|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Leading Altcoin Experiences Significant Selling Pressure in Indian Market

Apr 03, 2025 at 10:26 pm

The cryptocurrency market showcased its signature volatility once again on April 3rd, with Ether (ETH), the native token of the Ethereum blockchain and the second-largest cryptocurrency

Leading altcoin experiences significant selling pressure in the Indian market.

Cryptocurrency prices displayed a substantial shift on April 3, as Ether (ETH) faced a notable decline against the Indian Rupee (INR).

According to data from Binance, Ether was trading at ₹151,233.97 at approximately 2:18 PM (UTC). This represented a 1.48% drop over the last two hours and a change of about ₹2,266.55 from its previous closing value of ₹153,500.52.

The decrease occurred after Ether breached key support levels, including the previous day’s close and the ₹152,000 mark. The 1-day price chart highlighted that the initial gains seen in the early hours of the session were completely erased by the time period of the news report as selling pressure mounted.

Unpacking the intraday ETH/INR price volatility

A closer look at the 1-day chart for Ether versus the Indian Rupee revealed a classic "rise and fall" pattern for the session:

* Initial bullish surge: The trading day began close to the previous close around the level of ₹153,500. However, strong buying interest emerged in the early UTC hours (before 2:30 AM and continuing shortly after). Ether experienced a rally, pushing above ₹154,000, ₹155,000, and ₹156,000. The chart showed the price actually peaked significantly higher, potentially touching the ₹158,000 resistance level, which highlighted the early optimism.

* Consolidation and waning momentum: After this peak, the upward thrust lost steam. Through the mid-morning hours (around 2:30 AM to 10:30 AM UTC), Ether entered a consolidation phase, trading in a choppy manner mostly above the ₹155,000 level but failing to retest the highs. The price action formed several lower peaks within this range, which signaled that the buying power was being absorbed by increasing selling pressure.

* The midday plunge: A decisive shift occurred around the 10:30 AM UTC mark. As selling pressure intensified sharply, triggering a significant breakdown. The price dropped rapidly, falling below the consolidation range support near ₹155,000, sliced through the previous close level at ₹153,500, and continued its descent to move below ₹152,000. The velocity of this drop showed a strong bearish sentiment, possibly amplified by technical factors.

* Testing lower support and minor rebound: The decline extended further, briefly pushing Ether’s price below the psychologically important ₹150,000 level to establish its lowest point for the entire trading session. After hitting this trough, some buyers appeared to enter the market again, providing support. By the time of the data snapshot (2:18 PM UTC), Ether had rebounded slightly from the lows, settling at the observed price of ₹151,233.97. Despite this minor recovery, the price remained substantially lower than its early high and below the crucial previous close level.

This intraday journey, marked by a failure to hold early gains and a sharp reversal, highlighted the challenges and the need for strategic positioning when engaging with major cryptocurrencies.

Potential factors driving the ETH/INR decline

Explaining specific crypto price movements usually involved considering a confluence of factors. Several elements could have contributed to Ether’s decline against the Indian Rupee.

Broad market weakness (Bitcoin correlation): While having its own strong fundamentals, Ether still displayed a high degree of correlation with Bitcoin (BTC). As seen in the market data for the same period, Bitcoin also experienced a decline against the INR. A downturn in Bitcoin, the market’s bellwether, often triggered a broader risk-off sentiment across the crypto space, dragging major altcoins like Ether lower.

Profit-taking: The substantial rally in the early hours of the session, pushing towards ₹158,000, created an opportunity for traders who had bought at lower levels to take their profits. As the price struggled to move higher, profit-taking might have intensified, adding to the selling pressure that eventually overwhelmed buyers.

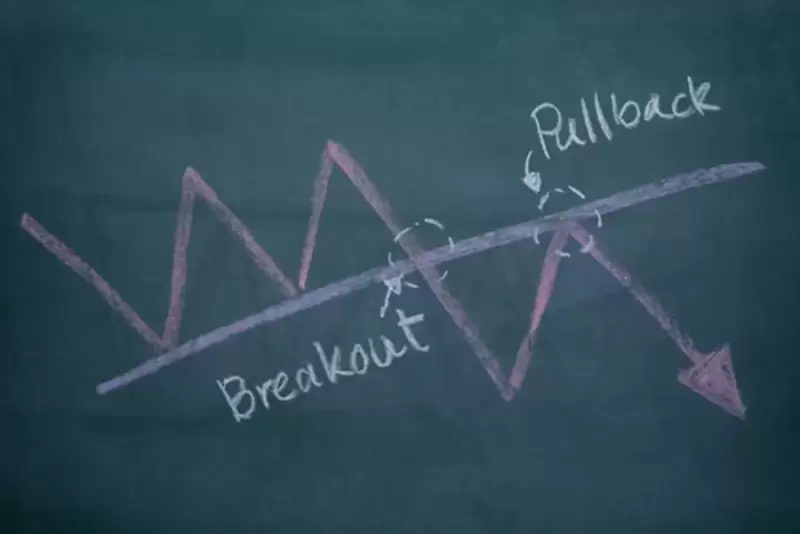

Technical factors and support breaches: The failure to sustain gains above the ₹156,000-₹158,000 zone could have been seen as a rejection at resistance. More critically, the break below key support levels—the consolidation floor around ₹155,000, the previous close at ₹153,500, and the ₹152,000 mark—might have triggered automated stop-loss orders. These breaches would also have been interpreted as bearish signals by technical analysts, potentially prompting further selling or short positions.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- BONK GUY predicts BONK will “speedrun” to a new ATH, citing historical 90% corrections and bullish trends

- Apr 27, 2025 at 11:15 am

- BONK, the popular meme token, has seen a significant price increase in recent days. Starting at $0.000012 on April 22, the price of BONk's rose to $0.00001596 by April 25

-

-

- Brazil Has Marked a Historical Turning Point After Beating the United States to Debut the First-Ever Exchange-Traded Fund (ETF)

- Apr 27, 2025 at 11:10 am

- XRP is the industry's fourth most valuable cryptocurrency with a $158 billion market cap as of this writing. But despite its dominance in the cryptosphere

-

-

- New Energy Cloud Mining Attracts Users with High Profit and Simple Operation

- Apr 27, 2025 at 11:05 am

- As times change, people's attitudes towards energy have also changed. They rely on renewable energy sources such as solar and wind power to drive new energy cloud mining operations, which greatly reduces mining costs and integrates the electricity of surplus energy into the grid. This not only saves a lot of energy consumption, but also generates high profits and allows investors to see the opportunities of new energy.

-

-

-