|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin (BTC) Reaches a Technical Crossroads After a Sharp Rise Near the End of the Weekend

Apr 22, 2025 at 02:45 am

After a sharp rise near the end of the weekend, Bitcoin is now at a technical crossroads. While momentum sparked hopes of a trend reversal, the underlying structure tells a more cautious story — one that traders shouldn't ignore.

After a sharp rise near the end of the weekend, Bitcoin is now at a technical crossroads. While momentum sparked hopes of a trend reversal, the underlying structure tells a more cautious story — one that traders shouldn't ignore.

Bitcoin (BTC) began the week with an impulsive move to the upside, breaking out of a short-term consolidation and sweeping liquidity above recent highs.

This breakout has generated attention, but in the broader context, Bitcoin has yet to shift the overall trend, which continues to reflect a bearish bias.

The recent swing high at $88,465 falls just short of breaking the previous high at $88,500 — a key level that defines the continuation of the downtrend.

Source: Ben Armstrong

A legitimate break of trend would require Bitcoin to move above $88,500 with strength, ideally supported by a surge in volume and momentum. Without that, this recent move is better viewed as another lower high within the existing downtrend, rather than a signal of bullish continuation.

From a structural standpoint, this pattern of lower highs and lower lows has been consistent over recent weeks.

If the $88,465 level holds and price begins to roll over, it opens the door for a sweep of liquidity resting at $74,500 — a level that has historically attracted demand but could be vulnerable in this context.

Below that, the next significant support comes in at $67,850, which would mark a fresh lower low and confirm the ongoing bearish cycle.

For traders, this setup calls for caution. While the upside move may appear strong on lower time frames, it lacks confirmation on higher time frame structures.

Unless Bitcoin can convincingly break and hold above $88,500, the safer bias remains bearish. Longs from current levels are riskier plays unless they’re tightly managed or supported by strong confirmation.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- XRP price fell as uncertainty set in the market following Donald Trump's announcement of reciprocal tariffs.

- Apr 28, 2025 at 01:50 am

- The news led to a general sell-off in digital assets, which had a negative impact on market sentiment, and thus the $2 price level has become an important support area for XRP traders and investors.

-

-

- Qubetics Interoperability Breaks the Mold—VeChain and AAVE Follow With Real Adoption Among Top Crypto Gems to Buy

- Apr 28, 2025 at 01:45 am

- This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page.

-

-

-

-

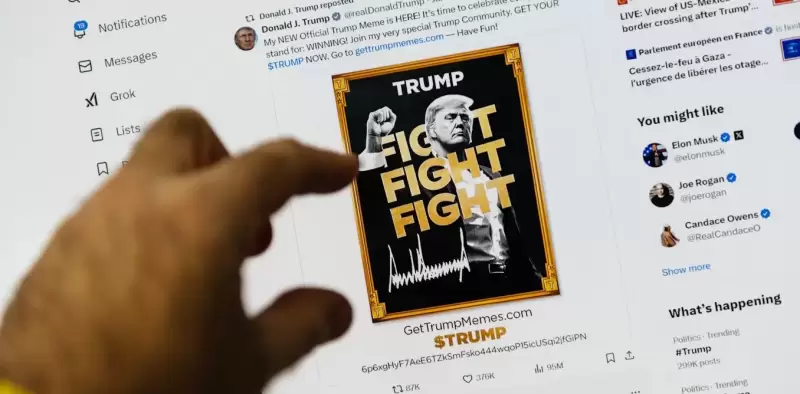

- Launched three days before the inauguration of Donald Trump, the crypto $ Trump, without concrete utility, nevertheless experienced a spectacular outbreak.

- Apr 28, 2025 at 01:35 am

- What if political notoriety became a sound and stumbling currency? It is the bet, provocative and potentially lucrative, that Donald Trump made by launching his cryptocurrency, soberly baptized $ Trumpon January 17, 2025, three days before his official return to the White House.

-