All-time High

All-time Low

Volume(24h)

242.89M

Turnover rate

17.57%

Market Cap

1.3823B

FDV

1.4B

Circulating supply

333.76K

Total supply

333.76K

Max supply

Website

Contracts

Explorers

https://etherscan.io/token/0x45804880de22913dafe09f4980848ece6ecbaf78

https://etherscan.io/token/0x45804880de22913dafe09f4980848ece6ecbaf78

https://app.nansen.ai/token-god-mode?chain=ethereum&tab=transactions&tokenAddress=0x45804880de22913dafe09f4980848ece6ecbaf78

https://solscan.io/token/C6oFsE8nXRDThzrMEQ5SxaNFGKoyyfWDDVPw37JKvPTe

https://www.oklink.com/eth/token/0x45804880de22913dafe09f4980848ece6ecbaf78

https://explorer.solana.com/address/C6oFsE8nXRDThzrMEQ5SxaNFGKoyyfWDDVPw37JKvPTe

Currency Calculator

{{conversion_one_currency}}

{{conversion_two_currency}}

| Exchange | Pairs | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{val.price}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

Community sentiment

26%

74%

Bullish

Bearish

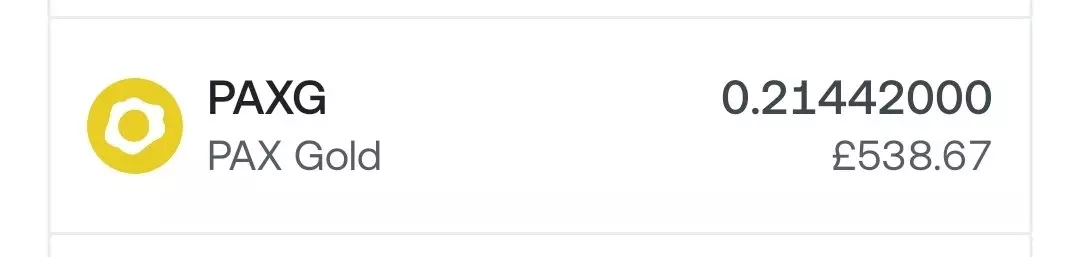

Traded on and closed at +$741 with 100x lev. Kept it simple, waited for the move, done for the day. The ticker is $PAXG. Trade on Reya: https://app.reya.xyz/trade?referredBy=rxxn3rp0…

Traded on and closed at +$741 with 100x lev. Kept it simple, waited for the move, done for the day. The ticker is $PAXG. Trade on Reya: https://app.reya.xyz/trade?referredBy=rxxn3rp0…

1.

1.  +

+  2. tag a friend to win with you

2. tag a friend to win with you  25usdt for each! Winner announcement: 2025, Dec 5th. Good luck

25usdt for each! Winner announcement: 2025, Dec 5th. Good luck  #gold #CryptoMarket

#gold #CryptoMarket

DeFi users can now earn yield in the $LUNA - $PAXG pool on Terra Liquidity Alliance.

DeFi users can now earn yield in the $LUNA - $PAXG pool on Terra Liquidity Alliance.  https://erisprotocol.com/terra/liquidity-hub…

https://erisprotocol.com/terra/liquidity-hub…

| Exchange | Pair | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{val.price}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

About PAX Gold

Where Can You Buy Pax Gold (PAXG)?

Pax Gold is an ERC-20 token, which means it can be bought on many established exchanges and can be stored in a wide variety of cryptocurrency wallets. Some of the top recommended exchanges for trading Pax Gold are [Binance](https://coinmarketcap.com/exchanges/binance/), [BitZ](https://coinmarketcap.com/exchanges/bitz/) and [Kraken](https://coinmarketcap.com/exchanges/kraken/). It is important to note that while Pax Gold is backed by physical gold bars, there still is risk associated with investing and trading PAXG. [Find out more here](https://coinmarketcap.com/how-to-buy-bitcoin/) about buying cryptos.

How Is the Pax Gold Network Secured?

In the official whitepaper, Pax Gold CEO Charles Cascarilla explains that the PAXG protocol is created entirely on the [Ethereum](https://coinmarketcap.com/currencies/ethereum/) blockchain and is secured by the proof-of-work ([PoW](https://coinmarketcap.com/alexandria/glossary/proof-of-work-pow)) model. However, PAXG is not exclusively tied to Ethereum and can be launched on other blockchains as well. Proof-of-work protocols represent a classic approach to cryptocurrency mining, [Bitcoin](https://coinmarketcap.com/currencies/bitcoin/) being the most prominent example. Ethereum has, however, recently begun its transition to the proof-of-stake ([PoS](https://coinmarketcap.com/alexandria/glossary/proof-of-stake-pos)) model, aiming to reduce the resources necessary for token mining, among other things.

How Many Pax Gold (PAXG) Coins Are There in Circulation?

Pax Gold tokens have a one to one ratio with the gold storage backing it. This means that there is a PAXG coin for each ounce of gold in rotation covered by the Pax Gold protocol. In this sense, the amount of PAXG tokens in circulation changes frequently. At the moment of writing, there are about 60,161 PAXG coins in circulation. However, the number of coins shifts almost by the minute as new investors are introduced, and Pax Gold increases the available gold supply for backing.

What Makes Pax Gold Unique?

With a growing number of ERC-20 tokens available for purchase, Pax Gold stands out because it is backed by an already established commodity. One of the main goals for Pax Gold is to make investing in gold more accessible. The official whitepaper states that “more than USD 3.5 trillion of the total gold available today is used solely for investment purposes;” however, a large portion of it is unavailable to small-time investors. This is where Pax Gold comes into play. Each PAXG token is backed by a fraction of a piece of [London Good Delivery](http://www.lbma.org.uk/good-delivery) gold bar, stored in Brink’s gold vaults, which is the approved storage company by the London Bullion Market Association. Through combining the security and liquidity offered by blockchain-based cryptocurrency, and the established name of gold as a physical commodity, Pax Gold brings a new investment opportunity to traders. PAXG has inspired other cryptocurrency developers to create gold-backed tokens as well.

Who Are the Founders of Pax Gold?

[Charles Cascarilla](https://www.linkedin.com/in/charlescascarilla/) is the founder and chief executive officer of both Paxos Standard and Pax Gold. Cascarilla has an extensive career in capital management, which is what led him to explore the vast possibilities cryptocurrencies offer. After acquiring a degree in finance from the University of Notre Dame, he co-founded Cedar Hill Capital Partners in 2005. This was the start of his career in finance and capital management. Since 2005, Mr. Cascarilla has participated in several traditional and blockchain-based venture capital projects.

What Is Pax Gold (PAXG)?

Pax Gold (PAXG) is a gold-backed cryptocurrency, launched by the creators of Paxos Standard (PAX) in September 2019. As an [ERC-20](https://coinmarketcap.com/alexandria/glossary/erc-20) token operating on the Ethereum [blockchain](https://coinmarketcap.com/alexandria/glossary/blockchain), Pax Gold is tradeable on a large variety of exchanges and has become an accessible way for traders to start investing in gold. The main goal behind Pax Gold is to make gold more tradable, as the physical commodity is not easily divisible or flexible in terms of transport. This is why [Paxos Standard](https://coinmarketcap.com/currencies/paxos-standard/) decided to create a cryptocurrency entirely backed by gold. According to the [official whitepaper](https://www.paxos.com/wp-content/uploads/2019/09/PAX-Gold-Whitepaper.pdf), Pax Gold was created to allow investors to buy indefinitely small amounts of gold through the cryptocurrency, thus virtually eliminating minimum buy limits for the commodity.

PAX Gold News

-

Bitcoin faces volatility as Saylor and Kiyosaki remain bullish. Will Kiyosaki's crash warning trigger panic or a major breakout?

Nov 05, 2025 at 08:17 am

-

CZ's personal investment in Aster Token sparks market frenzy. This blog explores CZ's history with crypto investments, the rise of Aster, and market risks.

Nov 05, 2025 at 06:00 am

-

Bitcoin's recent tumble below $100,000 signals a deepening crypto correction. What's behind the plunge, and is this a buying opportunity or a sign of more pain to come?

Nov 05, 2025 at 05:22 am

-

Navigating the crypto market's volatility: Analyzing Bitcoin's dips, XRP's developments, and emerging trends for 2025. Stay informed on the forces shaping digital asset investments.

Nov 05, 2025 at 03:52 am

-

A deep dive into the ASTER crash, Binance's influence, and the resulting market chaos, exploring the psychology behind crypto volatility and offering insights for navigating the turbulent landscape.

Nov 05, 2025 at 03:48 am

-

BNB price faces sharp decline amid broader crypto sell-off. Is this a temporary dip or a sign of deeper troubles? Let's analyze the situation.

Nov 05, 2025 at 03:46 am

-

Explore NIP Group's expanded Bitcoin mining, Bitget's altcoin liquidity program, and the potential of tokens like Little Pepe in shaping the next crypto bull run.

Nov 05, 2025 at 03:45 am

-

Bitcoin plunges below $104K amid massive liquidations and ETF outflows. Is this a temporary blip or a sign of deeper trouble? Plus, MicroStrategy's bold Euro move.

Nov 05, 2025 at 03:34 am

-

Bitcoin plunges below $101K, triggering a $200B crypto market rout. Is this a buying opportunity or the start of a deeper correction?

Nov 05, 2025 at 03:25 am

Similar Coins

![[4K 60fps] epilogue by SubStra (The Demon Route, 1 Coin) [4K 60fps] epilogue by SubStra (The Demon Route, 1 Coin)](/uploads/2026/01/30/cryptocurrencies-news/videos/origin_697c08ce4555f_image_500_375.webp)

Twitter

GitHub

Close