|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Ethereum (ETH) Transaction Fee Revenue Drops 95% From Its All-Time High

Mar 24, 2025 at 01:32 pm

This decline can be primarily attributed to a decrease in Layer 2 contributions, coupled with a significant dip in activity within the non-fungible token (NFT) market.

Ethereum (ETH), the world’s second-largest blockchain by market capitalization, has seen its quarterly transaction fee revenue drop dramatically.

According to Token Terminal, Ethereum’s transaction fee revenue for Q1 2025 is expected to reach around $217 million. This represents an approximately 95% decline from the all-time high of $4.3 billion recorded in Q4 2021.

Back then, Ethereum’s revenue soared by 1,777% year-over-year, as highlighted by Bankless. It rose from $231.4 million in Q4 2020 to $4.3 billion by the last quarter of 2021.

Furthermore, Ethereum’s DeFi ecosystem witnessed significant growth in Total Value Locked (TVL), decentralized exchange (DEX) volumes, NFT sales, and Layer 2 TVL. However, the dynamics have shifted since then.

This is evident from Ethereum’s recent performance in 2025, where monthly revenues have sharply decreased. January saw $150.8 million, while February recorded only $47.5 million. Assuming the trend of declining transaction fees continues, March could also see similarly low figures.

Moreover, in the fourth quarter of 2024, Ethereum generated only $551.8 million in transaction fee revenue, emphasizing the continued downward trend.

One of the major contributors to the decline is the shift to Layer 2 solutions. These have become increasingly popular for their ability to process transactions off-chain while settling on Ethereum’s mainnet.

In addition, the activation of EIP-4844 has significantly reduced the data cost of posting to Ethereum’s chain, further lowering L2 fee contributions. According to a CoinShares report, this upgrade has made transactions cheaper but has also diminished the revenue Ethereum’s mainnet collects from L2 activity.

“Layer 2-related fees, which were high in 2023 and early 2024, have since declined due to cost savings introduced by EIP-4844,” the CoinShares report read.

The decline in NFT activity has also played a significant role. Q4 2021 marked the peak of the NFT craze, with platforms like OpenSea recording billions of dollars in monthly trading volume. Nonetheless, now the interest has waned, leading to a sharp drop in transaction volume and, consequently, fee revenue.

ETH Suffers its Worst Quarterly Decline Since 2018

This decline extends beyond transaction fee revenue. The price of Ethereum has followed a similar downward trend. After reaching an ATH in November 2021, ETH has dropped substantially, now trading 58.8% below that peak.

Even during the election euphoria, when many cryptocurrencies, including Bitcoin (BTC), saw new highs, Ethereum failed to keep pace.

“ETH has experienced the sharpest decline in Q1, dropping by -40%, marking its biggest quarterly loss since 2018,” an analyst wrote on X.

Over the past month alone, ETH has fallen by 25.1%. As of press time, the altcoin was trading at $1,997, representing a slight gain of 0.45% over the past day.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- XRP price fell as uncertainty set in the market following Donald Trump's announcement of reciprocal tariffs.

- Apr 28, 2025 at 01:50 am

- The news led to a general sell-off in digital assets, which had a negative impact on market sentiment, and thus the $2 price level has become an important support area for XRP traders and investors.

-

-

- Qubetics Interoperability Breaks the Mold—VeChain and AAVE Follow With Real Adoption Among Top Crypto Gems to Buy

- Apr 28, 2025 at 01:45 am

- This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page.

-

-

-

-

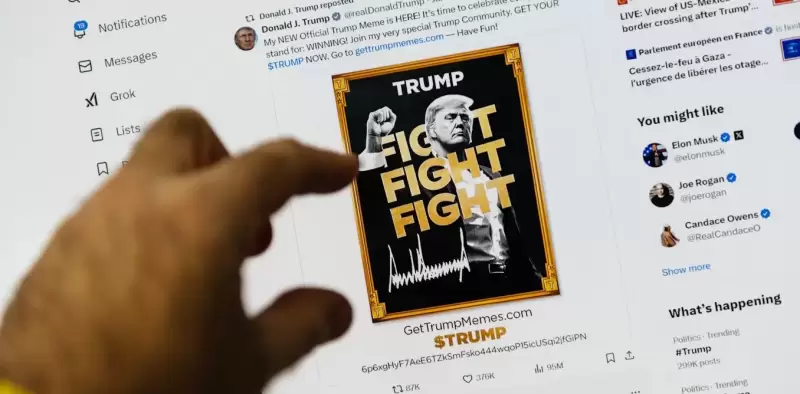

- Launched three days before the inauguration of Donald Trump, the crypto $ Trump, without concrete utility, nevertheless experienced a spectacular outbreak.

- Apr 28, 2025 at 01:35 am

- What if political notoriety became a sound and stumbling currency? It is the bet, provocative and potentially lucrative, that Donald Trump made by launching his cryptocurrency, soberly baptized $ Trumpon January 17, 2025, three days before his official return to the White House.

-