|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Chainlink (LINK) Ranked First Among DeFi Protocols Based on Development Rate

Mar 24, 2025 at 05:32 am

Chainlink (LINK) ranked first among DeFi protocols based on development rate because it carried out 547.5 activities.

Chainlink (LINK) claimed the top spot among DeFi protocols with a remarkable 547.5 development activities over the past six months, showcasing its dominant presence in the decentralized finance domain.

As the leading blockchain oracle network, Chainlink's primary focus is to provide decentralized applications (dapps) with access to real-time, safe data, a critical role in facilitating the smooth operation of DeFi protocols.

This role arises from Chainlink's key decentralized finance activities that combine accurate pricing services for smart contracts and cross-chain connectivity with automatic smart contract features to enhance DeFi platform performance within the growing DeFi ecosystem.

Chainlink's contributions have earned it the number one ranking among 45 protocols in terms of development rate, a testament to its significant contributions to the DeFi space.

The analysis of Chainlink's price action on the 2-day time frame revealed interesting insights.

As the chart showed, LINK reached its highest price of $30 in the first of December 2024.

After reaching highs of $30, LINK's price experienced a decline, eventually breaking through the $15 support level.

During the period from January through March 2025, LINK's price moved within an extended support zone between $12 and $13.

The price of LINK is projected to trade back to $26 by May after reaching $12 support through this March.

Thus it’s potentially validating a bullish trend reversal above the descending trendline.

The bulls could push LINK price to $20 from the current value of $14.71 during the next week if it overcomes $15 resistance along with strong market volume.

The price of LINK must maintain support at $13 to prevent further decreases to $12 or $11 which would start a downward price movement.

The support at $12 passed the reevaluation test before LINK's price increased to $14.71, showing new potential growth while any loss below $13 could create additional downside movement.

Moreover, the analysis of Chainlink's sentiment by professional traders and retail investors yielded interesting findings.

According to the Crowd Sentiment gauge, the overall sentiment of retail investors matched a score of 1.32 which sits on a range from -5 to 5.

These market sentiments tend towards moderate optimism, which explains either recent price developments or raised community awareness about LINK.

In contrast, institutional trader sentiment, measured by the Smart Money Sentiment, maintained a negative value of 1.00.

Despite the bearish signals from experienced traders there is a possibility that market conditions or LINK fundamentals will limit future upward price movement.

The contrasting views from these two main participants in the market implied that Chainlink's (LINK) present situation remained uncertain.

Institutional caution works to limit major growth despite retail sales driving brief price increases in the market.

LINK stands to benefit from sustained price growth if retail traders maintain their position and professional investors shift from bearish to bullish sentiment.

Long-term growth might be affected by ongoing institutional negative sentiment which needs constant observation of related metrics.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

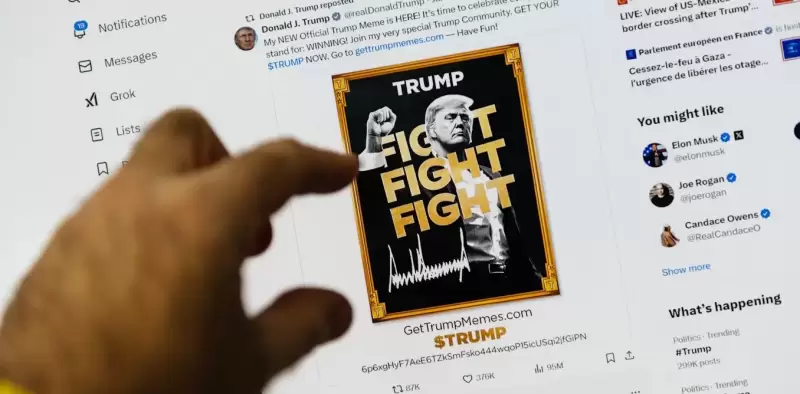

- Launched three days before the inauguration of Donald Trump, the crypto $ Trump, without concrete utility, nevertheless experienced a spectacular outbreak.

- Apr 28, 2025 at 01:35 am

- What if political notoriety became a sound and stumbling currency? It is the bet, provocative and potentially lucrative, that Donald Trump made by launching his cryptocurrency, soberly baptized $ Trumpon January 17, 2025, three days before his official return to the White House.

-

-

- Pi Network Named Official Sponsor of Consensus 2025: Analyst Gave His Price Prediction

- Apr 28, 2025 at 01:30 am

- In a major announcement, Pi Network was officially named as an Official Sponsor of Consensus 2025, one of the largest and most prestigious blockchain and cryptocurrency conferences globally.

-

-

-

- If You Missed Solana's Explosive Breakout, There May Still Be Time to Catch the Next Big Opportunity—Lightchain AI

- Apr 28, 2025 at 01:20 am

- With the crypto presale already raising $19.5 million, Lightchain AI is attracting early believers who see its long-term potential to rival previous market leaders.

-

-