All-time High

All-time Low

Volume(24h)

34.63M

Turnover rate

18.07%

Market Cap

191.6095M

FDV

189.6M

Circulating supply

343.47M

Total supply

343.89M

Max supply

339.89M

Website

Contracts

Explorers

https://etherscan.io/token/0xc011a73ee8576fb46f5e1c5751ca3b9fe0af2a6f

https://etherscan.io/token/0xc011a73ee8576fb46f5e1c5751ca3b9fe0af2a6f

https://app.nansen.ai/token-god-mode?chain=ethereum&tab=transactions&tokenAddress=0xc011a73ee8576fb46f5e1c5751ca3b9fe0af2a6f

https://solscan.io/token/8cTNUtcV2ueC3royJ642uRnvTxorJAWLZc58gxAo7y56

https://bscscan.com/token/0x9ac983826058b8a9c7aa1c9171441191232e8404

https://www.okx.com/web3/explorer/eth/token/0xc011a73ee8576fb46f5e1c5751ca3b9fe0af2a6f

Currency Calculator

{{conversion_one_currency}}

{{conversion_two_currency}}

| Exchange | Pairs | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{val.price}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

Community sentiment

26%

74%

Bullish

Bearish

| Exchange | Pair | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{val.price}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

About Synthetix

Where Can You Buy Synthetix (SNX)?

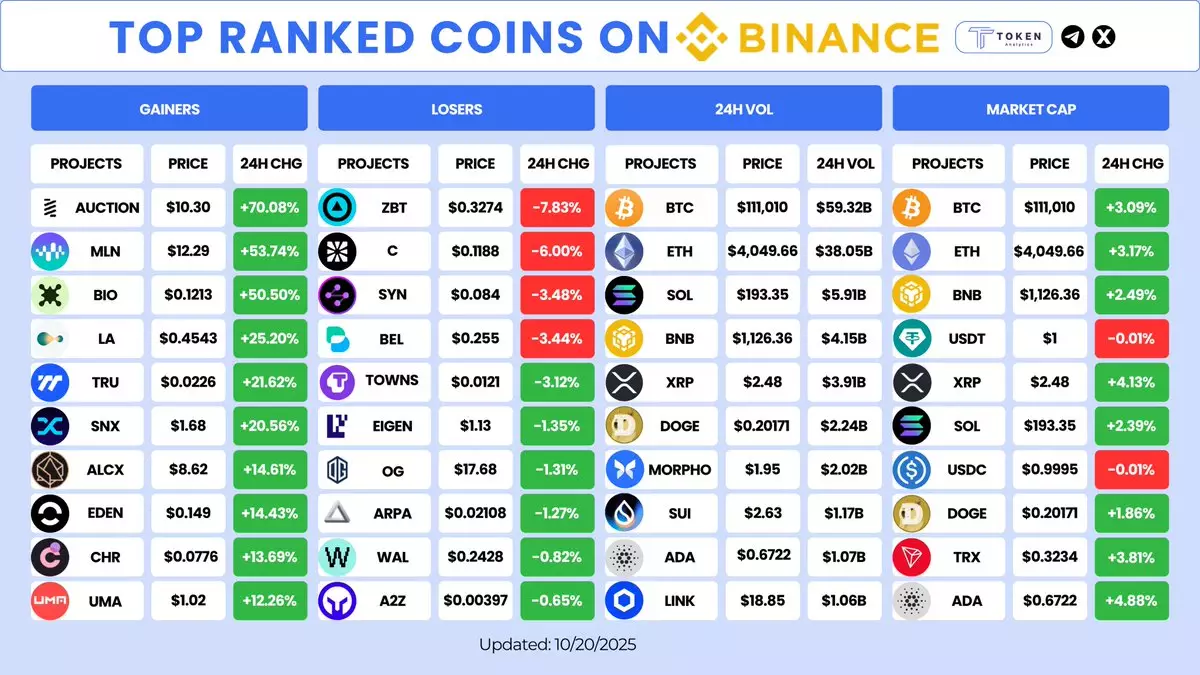

SNX tokens can be purchased at top exchanges, such as: * [Binance](https://coinmarketcap.com/exchanges/binance/) * [OKEx](https://coinmarketcap.com/exchanges/okex/) * [Coinbase Pro](https://coinmarketcap.com/exchanges/coinbase-pro/) * [Uniswap (V2)](https://coinmarketcap.com/exchanges/uniswap-v2/) If you are interested in learning more about how to buy Bitcoin, read CoinMarketCap’s full guide [here](https://coinmarketcap.com/how-to-buy-bitcoin/).

How Is the Synthetix Network Secured?

The SNX token is compatible with Ethereum’s [ERC20](https://coinmarketcap.com/alexandria/glossary/erc-20) standard. The Synthetix network is secured through proof-of-stake ([PoS](https://coinmarketcap.com/alexandria/article/proof-of-work-vs-proof-of-stake)) consensus. Synthetix holders [stake](https://coinmarketcap.com/alexandria/article/what-is-staking) their SNX and earn returns from the network fees. Another way for SNX stakers to earn rewards is via the protocol’s inflationary monetary policy, known as staking rewards.

How Many Synthetix (SNX) Coins Are There in Circulation?

The maximum supply of SNX is 212,424,133 coins, of which 114,841,533 SNX is in circulation as of February 2021. At the seed round and token sale stages, Synthetix sold more than 60 million tokens and was able to raise $30 million. Of the total 100,000,000 coins issued during the ICO, 20% was allocated to the team and advisors, 3% to bounties and marketing incentives, 5% to partnership incentives and 12% to the foundation.

What Makes Synthetix Unique?

Synthetix is a decentralized exchange ([DEX](https://coinmarketcap.com/alexandria/article/what-are-decentralized-exchanges-dex)) and a platform for synthetic assets. The protocol is designed in a way that exposes users to the underlying assets via synths, without having to hold the underlying asset. The platform allows users to autonomously trade and exchange synths. It also has a staking pool where holders can stake their SNX tokens and are rewarded with a share of the transaction fees on the Synthetix Exchange. The platform tracks the underlying assets using smart contract price delivery protocols called oracles. Synthetix allows users to trade synths seamlessly, without liquidity/slippage issues. It also eliminates the need for [third-party](https://coinmarketcap.com/alexandria/article/what-is-a-dao) facilitators. SNX tokens are used as collateral for the synthetic assets that are minted. This means that whenever synths are issued, SNX tokens are locked up in a smart contract. Since launch, the protocol has transitioned to the Optimistic Ethereum mainnet to help reduce the gas fees on the network and lower oracle latency.

Who Are the Founders of Synthetix?

The network was launched in September 2017 by Kain Warwick under the name Havven (HAV). About a year later the company rebranded to Synthetix. Kain Warwick is the founder of Synthetix and a non-executive director at the blueshyft retail network. Prior to founding Synthetix, Warwick has worked on several other cryptocurrency projects. He also founded Pouncer, a live auction site exclusive to Australia. Peter McKean, the project’s CEO, has over two decades of experience in software development. He previously worked as a programmer at ICL Fujitsu. Jordan Momtazi, the COO of Synthetix, is a business strategist, market analyst and sales leader with several years of experience in blockchain, cryptocurrency, digital payments and e-commerce systems. Justin J. Moses, the CTO, was the former director of engineering at MongoDB and deputy practice head of engineering at Lab49. He also co-founded Pouncer.

What Is Synthetix (SNX)?

Synthetix is building a decentralized liquidity provisioning protocol that any protocol can tap into for various purposes. Its deep liquidity and low fees serve as a backend for many exciting protocols on both [Optimism](https://coinmarketcap.com/currencies/optimism-ethereum/) and [Ethereum](https://coinmarketcap.com/currencies/ethereum/). Many user-facing protocols in the Synthetix ecosystem, such as [Kwenta](https://coinmarketcap.com/currencies/kwenta/) (Spot and Futures), [Lyra](https://coinmarketcap.com/currencies/lyra-finance/) (Options), Polynomial (Automated Options), and [1inch](https://coinmarketcap.com/currencies/1inch/) & [Curve](https://coinmarketcap.com/currencies/curve-dao-token/) (Atomic Swaps), tap into Synthetix liquidity to power their protocols. Synthetix is built on Optimism and Ethereum mainnet. The Synthetix Network is collateralized by SNX, ETH, and [LUSD](https://coinmarketcap.com/currencies/liquity-usd/), enabling the issuance of synthetic assets (Synths). Synths track and provide returns on the underlying asset without requiring one to directly hold the asset. This pooled collateral enables an array of on-chain, composable financial instruments backed by liquidity from Synthetix. Some of the most exciting upcoming releases from SNX are Perps V2, which hopes to enable low-fee on-chain futures trading through the usage of off-chain oracles, and Synthetix V3, which aims to rebuild the protocol to achieve its earliest goal, being a fully permissionless derivatives protocol. Learn more about Synthetix on their blog or by joining the SNX Discord. The platform aims to broaden the cryptocurrency space by introducing non-blockchain assets, providing access to a more robust financial market.

Synthetix News

-

Explore the world of Synthetix, liquidation events, and perps traders. Learn about market dynamics and trading strategies for navigating the DeFi space.

Oct 22, 2025 at 10:47 pm

-

Shiba Inu faces price risk as whale sell-offs intensify. Can SHIB weather the storm?

Oct 21, 2025 at 04:13 am

-

A deep dive into the latest crypto trends, from Synthetix's trading competition to MoonBull's presale and Ripple's surprising moves, revealing key insights for investors.

Oct 20, 2025 at 08:50 pm

-

Dive into the latest crypto trends! Bitcoin's resilience, SNX's surge, and the growing stablecoin supply signal exciting shifts in the digital asset landscape.

Oct 20, 2025 at 01:17 pm

-

Forget crystal balls! We're diving deep into the latest crypto buzz around Digitap, Little Pepe, and MAGACOIN Finance. Which one will be the next moonshot? Find out here!

Oct 20, 2025 at 04:42 am

-

Dive into the dynamic world of altcoins! Explore the surprising trends, top searches, and key factors influencing the crypto market this week.

Oct 20, 2025 at 04:22 am

-

Exploring the intersection of KidWorks, cryptocurrency, and donations, and what it means for the future of charitable giving.

Oct 18, 2025 at 06:01 am

-

Is Synthetix (SNX) poised for a major comeback? Analyzing price predictions, expert opinions, and the factors driving SNX's potential resurgence in the DeFi space.

Oct 17, 2025 at 09:22 pm

-

Dive into the world of cryptocurrencies and altcoins. Is dip buying a viable strategy? Explore the latest trends, insights, and potential opportunities in the market.

Oct 17, 2025 at 07:59 pm

Similar Coins

Twitter

GitHub

Close