems to Buy

- Apr 28, 2025 at 01:45 am

- This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page.

-

-

-

-

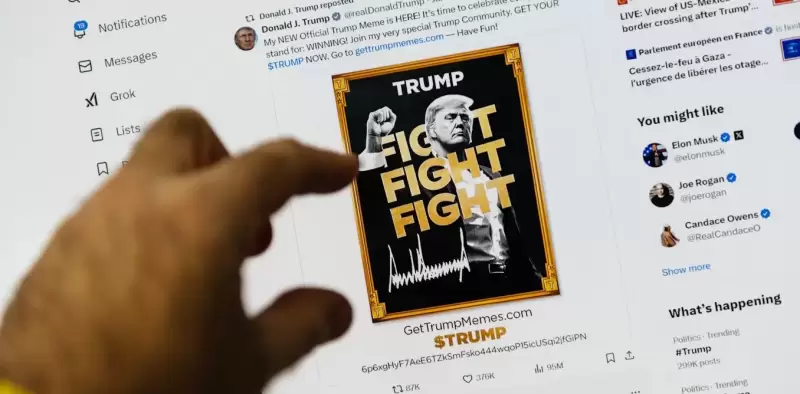

- Launched three days before the inauguration of Donald Trump, the crypto $ Trump, without concrete utility, nevertheless experienced a spectacular outbreak.

- Apr 28, 2025 at 01:35 am

- What if political notoriety became a sound and stumbling currency? It is the bet, provocative and potentially lucrative, that Donald Trump made by launching his cryptocurrency, soberly baptized $ Trumpon January 17, 2025, three days before his official return to the White House.

-