All-time High

$4.9

Oct 08, 2021

All-time Low

$0.034

Jun 28, 2025

Volume(24h)

$0

Turnover rate

0%

Market Cap

$7.7385M

FDV

$89M

Circulating supply

$86.93M

Total supply

$1B

Max supply

Website

Contracts

Explorers

Currency Calculator

{{conversion_one_currency}}

{{conversion_two_currency}}

| Exchange | Pairs | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{decimal(val.price,true,2)}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

Community sentiment

26%

74%

Bullish

Bearish

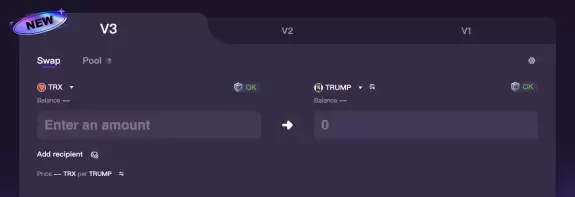

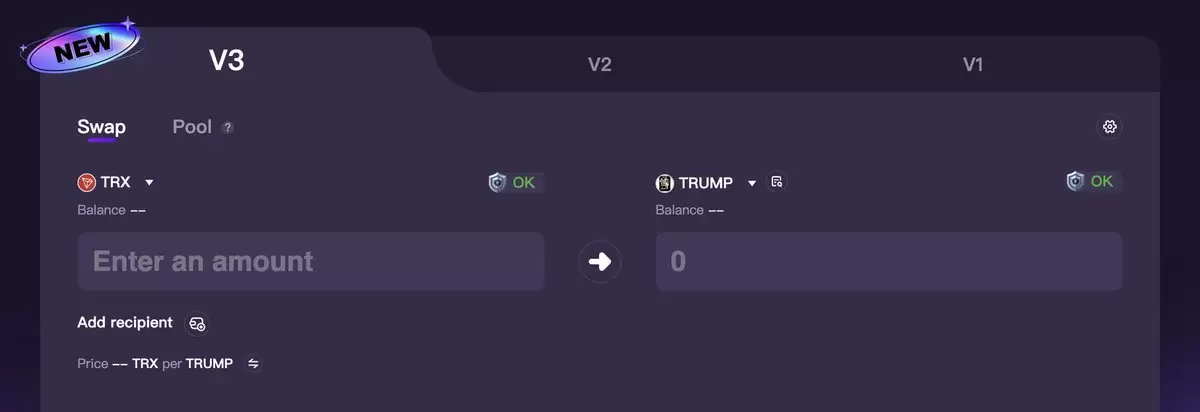

$TRUMP Officially logged in http://SUN.io , the trading experience is very good! $TRUMP Now it has officially launched http://SUN.io , a one-stop decentralized trading platform within the TRON ecosystem, bringing new trading opportunities to meme coin enthusiasts. As a cryptocurrency trader, I personally experienced trading on http://SUN.io $TRUMP

$TRUMP Officially logged in http://SUN.io , the trading experience is very good! $TRUMP Now it has officially launched http://SUN.io , a one-stop decentralized trading platform within the TRON ecosystem, bringing new trading opportunities to meme coin enthusiasts. As a cryptocurrency trader, I personally experienced trading on http://SUN.io $TRUMP

| Exchange | Pair | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{decimal(val.price,true,2)}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

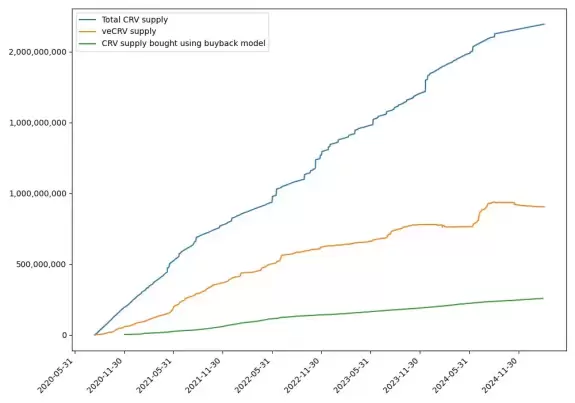

About Ribbon Finance

What is Ribbon Finance?

Ribbon uses financial engineering to create structured products that deliver sustainable yield. Ribbon's first product focuses on yield through automated options strategies. The protocol also allows developers to create arbitrary structured products through combining various DeFi derivatives. Structured products are packaged financial instruments that use a combination of derivatives to achieve some specific risk-return objective, such as betting on volatility, enhancing yields or principal protection. Theta Vault is a new product that automates a covered call strategy to earn high yield on ETH. The vault runs a covered call strategy and sells out of the money call options on a weekly basis for yield. The primary risk for running this strategy is that depositors could potentially give up upside in exchange for guaranteed yield. By selling a call option, users are basically promising to sell the asset at the strike price, even if it goes above it (a.k.a selling early). Because of this, if the price of the asset moves up significantly in a short period of time, it is possible for depositors to have "negative yield" on their ETH. However, this only happens if ETH/USD appreciates significantly, so depositors will still be up in USD terms. The vault also sells call options that are very out of the money, which means there is a relatively low chance of the options getting exercised.

Ribbon Finance News

-

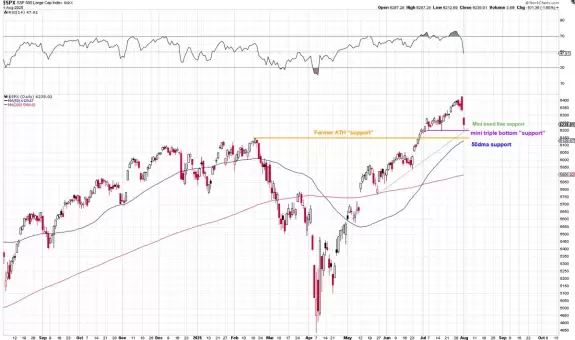

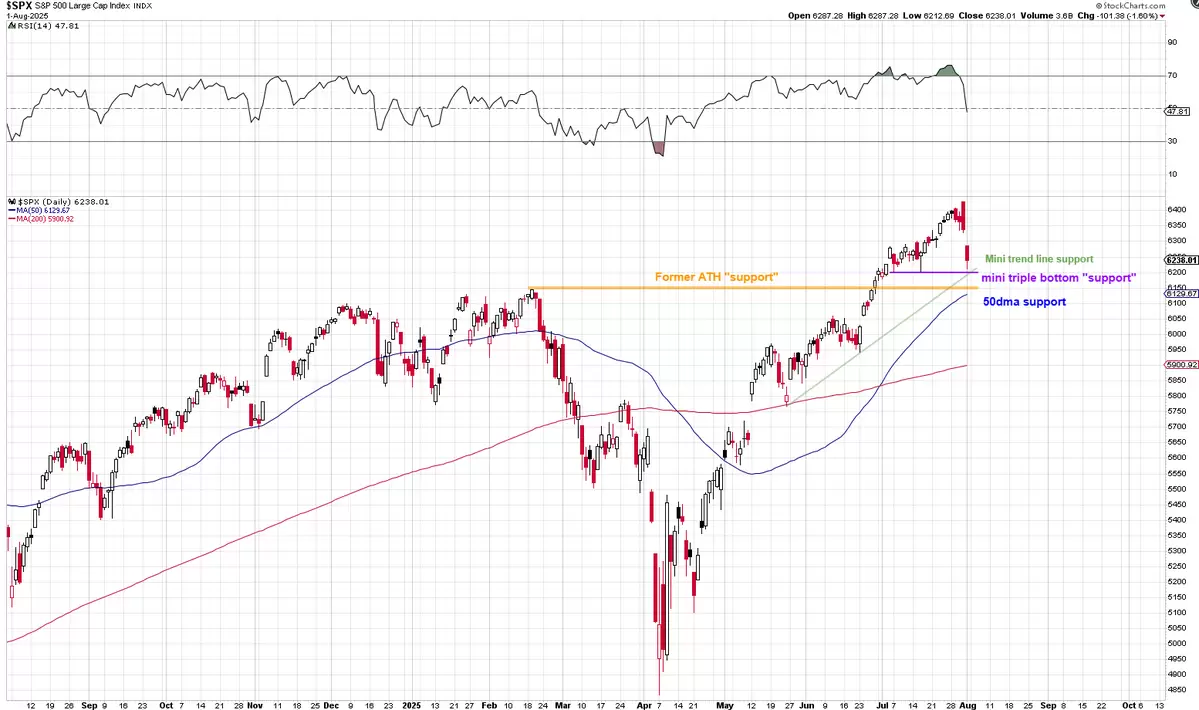

Solana defies macro headwinds with strong revenue, even as weak jobs data spooks markets. Is this the future of crypto?

Aug 02, 2025 at 06:43 am

-

XRP/BTC faces potential volatility. Analyst predicts surge, then 90% crash! Is now the time to buckle up or bail out? Let's break down the technicals.

Aug 02, 2025 at 03:30 am

-

Recent events highlight the volatile intersection of Bitcoin, violent crime, and shifting investment strategies, creating a complex landscape for investors.

Aug 02, 2025 at 03:17 am

-

Exploring the intersection of Bitcoin's evolution, block size debates, and the spirit of Independence Day in the crypto world, with a New York twist.

Aug 02, 2025 at 03:01 am

-

Bitcoin's recent surge has analysts buzzing. Is this a temporary blip, or are we on the cusp of a major crypto upswing? Dive into the key trends and insights.

Aug 02, 2025 at 01:58 am

-

Explore how Strategy's Bitcoin bet led to a $10 billion profit and what it means for crypto strategy. Dive into trends, risks, and insights in this analysis.

Aug 01, 2025 at 09:46 pm

-

A look into the SEC's Project Crypto, Bitcoin's market dominance, and inflation's impact on crypto, offering insights for investors.

Aug 01, 2025 at 12:27 pm

-

Bitcoin's evolving landscape: whale movements, institutional influx, and the shift towards a more mature, less volatile market.

Aug 01, 2025 at 12:21 pm

-

A look at the latest trends in crypto, including American Bitcoin's Nasdaq listing, TRON's surge, and the ongoing bull cycle dynamics.

Aug 01, 2025 at 12:12 pm

Similar Coins

Twitter

GitHub

Close