All-time High

All-time Low

Volume(24h)

78.62M

Turnover rate

6.52%

Market Cap

1.206B

FDV

1.2B

Circulating supply

479.56M

Total supply

479.56M

Max supply

Website

Contracts

Explorers

Currency Calculator

{{conversion_one_currency}}

{{conversion_two_currency}}

| Exchange | Pairs | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{val.price}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

Community sentiment

26%

74%

Bullish

Bearish

| Exchange | Pair | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{val.price}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

About Cosmos

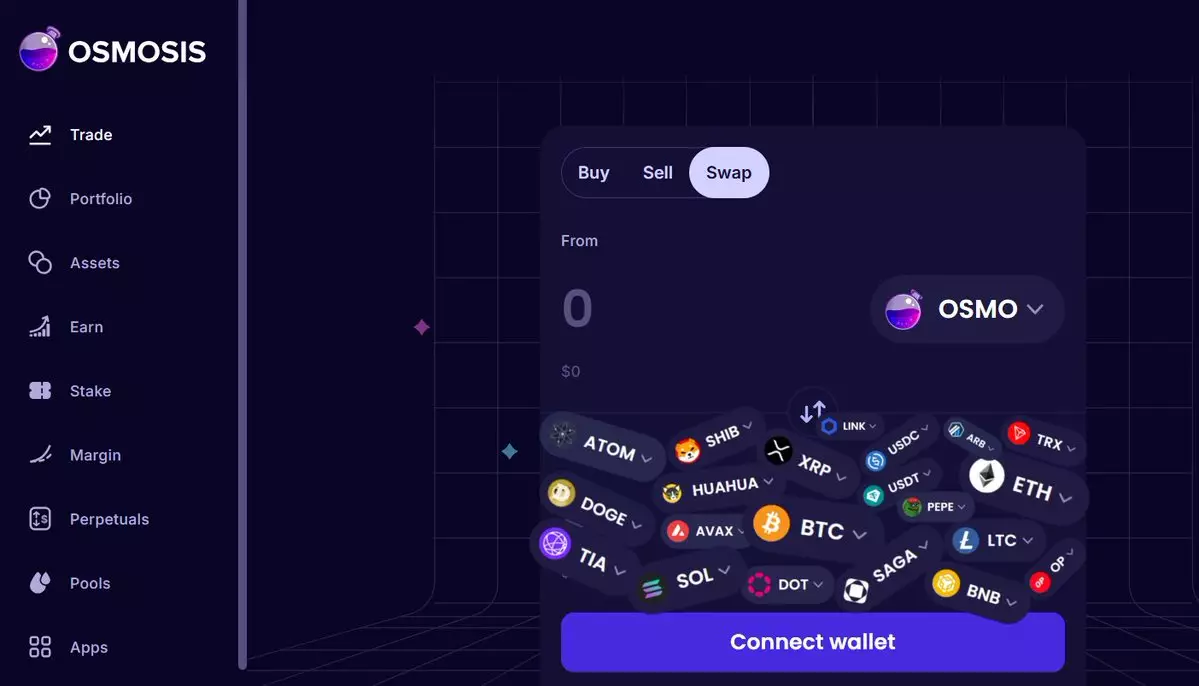

Where Can You Buy Cosmos (ATOM)?

It is now available across a number of major exchanges — many people choose to [buy Cosmos](https://www.binance.com/en/buy-Cosmos) on Binance, Coinbase and OKEx. It’s possible to find trading pairs with a number of fiat currencies, and you can find more about the process of converting dollars and euros to crypto[ here](https://coinmarketcap.com/how-to-buy-bitcoin/).

How Is the Cosmos Network Secured?

As we mentioned earlier, Cosmos uses a proof-of-stake consensus algorithm. Validator nodes that stake a higher quantity of ATOM tokens are more likely to be chosen to verify transactions and earn rewards. Nodes that are found to be acting dishonestly are penalized — and they can end up losing the tokens that they had at stake.

How Many Cosmos (ATOM) Coins Are There in Circulation?

ATOM has a very specific total supply — 260,906,513 to be exact. Of these, at the time of writing, about 203,121,910 were in circulation. It is worth noting that these cryptocurrencies aren’t mined — instead, they are earned through [staking](https://coinmarketcap.com/alexandria/glossary/staking). Two private sales were held in January 2017, followed by a public sale in April of that year. This raised a total of $16 million, which is the equivalent of about $0.10 per ATOM. Breaking down the token distribution, about 80% was allocated to investors, while the remaining 20% was split between two companies: All In Bits and the Interchain Foundation. Cosmos has compared ATOM tokens to the ASICs that are used to mine Bitcoin. As a technical paper written by the Tendermint team explained: “It is a piece of virtualized hardware (economic capital) that you need to obtain in order to participate as a keeper in the network.”

What Makes Cosmos Unique?

A major concern for some in the crypto industry centers on the levels of fragmentation seen in blockchain networks. There are hundreds in existence, but very few of them can communicate with each other. Cosmos aims to turn this on its head by making this possible. Cosmos is described as “Blockchain 3.0” — and as we mentioned earlier, a big goal is ensuring that its infrastructure is straightforward to use. To this end, the Cosmos software development kit focuses on modularity. This allows a network to be easily built using chunks of code that already exist. Long-term, it’s hoped that complex applications will be straightforward to construct as a result. Scalability is another priority, meaning substantially more transactions can be processed a second than more old-fashioned blockchains like Bitcoin and Ethereum. If blockchains are to ever achieve mainstream adoption, they’ll need to be able to cope with demand as well as existing payment processing companies or websites — or be even better.

How Does Cosmos Work?

The Cosmos network consists of three layers: the [application layer](https://coinmarketcap.com/alexandria/glossary/application-layer), the networking layer and the consensus layer. The application layer processes transactions and updates the state of the network, while the networking layer allows communication between transactions and blockchains. The consensus layer helps nodes agree on the system's current state. Cosmos uses a set of open-source tools to connect the various layers together and enable developers to build [dApps](https://coinmarketcap.com/alexandria/glossary/decentralized-applications-dapps).

Who Are the Founders of Cosmos?

The co-founders of Tendermint — the gateway to the Cosmos ecosystem — were Jae Kwon, Zarko Milosevic and Ethan Buchman. Although Kwon is still listed as principal architect, he stepped down as CEO in 2020. He maintains he is still a part of the project but is mainly focusing on other initiatives. He has now been replaced as Tendermint’s CEO by Peng Zhong, and the whole board of directors was given quite a substantial refresh. Their goals include enhancing the experience for developers, creating an enthusiastic community for Cosmos and building educational resources so greater numbers of people are aware of what this network is capable of.

What Is Cosmos (ATOM)?

In a nutshell, Cosmos bills itself as a project that solves some of the “hardest problems” facing the blockchain industry. It aims to offer an antidote to “slow, expensive, unscalable and environmentally harmful” [proof-of-work](https://coinmarketcap.com/alexandria/article/proof-of-work-vs-proof-of-stake) protocols, like those used by Bitcoin, by offering an ecosystem of connected blockchains. The project’s other goals include making blockchain technology less complex and difficult for developers thanks to a modular framework that demystifies decentralized apps. Last but not least, an Interblockchain Communication protocol makes it easier for blockchain networks to communicate with each other — preventing fragmentation in the industry. Cosmos’ origins can be dated back to 2014, when Tendermint, a core contributor to the network, was founded. In 2016, a white paper for Cosmos was published — and a token sale was held the following year. ATOM tokens are earned through a hybrid proof-of-stake algorithm, and they help to keep the Cosmos Hub, the project’s flagship blockchain, secure. This cryptocurrency also has a role in the network’s governance.

Cosmos News

-

Akash Network's Proposal #308 aims to boost network performance. Despite this, AKT price remains bearish. What's next for AKT recovery?

Oct 22, 2025 at 03:11 am

-

October 2025 saw a brutal crypto crash. We're diving into the causes, the carnage, and what it means for the future of digital assets. Buckle up, buttercups!

Oct 21, 2025 at 06:56 am

-

Dive into the world of tokenized real estate with EleveX, MANTRA, and PlayAI's innovative mainnet launch, reshaping investment and automation in the blockchain space.

Oct 21, 2025 at 02:57 am

-

Japan's leading banks are launching a Yen and USD-backed stablecoin, signaling a major shift in digital finance and global payments. Get the inside scoop!

Oct 20, 2025 at 11:25 am

-

Exploring Kava's role in Web3 and its ambition to lead the world through blockchain innovation. From DeFi to AI, Kava's impact is undeniable.

Oct 20, 2025 at 05:00 am

-

Is Cosmos (ATOM) still a contender? Unpacking the Cosmos price, ATOM forecast, and broader crypto potential, while exploring new rivals shaking up the scene in 2025.

Oct 19, 2025 at 09:38 pm

-

Japan's top banks are diving into stablecoins, aiming to revolutionize corporate settlements and potentially redefine cross-border payments in Asia. Is this the future of finance?

Oct 19, 2025 at 05:30 am

-

The crypto market faced a severe liquidation event, with experts weighing in on the causes and potential recovery.

Oct 19, 2025 at 02:33 am

-

ATOM price is feeling the heat from a Binance security incident and broader crypto market unease. Will it bounce back or sink further? Let's break it down.

Oct 18, 2025 at 05:01 am

Similar Coins

![[4K 60fps] epilogue by SubStra (The Demon Route, 1 Coin) [4K 60fps] epilogue by SubStra (The Demon Route, 1 Coin)](/uploads/2026/01/30/cryptocurrencies-news/videos/origin_697c08ce4555f_image_500_375.webp)

Twitter

GitHub

Close