|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

KODA Bitcoin Custody Integrates Core: A Milestone for Bitcoin Staking in South Korea

Mar 22, 2025 at 08:20 pm

KODA, the largest custody provider in South Korea, has recently made a significant step in integrating itself into Core, Bitcoin's first proof of stake (PoS) layer

The largest custody provider in South Korea, KODA, has integrated itself into Core, Bitcoin’s first proof of stake (PoS) layer, and a leading DeFi ecosystem for Bitcoin, allowing users to access CORE, the native token of Core, within the regulated Bitcoin staking services it would enable, it was announced on Wednesday.

The integration signals KODA’s active role in expanding subsidized subscription opportunities for institutions in Korea in terms of Bitcoin yield, especially as institutional interest in Bitcoin continues to grow.

This partnership also marks KODA’s support for its first-ever Bitcoin-scaling blockchain, enabling regulated services in that region. As Korea is a leader in global crypto trends, this integration opens doors for institutional investors to access Bitcoin yield products safely and efficiently.

KODA’s leadership in custody services also shows its commitment to innovation and scaling in an ever-changing digital asset landscape.

KODA Bitcoin Custody Integrates Core: A Milestone for Bitcoin Staking in South Korea

The integration of core and bitcoin custody signifies a turning point in the Korean crypto sector with further impetus on institutional adoption and innovation. The largest custody provider in Korea, KODA, now factors Core into the mix with Bitcoin’s first Proof of Stake (PoS) layer and the prime DeFi ecosystem. Bitcoin price is expected to get a lift with aggressive institutional interest and innovations by end of 2025. The prospect of the slow lifting of restrictions on crypto trading for institutions in Korea now puts KODA’s move front and center as the potential engine to unlock the Bitcoin value in the region.

This integration also marks KODA’s support for its first-ever Bitcoin-scaling blockchain, enabling regulated services in that region. As Korea is a leader in global crypto trends, this integration opens doors for institutional investors to access Bitcoin yield products safely and efficiently.

KODA’s leadership in custody services also shows its commitment to innovation and scaling in an ever-changing digital asset landscape.

Bitcoin Price Prediction: Can Bulls Overcome the Death Cross Pattern?

The price of Bitcoin reached $84,300 at the beginning of the day before remaining confined by a support area of $83,380 and resistance of $84,861. At the beginning of the day, the price broke through the support level yet it quickly reversed back into its original trading range. At 02:15 UTC the MACD produced a death cross that indicated negative market direction.Chart 1, analysed by anushrivarshney2613, published on TradingView, March 22, 2025The RSI indicator demonstrated indecision through its movement between the overbought and oversold territories. The MACD indicator showed another golden cross at 04:00 UTC which lifted bullish bitcoin price predictions during the last part of the day though traders failed to break through the $84,861 resistance level. The observed price fluctuations correspond to recent changes implemented by KODA Bitcoin custody as well as Bitcoin staking operations. The integration of the Proof of Stake (PoS) layer from Core enables KODA to attract more institutional stakeholders. The rising demand for Bitcoin due to institutional investment could boost Bitcoin prices in the extended future period. Instrumental adoption alongside favorable regulatory changes from South Korea should generate rising bullish momentum for Bitcoin even though its present-ranging market seeks stabilization.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- XRP price fell as uncertainty set in the market following Donald Trump's announcement of reciprocal tariffs.

- Apr 28, 2025 at 01:50 am

- The news led to a general sell-off in digital assets, which had a negative impact on market sentiment, and thus the $2 price level has become an important support area for XRP traders and investors.

-

-

- Qubetics Interoperability Breaks the Mold—VeChain and AAVE Follow With Real Adoption Among Top Crypto Gems to Buy

- Apr 28, 2025 at 01:45 am

- This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page.

-

-

-

-

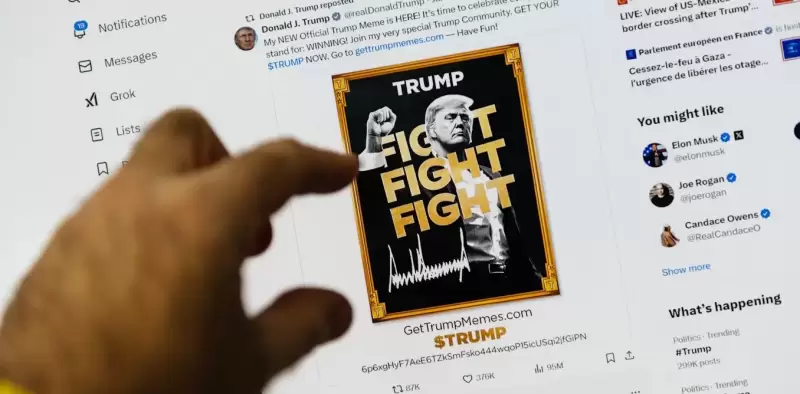

- Launched three days before the inauguration of Donald Trump, the crypto $ Trump, without concrete utility, nevertheless experienced a spectacular outbreak.

- Apr 28, 2025 at 01:35 am

- What if political notoriety became a sound and stumbling currency? It is the bet, provocative and potentially lucrative, that Donald Trump made by launching his cryptocurrency, soberly baptized $ Trumpon January 17, 2025, three days before his official return to the White House.

-