|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Mutuum Finance (MUTM) Gains Traction in the DeFi Space

Mar 22, 2025 at 08:11 pm

The decentralized finance (DeFi) space has seen significant innovation over the years, with projects like XRP making waves in the financial sector. However, a new contender is quickly gaining traction—Mutuum Finance (MUTM).

The decentralized finance (DeFi) space has seen significant innovation over the years, with projects like XRP making waves in the financial sector. However, a new contender is quickly gaining traction—Mutuum Finance (MUTM). Designed as a decentralized lending and borrowing protocol, Mutuum Finance is positioning itself as a game-changer with its structured financial model, overcollateralized stablecoin, and buy-and-distribute mechanism that supports long-term token value.

Mutuum Finance (MUTM)

One of the standout features of Mutuum Finance is its overcollateralized stablecoin, which offers users access to liquidity without relying on traditional financial intermediaries. Unlike centralized stablecoins, this asset is minted directly through the platform when borrowers provide collateral above a required ratio. This ensures that every stablecoin in circulation is fully backed by on-chain assets, maintaining a predictable and sustainable peg to the U.S. dollar.

Additionally, the stablecoin model benefits the overall Mutuum ecosystem. Borrowers can access liquidity without selling their assets, and lenders receive interest on their deposited funds. Interest generated from stablecoin loans remains within the platform, reinforcing protocol reserves and enhancing long-term stability.

Mutuum Finance enables both peer-to-contract (P2C) and peer-to-peer (P2P) lending models, offering users flexibility in accessing liquidity or generating passive income. In the P2C model, lenders supply assets into liquidity pools and earn a dynamic annual percentage yield (APY). Borrowers can access these funds by locking collateral, ensuring overcollateralization to maintain platform stability and minimize defaults.

The P2P lending model allows borrowers and lenders to negotiate loan terms directly, making it an attractive option for those looking for customized agreements. This is particularly useful for more volatile assets, which may not fit into traditional DeFi lending pools. By offering both models, Mutuum Finance creates an inclusive and scalable lending protocol that caters to a wide range of users.

Mutuum Finance incorporates a buy-and-distribute mechanism that actively supports long-term token appreciation. A portion of the platform’s revenue is used to buy back MUTM tokens from the market, which are then distributed to mtToken holders. This process not only creates consistent buy pressure but also incentivizes long-term participation in the ecosystem.

Additionally, mtTokens play a crucial role in the platform’s functionality. When users deposit assets, they receive mtTokens, which represent their stake in the liquidity pool. These tokens automatically accumulate interest over time and increase in redemption value, allowing users to earn passive income without actively managing their funds.

Mutuum is currently in its presale phase, offering early investors an opportunity to enter before the price surges. The project is now in Phase 3, with MUTM priced at $0.02. The presale consists of 11 phases in total, and the price is set to increase to $0.025 in Phase 4.

With over $4.45 million raised so far and more than 6,250 holders, demand for MUTM continues to rise as investors secure their positions ahead of the next phase. The rapid fundraising and structured presale model attest to the growing confidence in Mutuum's potential.

As Mutuum progresses toward its token launch, investors are anticipating significant value appreciation, especially given the project's upcoming exchange listings and beta platform release. This makes Mutuum stand out from traditional DeFi lending protocols.

Mutuum combines stablecoin functionality, flexible lending models, and a sustainable token economy. With a growing community, a presale that continues to gain traction, and a unique buy-and-distribute mechanism reinforcing its market strength, MUTM is shaping up to be a strong competitor in the DeFi space.

Those looking for an early opportunity in a fast-growing DeFi ecosystem may find that Mutuum offers one of the most compelling investment prospects of 2024. With momentum building, now may be the best time to consider joining before the next price increase and broader market adoption.

For more information about Mutuum Finance (MUTM)

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

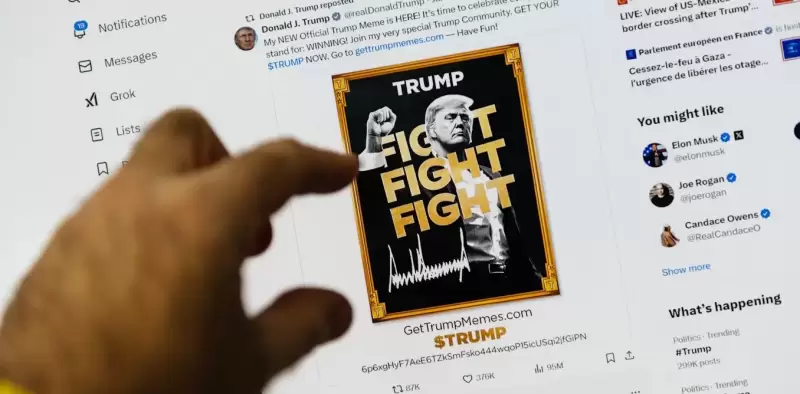

- Launched three days before the inauguration of Donald Trump, the crypto $ Trump, without concrete utility, nevertheless experienced a spectacular outbreak.

- Apr 28, 2025 at 01:35 am

- What if political notoriety became a sound and stumbling currency? It is the bet, provocative and potentially lucrative, that Donald Trump made by launching his cryptocurrency, soberly baptized $ Trumpon January 17, 2025, three days before his official return to the White House.

-

-

- Pi Network Named Official Sponsor of Consensus 2025: Analyst Gave His Price Prediction

- Apr 28, 2025 at 01:30 am

- In a major announcement, Pi Network was officially named as an Official Sponsor of Consensus 2025, one of the largest and most prestigious blockchain and cryptocurrency conferences globally.

-

-

-

- If You Missed Solana's Explosive Breakout, There May Still Be Time to Catch the Next Big Opportunity—Lightchain AI

- Apr 28, 2025 at 01:20 am

- With the crypto presale already raising $19.5 million, Lightchain AI is attracting early believers who see its long-term potential to rival previous market leaders.

-

-