All-time High

$310.91

Jun 07, 2024

All-time Low

$28.88

May 11, 2025

Volume(24h)

$0

Turnover rate

0%

Market Cap

$61.0329M

FDV

$61M

Circulating supply

$48.83M

Total supply

$250K

Max supply

250K

Website

Contracts

Explorers

Currency Calculator

{{conversion_one_currency}}

{{conversion_two_currency}}

| Exchange | Pairs | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{decimal(val.price,true,2)}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell |

Community sentiment

26%

74%

Bullish

Bearish

| Exchange | Pair | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{decimal(val.price,true,2)}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell |

BloomBeans News

-

According to a report from CoinShares, global crypto investment products attracted US$882M (AU$1.34B) in the past week, bringing year-to-date inflows to US$6.7B (AU$10.3B)

May / 14

-

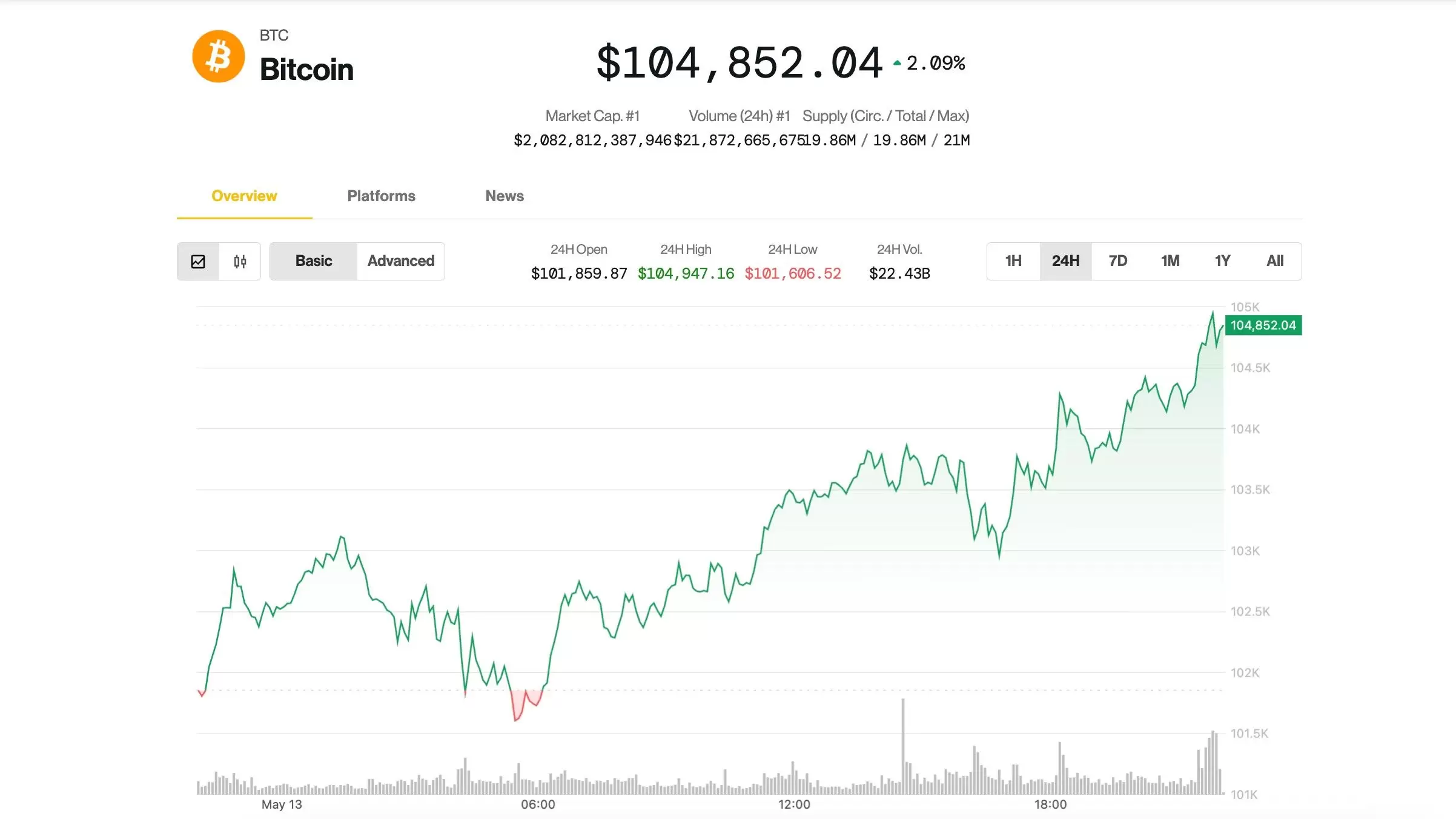

Rising 1.7% over $103,000, Bitcoin BTC/USD is firmly above its lowest point as institutional accumulation and bettering macroeconomic conditions create a favorable environment for the top cryptocurrency.

May / 14

-

Bitcoin (BTC) has once again surged past the six-figure mark, decisively crossing the $100,000 threshold with strong market momentum.

May / 14

-

Renowned crypto analyst PlanB has pointed out a historically significant technical pattern: Bitcoin's 200-week moving average (200WMA) is diverging upward from its 200-week geometric mean

May / 14

-

Tracy Jin of MEXC points to several signs of a potential coming altcoin season, including falling Bitcoin dominance and Ethereum’s strong performance.

May / 14

-

with welcome fresh inflation data, President Trump's bullish outlook on financial markets, and Coinbase's inclusion into the S&P 500

May / 14

-

For much of its history, Bitcoin (CRYPTO: BTC) has been considered the ultimate "risk on" asset. It is highly volatile, and it is prone to boom-and-bust cycles.

May / 14

-

Institutional momentum and the integration of cryptocurrencies into traditional financial frameworks are steadily transforming how digital assets are evaluated

May / 14

-

Bitcoin ETFs saw a notable outflow amid geopolitical tensions and a renewed global trade war earlier this year. Billions exited the funds

May / 14

Similar Coins