By Omkar Godbole (All times ET unless indicated otherwise) Last week, we described bitcoin above $100,000 as a coiled spring ready to unleash energy in either direction.

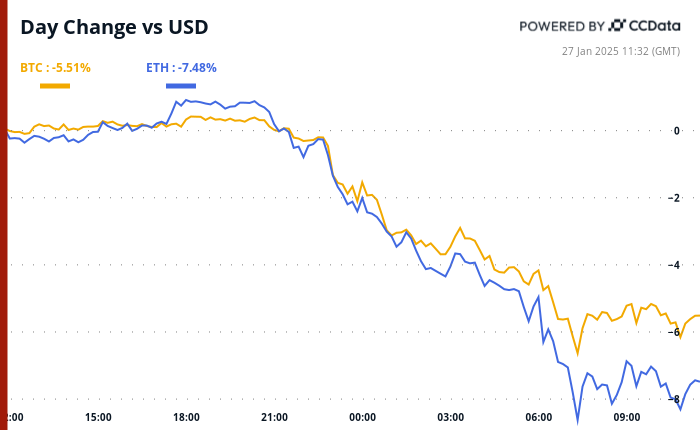

Bitcoin dropped below $98,000 on Monday as market sentiment shifted in response to concerns over the impact of low-cost Chinese artificial intelligence (AI) startup DeepSeek on the U.S. AI sector.

Bitcoin dropped to as low as $97,800 during Asian trading hours, with large sell-offs of up to 40% seen in GPU-heavy AI tokens and sell pressure also hitting GameFi assets.

Nasdaq futures tanked 700 points, with shares in chipmaker Nvidia (NASDAQ:NVDA) indicated 10% lower in pre-market trading. DeepSeek-R1 is expected to reduce the costs of developing large language models by a factor of 100, raising questions on the validity of the rich valuations for AI-associated companies like Nvidia.

“The problem is, few understand how DeepSeek changes things,” trader and analyst Alex Kruger noted on Twitter (NYSE:TWTR). “it's hard to quantify the issue—and when facing uncertainty, people derisk. When this happens in low liquidity conditions, the market flushes hard.”

Kruger is opting not to buy the dip, telling his followers that he prefers to short positions above $100,000 as he anticipates heightened volatility from the upcoming Fed meeting and potential political maneuvering from President Donald Trump. The Fed is expected to reiterate its wait-and-see approach, maintaining its hawkish December guidance on interest rates.

Still, all is not lost. Paul Howard, Senior Director at Wincent, told CoinDesk that institutional participation could ramp up in the coming months.

“The next wave up will likely come from organic participation from institutions in the next 3-4 months. I'd be surprised to see a sharp bounce back to all-time highs before Q2,” he said in an email.

“For long-biased funds, discovering alpha in a bearish market involves seeking out low market-cap layer-1s,” he added. “The market will likely continue to favor layer-1 protocols with a focus on security and transactions per second, like SUPRA. Stay alert!”

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

![Trading is to follow [Review Video] Gold Bitcoin Crude Oil Orders Make Profits! Trading is to follow [Review Video] Gold Bitcoin Crude Oil Orders Make Profits!](/uploads/2025/04/26/cryptocurrencies-news/videos/trading-follow-review-video-gold-bitcoin-crude-oil-profits/image-1.webp)

![ARK Invest Predicts Bitcoin [BTC] Could Surge to $2.4 million by 2030 ARK Invest Predicts Bitcoin [BTC] Could Surge to $2.4 million by 2030](/uploads/2025/04/26/cryptocurrencies-news/articles/ark-invest-predicts-bitcoin-btc-surge/middle_800_480.webp)