All-time High

$5.6

Dec 06, 2021

All-time Low

$0.0017

Jul 29, 2025

Volume(24h)

$14.15K

Turnover rate

0.26%

Market Cap

$5.3458M

FDV

$7.7M

Circulating supply

$828.94M

Total supply

$1.15B

Max supply

1.2B

Currency Calculator

{{conversion_one_currency}}

{{conversion_two_currency}}

| Exchange | Pairs | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{decimal(val.price,true,2)}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

Community sentiment

26%

74%

Bullish

Bearish

| Exchange | Pair | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{decimal(val.price,true,2)}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

About DeFiChain

What Is DeFiChain (DFI)?

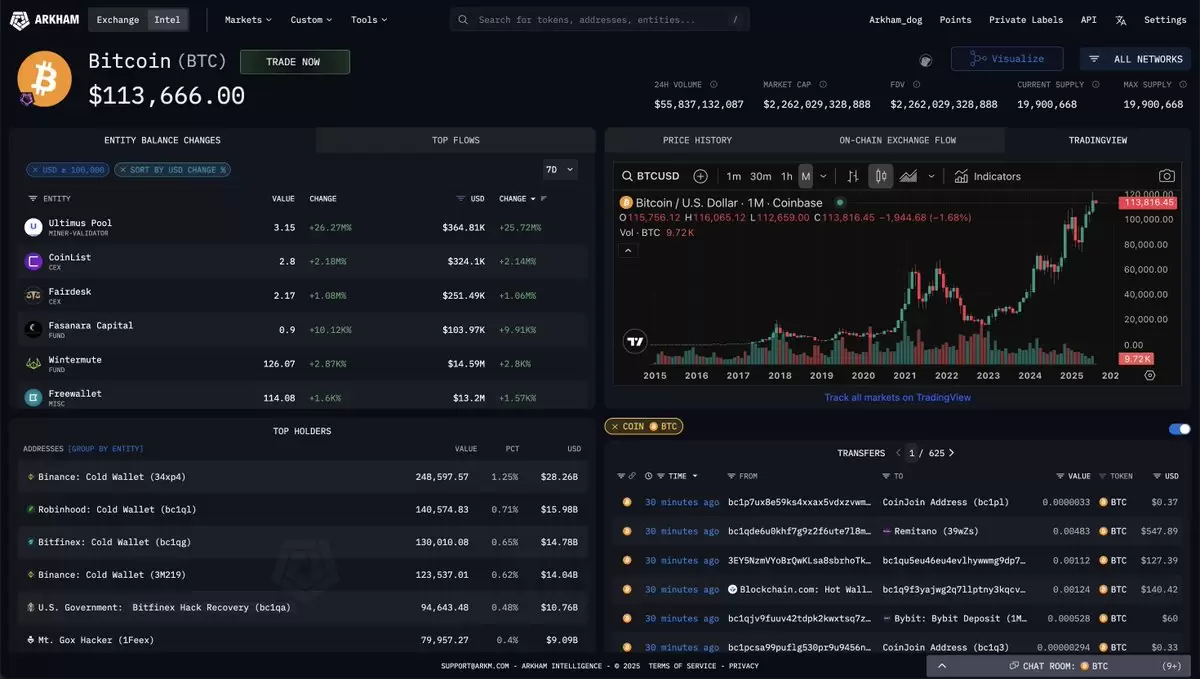

[DeFiChain](https://coinmarketcap.com/currencies/defichain/) (DFI) is a [blockchain](https://coinmarketcap.com/alexandria/glossary/blockchain) platform built with the mission of maximizing the full potential of [DeFi](https://coinmarketcap.com/alexandria/article/what-is-decentralized-finance) within the [Bitcoin](https://coinmarketcap.com/currencies/bitcoin/) (BTC) ecosystem. The software platform is supported by a distributed network of computers and is designed to facilitate fast and transparent transactions. The development team positions DeFiChain as an innovative blockchain project and offers solutions to [problems](https://coinmarketcap.com/alexandria/glossary/blockchain-trilemma) like scalability, security and decentralization. The project was launched in the fall of 2019 with the aim of offering financial services that commercial banks typically provide (borrowing, lending, investing, keeping funds). Yet there is a key difference between DeFiChain and a banking network: DeFiChain is a [decentralized](https://coinmarketcap.com/alexandria/glossary/decentralized) platform. This provides a number of advantages: authorities and entities cannot control the network and anyone has the right to participate in the launch of the network [protocol](https://coinmarketcap.com/alexandria/glossary/protocol). All actions support the entire network and participants in the process receive DFI tokens. The DeFiChain platform ensures fast, transparent and decentralized financial services. The project is built on Bitcoin as a software [fork](https://coinmarketcap.com/alexandria/glossary/fork-blockchain) and is tied to the Bitcoin blockchain using a [Merkle](https://coinmarketcap.com/alexandria/glossary/merkle-tree) root every few blocks. DeFiChain transactions are non-Turing complete, which makes them fast and smooth, with low [gas](https://coinmarketcap.com/alexandria/glossary/gas) costs and a reduced risk of smart contract errors. DeFiChain’s initial functions and products include: lending, token wrapping, pricing oracles, exchanges, asset tokenization, distribution of dividends, and more. Who Are the Founders of DeFiChain? The DeFiChain Foundation owns all [DeFiChain](https://coinmarketcap.com/currencies/defichain/) (DFI) trademarks and domains. The organization is responsible for developing the ecosystem, forging new partnerships, guiding the development of tools for partners, and overseeing DFI funds. At the origins of the project are two key figures: Dr. Julian Hosp and U-Zyn Chua. Hosp is an influential and authoritative specialist in the crypto industry, with a large following around the world. He is also the co-founder and CEO of Cake DeFi. U-Zyn Chua, fellow co-founder of Cake DeFi, serves as chief technical officer (CTO) and researcher at DeFiChain. Chua is also chief engineer at Zynesis and a blockchain advisor to the Singapore government. What Makes DeFiChain Unique? There are two towering blockchains in the crypto industry: [Bitcoin](https://coinmarketcap.com/currencies/bitcoin/) (BTC) and [Ethereum](https://coinmarketcap.com/currencies/ethereum/) (ETH), both of which have inspired the emergence of decentralized finance. However, these early innovations have their limitations: Bitcoin has a long-standing reputation for security, yet can only support basic BTC transactions. As for Ethereum, developers can create applications to perform more complex transactions, yet the network has problems with scalability. This is where [DeFiChain](https://coinmarketcap.com/currencies/defichain/) (DFI) comes in, aiming to tackle challenges like scalability, security and fair governance. The solutions it proposes are as follows: * Building a blockchain platform for DeFi use cases, which is based upon Bitcoin in order to ensure a high level of security. * Using a hybrid [proof of stake](https://coinmarketcap.com/alexandria/glossary/proof-of-stake-pos) (PoS)-[proof of work](https://coinmarketcap.com/alexandria/glossary/proof-of-work-pow) (PoW) consensus mechanism for network operation. The benefits of DeFiChain therefore include: * Offering a full suite of financial asset classes to users in a permisonless and borderless manner * Supporting a wide range of cryptoeconomic financial transactions. * Offering high throughput for all transactions. * Achieving a high level of security through its hybrid consensus mechanism and the fact that transactions are non-Turing complete. * Offering developers the ability to create DeFi apps on one chain. * Providing a reliable and decentralized governance system. How Many DeFiChain (DFI) Coins Are There in Circulation? [DeFiChain](https://coinmarketcap.com/currencies/defichain/) (DFI) is the native unit of account for the DeFiChain platform. The token is utilized both as payment for transaction fees and as a governance tool (i.e., token holders can vote on ecosystem improvements). On top of this, DFI can be used as collateral to borrow other crypto assets. DFI has a capped supply of 1.2 billion coins. 49% of the total supply was transferred to the DeFiChain Fund and the remaining 51% has been issued to masternode holders (over time). The project didn’t participate in [ICO](https://coinmarketcap.com/alexandria/glossary/initial-coin-offering-ico) or initial exchange offering ([IEO](https://coinmarketcap.com/alexandria/glossary/initial-exchange-offering)) events and the DeFiChain team did not conduct any sales rounds. How Is the DeFiChain Network Secured? The [DeFiChain](https://coinmarketcap.com/currencies/defichain/) (DFI) [smart contract](https://coinmarketcap.com/alexandria/glossary/smart-contract) programming language is considered a safe option because it’s non-Turing complete. In addition, DeFiChain is tied to [Bitcoin](https://coinmarketcap.com/currencies/bitcoin/) (BTC) for security reasons: every few minutes DeFiChain takes cryptographic snapshots of the current state of the network and stores it on the Bitcoin blockchain (the action resembles a backup). In September 2020, DeFiChain smart contracts were audited by SlowMist and in October of that year by KnownSec. No vulnerabilities were found. DeFiChain’s final layer of security is its hybrid [PoW-PoS](https://coinmarketcap.com/alexandria/article/proof-of-work-vs-proof-of-stake) consensus mechanism, which takes advantage of the best aspects of each. Where Can You Buy DeFiChain (DFI)? [DeFiChain](https://coinmarketcap.com/currencies/defichain/) (DFI) is listed on major cryptocurrency trading platforms like [Bittrex](https://coinmarketcap.com/exchanges/bittrex/). Other options for buying DFI include [KuCoin](https://coinmarketcap.com/exchanges/kucoin/), [Uniswap (V2)](https://coinmarketcap.com/exchanges/uniswap-v2/), [DeFiChain DEX](https://coinmarketcap.com/exchanges/defichain-dex/), [Hotbit](https://coinmarketcap.com/exchanges/hotbit/), [LATOKEN](https://coinmarketcap.com/exchanges/latoken/), [Bitrue](https://coinmarketcap.com/exchanges/bitrue/) and the mobile app from [DFX.SWISS](https://dfx.swiss/). Another way to get DFI tokens is direct purchase via the [Cake DeFi](https://cakedefi.com/) platform. However, prices can be slightly higher there than on crypto exchanges. If you are new to [cryptocurrency](https://coinmarketcap.com/alexandria/article/what-are-cryptocurrencies), have a look at the CoinMarketCap [blog](https://coinmarketcap.com/alexandria/categories/blog). Want to better understand crypto terminology? Check out CoinMarketCap's [glossary](https://coinmarketcap.com/alexandria/glossary).

DeFiChain News

-

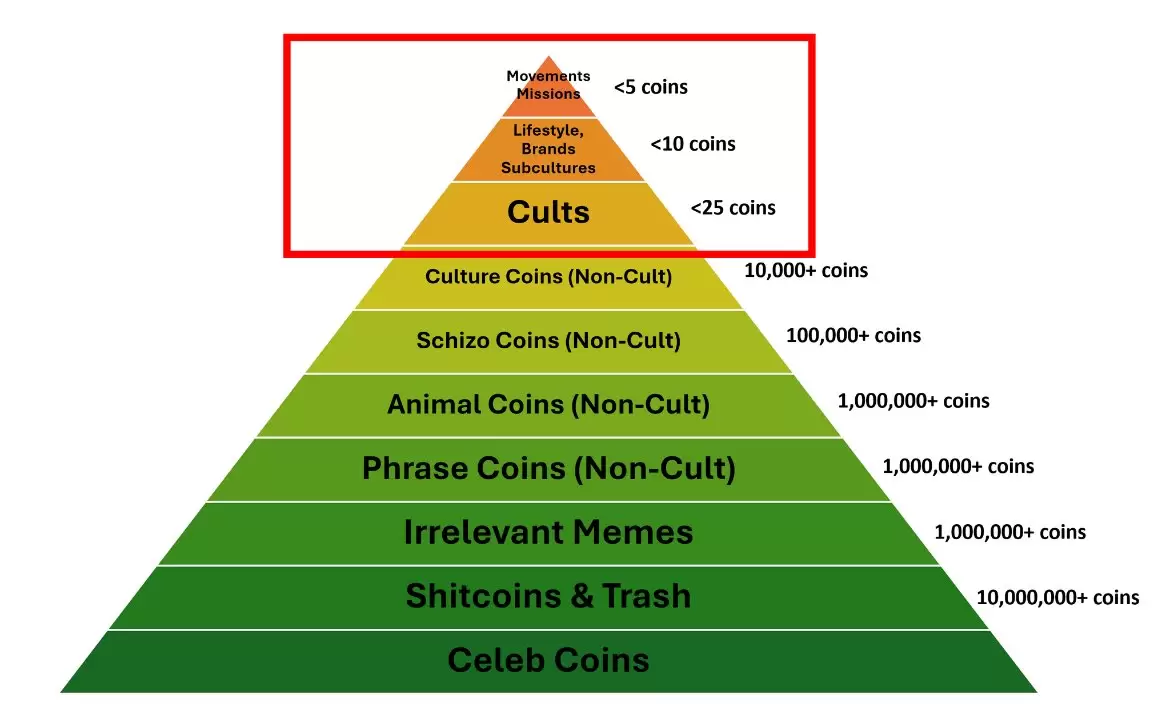

Exploring the top 10 DeFi projects, development trends, and insights into tokens with explosive potential, focusing on developer activity and market dynamics.

Jun 29, 2025 at 01:00 am

-

Chainlink, DeFiChain, and other projects are leading DeFi development. Dive into the trends, insights, and price predictions shaping the future of decentralized finance.

Jun 27, 2025 at 04:00 am

-

The results of the top 10 DeFi projects by development activity over the past 30 days are in, and Uniswap is lagging behind six other protocols.

Apr 17, 2025 at 11:49 pm

-

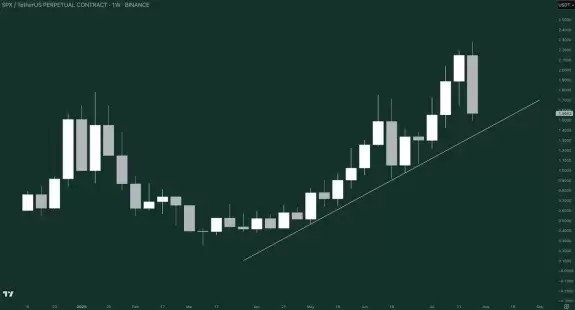

Chainlink (LINK) has reclaimed lost ground after testing a multi-year support level at $13, fueling discussions on whether the bottom is in.

Mar 21, 2025 at 06:51 am

-

Yield Farming has solidified its position as one of the most popular strategies within the DeFi ecosystem, allowing users to generate passive income

Dec 28, 2024 at 05:00 pm

-

According to analytics platform Santiment, Internet Computer (ICP) leads the list of top cryptocurrencies based on notable development activity over the

Dec 20, 2024 at 12:30 pm

-

According to analytics platform Santiment, Internet Computer (ICP) leads the list of top cryptocurrencies based on notable development activity over the past 30 days.

Dec 19, 2024 at 08:42 pm

-

Dr. Julian Hosp, a name that has become synonymous with ambition and controversy in the cryptocurrency world, has once again made headlines.

Dec 12, 2024 at 03:05 pm

-

Synthetix, a decentralized liquidity provisioning protocol, leads decentralized finance (DeFi) projects in development activity, surpassing notable ecosystems in the industry.

Nov 27, 2024 at 10:15 pm

Similar Coins

Twitter

GitHub

Close