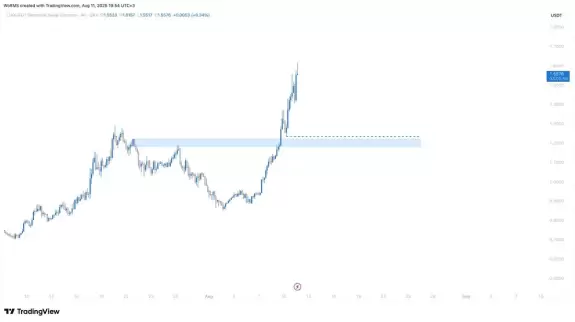

All-time High

All-time Low

Volume(24h)

176.07M

Turnover rate

14.35%

Market Cap

1.2269B

FDV

1.4B

Circulating supply

895.74M

Total supply

1B

Max supply

Website

Contracts

Explorers

https://solscan.io/token/HZRCwxP2Vq9PCpPXooayhJ2bxTpo5xfpQrwB1svh332p

https://solscan.io/token/HZRCwxP2Vq9PCpPXooayhJ2bxTpo5xfpQrwB1svh332p

https://app.nansen.ai/token-god-mode?chain=ethereum&tab=transactions&tokenAddress=0x5a98fcbea516cf06857215779fd812ca3bef1b32

https://etherscan.io/token/0x5a98fcbea516cf06857215779fd812ca3bef1b32

https://www.oklink.com/eth/token/0x5A98FcBEA516Cf06857215779Fd812CA3beF1B32

https://explorer.solana.com/address/HZRCwxP2Vq9PCpPXooayhJ2bxTpo5xfpQrwB1svh332p

Currency Calculator

{{conversion_one_currency}}

{{conversion_two_currency}}

| Exchange | Pairs | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{val.price}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

Community sentiment

26%

74%

Bullish

Bearish

Next goals: 1-

Next goals: 1-

| Exchange | Pair | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{val.price}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

About Lido DAO

Where Can You Buy Lido DAO (LDO)?

Lido DAO (LDO) is available for purchase on major cryptocurrency exchanges including [Binance](https://coinmarketcap.com/exchanges/binance/), [Coinbase](https://coinmarketcap.com/exchanges/coinbase-exchange/), [KuCoin](https://coinmarketcap.com/exchanges/kucoin/), [Kraken](https://coinmarketcap.com/exchanges/kraken/) and more.

How Is the Lido DAO Network Secured?

Funds are secured within a smart contract, making them inaccessible to validators. Subsequently, LDO token holders vote in the Lido DAO to vet, select and onboard new node operators, and penalize existing ones slashed by chain rules. Lido also has a $2,000,000 bug bounty program with the Immunefi platform, a leading DeFi bug bounty program. Lido Bug Bounty programs focus on avoiding user fund losses, denial of service, governance takeovers, data breaches and data leaks. Lido has already awarded $250,000 for 7 Bug Bounties.

How Many Lido DAO (LDO) Coins Are There in Circulation?

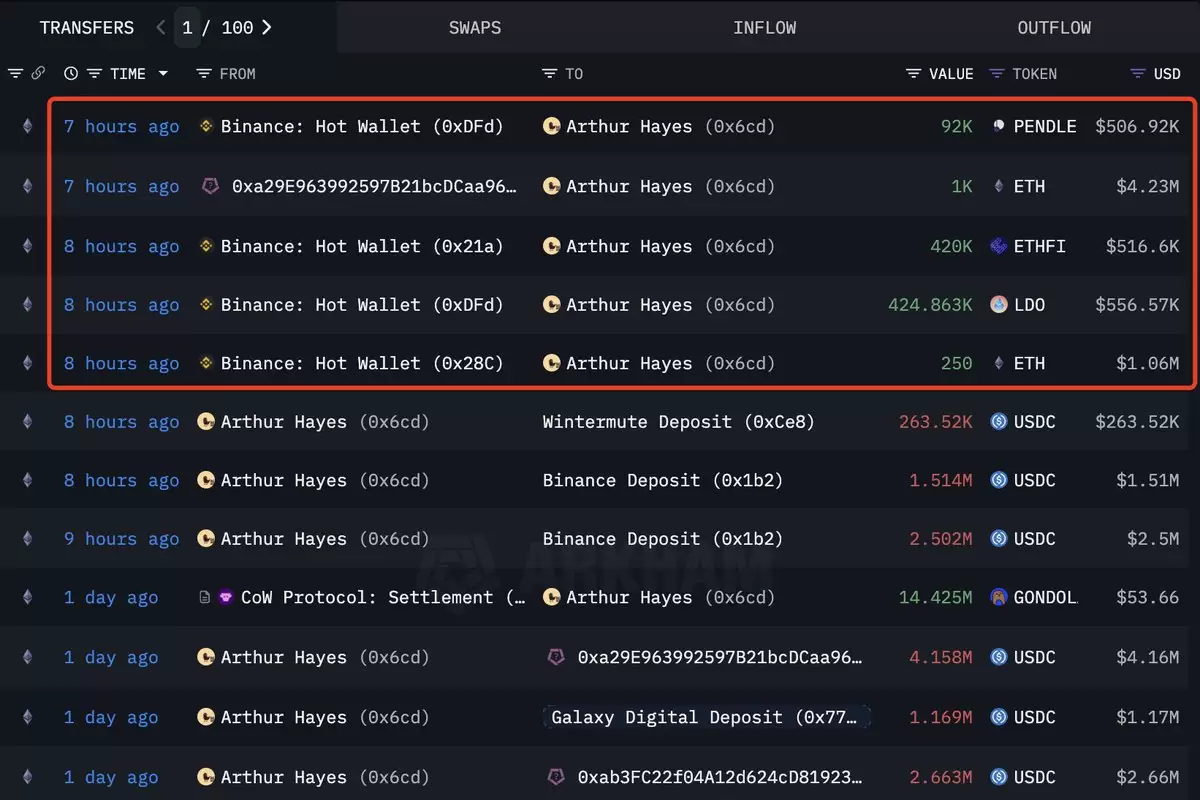

As of June 2023, the total circulating supply of Lido DAO tokens is 879,588,042 LDO, around 88% of the total supply. The max supply is 1,000,000,000 LDO. Looking at the tokenomics of LDO, the allocation of these tokens is as follows: DAO treasury — 36.32% Investors — 22.18% Validators and signature holders — 6.5% Initial Lido developers — 20% Founders and future employees — 15%

What Makes Lido DAO Unique?

Lido aims to make staking more accessible to a wider range of users by [pooling](https://coinmarketcap.com/alexandria/glossary/staking-pool) staked ETH from multiple users, which negates the need for any technical expertise on behalf of users. Users also don’t need to commit a minimum amount of 32 ETH to run their own validator, which lets more people stake their ETH. Lido Liquid Staking V2, or Lido V2, is the latest major release of the Lido DAO protocol. It was designed to provide a more efficient and versatile staking solution for Ethereum 2.0. One of Lido V2’s key features is its "Liquid Staking" model, which allows users to deposit ETH into the Lido pool and receive stETH (staked ETH) tokens in return. These tokens can be traded on secondary markets or used on “[LSDFi](https://coinmarketcap.com/alexandria/article/what-is-lsdfi-overview-of-lsdfi-protocols)” protocols, providing users with a more liquid form of staked ETH that can be used for other purposes. Overall, the Lido DAO network is a robust and secure system that enables users to participate in governance and earn rewards while helping the network to stay secure.

Who Are the Founders of Lido DAO?

Lido was established by Konstantin Lomashuk, Vasiliy Shapovalov and Jordan Fish in 2020. The organization was helped to launch by a collective of financial firms and angel investors. The finance firms include Semantic VC, ParaFi Capital, Libertus Capital, Bitscale Capital, StakeFish, StakingFacilities, Chorus, P2P Capital and KR1. The handful of angel investors who also helped Lido get off the ground include Stani Kulechov of Aave, Banteg of Yearn, Will Harborne of Deversifi, Julien Bouteloup of Stake Capital and Kain Warwick of Synthetix.

What Is Lido DAO (LDO)?

Lido DAO is a [decentralized autonomous organization](https://coinmarketcap.com/alexandria/glossary/decentralized-autonomous-organizations-dao) ([DAO](https://coinmarketcap.com/alexandria/glossary/decentralized-autonomous-organizations-dao)) which provides [staking](https://coinmarketcap.com/alexandria/glossary/staking) infrastructure for multiple [blockchain](https://coinmarketcap.com/alexandria/glossary/blockchain) networks. Most notably, the platform provides a liquid staking solution for Ethereum, allowing users to stake their ETH and receive [stETH](https://coinmarketcap.com/currencies/steth/) (Lido staked ETH) tokens in exchange, which represent the user's staked ETH and staking rewards. Lido DAO is secured by a mix of decentralized governance, audited code and smart contracts. The Lido protocol runs on Ethereum with help from smart contracts that process user deposits and distribute staking rewards, among other functions. Several third-party security firms have [audited](https://github.com/lidofinance/audits) Lido’s smart contracts in order to identify and address potential vulnerabilities. The platform’s native token is LDO - which also serves as the governance token for Lido DAO. Holders can participate in governance proposals and vote on key decisions such as board adjustments, new integrations and platform updates. LDO holders have the right to determine the development and operation of the platform. Lido currently supports staking for Ethereum and Polygon only with the recent sunsetting of Solana.

Lido DAO News

-

Exploring Bitfarms' strategic BTC sales, revenue surge, and shift towards high-performance computing amid Bitcoin's volatile market.

Aug 12, 2025 at 11:49 pm

-

A deep dive into the latest trends in BTC, ETH, and altcoins, including whale movements, emerging altcoins, and market insights. Stay informed and ahead of the curve!

Aug 12, 2025 at 03:00 pm

-

Analyzing the latest trends in Notcoin, Bitcoin, and zkSync. From BTC's steady climb to altcoin season predictions, here's what's shaping the crypto narrative.

Aug 12, 2025 at 07:30 am

-

Explore MicroStrategy's Bitcoin accumulation strategy and its influence on corporate finance.

Aug 12, 2025 at 07:29 am

-

Blue Origin is now accepting cryptocurrency payments for its spaceflights. This article dives into the implications of this move, exploring the intersection of space tourism and digital currency.

Aug 12, 2025 at 07:28 am

-

Explore how MARA Holdings' acquisition of Exaion and Block's Bitcoin banking services signal a significant shift in the Bitcoin landscape.

Aug 12, 2025 at 07:21 am

-

Bitcoin hits new highs in August 2025! Is $121,000 the new normal for BTC? Dive into the factors driving the surge and what experts predict.

Aug 11, 2025 at 11:51 am

-

Bitcoin's wild ride continues! Open interest skyrockets 45% as BTC eyes $122K. Will positive inflation data fuel a surge past $150K? Buckle up, buttercup!

Aug 11, 2025 at 11:48 am

-

A look at how Jack Dorsey's Block Inc. is leveraging Bitcoin, from adding to its treasury to integrating it into Cash App, and the profits they're reaping.

Aug 11, 2025 at 07:40 am

Similar Coins

Twitter

GitHub

Close