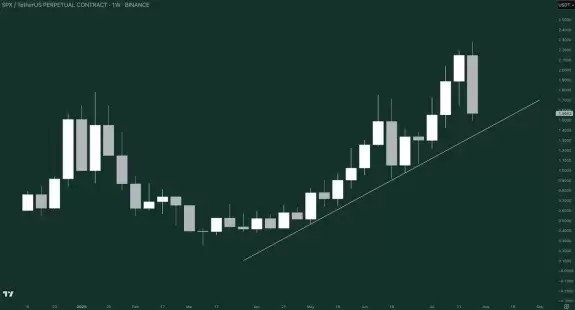

All-time High

$2.9

Feb 06, 2021

All-time Low

$0.0095

Jul 04, 2025

Volume(24h)

$2.93M

Turnover rate

21.79%

Market Cap

$13.4313M

FDV

$14.4M

Circulating supply

$935M

Total supply

$1B

Max supply

1B

Website

Contracts

Explorers

https://bscscan.com/address/0xa1faa113cbe53436df28ff0aee54275c13b40975

https://bscscan.com/address/0xa1faa113cbe53436df28ff0aee54275c13b40975

https://app.nansen.ai/token-god-mode?chain=ethereum&tab=transactions&tokenAddress=0xa1faa113cbe53436df28ff0aee54275c13b40975

https://etherscan.io/token/0xa1faa113cbe53436df28ff0aee54275c13b40975

https://snowtrace.io/token/0x2147efff675e4a4ee1c2f918d181cdbd7a8e208f

https://arbiscan.io/address/0xc9cbf102c73fb77ec14f8b4c8bd88e050a6b2646

Currency Calculator

{{conversion_one_currency}}

{{conversion_two_currency}}

| Exchange | Pairs | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{decimal(val.price,true,2)}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

Community sentiment

26%

74%

Bullish

Bearish

| Exchange | Pair | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{decimal(val.price,true,2)}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

About Stella

What can Stella (ALPHA) token holders do?

The value captured and accrued in the Stella ecosystem will be distributed to ALPHA stakers. ALPHA stakers will receive the following upon staking: Protocol fees from Stella protocol, regardless of which chains or layer-2 solutions Stella is built on. Tokens of the past incubated projects when the tokens become available publicly. This allows stakers to take part in high-quality projects early on. Voting rights on protocol’s proposals to participate in Stella governance.

How Is the Stella Network Secured?

As an ERC-20 token, ALPHA is backed by one of the most robust and secure blockchain networks in popular usage — Ethereum. It is kept secure by its extensive proof-of-work (POW) mining network, which uses an army of dedicated miners to maintain the integrity of the network. Although Stella has dedicated developers and researchers, it also relies on external audits to ensure its smart contracts are secure. Stella is in the last phase of finalizing its smart contract audit with PeckShield and is also currently working with Trust 90 (tentative to complete on June 1, 2023). Please check our [Gitbook](https://docs.stellaxyz.io/) for updated information on our audit progress.

How Many Stella (ALPHA) Coins Are There in Circulation?

The ALPHA token is the native token of Stella. The token was initially launched with a circulating supply of 174.1 million tokens out of a total of 1 billion ALPHA. According to Binance’s Stella paper, the total supply of ALPHA tokens is allocated as follows: Binance Launchpad Sale: 10.00% of the total token supply Binance Launchpool: 5.00% of the total token supply Private Sale: 13.33% of the total token supply Liquidity Mining: 20.00% of the total token supply Team & Advisors: 15.00% of the total token supply Ecosystem: 36.67% of the total token supply Team tokens are locked until August 2021 and will be fully vested by March 2024. bu

What Makes Stella Unique?

* Stella Strategy enables users to increase their positions by borrowing funds from Stella Lend at 0% cost. This results in larger position sizes, leading to higher yields from trading fees, token rewards, or price exposure. Unlike traditional accruing borrow interest from utilization-based IRM, users at Stella pays 0% borrow interest. Stella adopts a Pay-As-You-Earn (PAYE) model. When a leveraged position is closed with a positive yield, a portion of the net yield is deducted as a fee for the borrowed liquidity from Stella Lend. * Stella Lend serves as a platform for users seeking to lend assets and passively earn APY through in-kind token rewards without putting a maximum cap on the lending APY. Users from Stella Strategy can borrow these lent assets to open leveraged positions. The yields generated by borrowers are shared to lenders in the form of lending APY as a result of Stella’s Pay-As-You-Earn (PAYE) model.

Who Are the Core Development Team of Stella?

1. Tascha Punyaneramitdee: Project Lead Former Head of Strategy at Band Protocol, Product Manager at Tencent, and Investment Banking Analyst at Jefferies. 2. Nipun Pitimanaaree: Tech Lead Former Chief Research Officer at OZT Robotics. 3. Arin Trongsantipong: Product Lead Former Software Engineer at SCB 10X, SCBC and Cleverse.

What is Stella (Previously Alpha Finance Lab) (ALPHA)?

Stella is the leveraged strategies protocol with 0% cost to borrow. Stella’s mission is to redefine how leveraged DeFi works. DeFi needs a good leverage system in order to drive more usages on DEXes and money markets, the fundamental building blocks of DeFi. With growing usages on these fundamentals, more protocols and new innovations can arise and tap into the deep liquidity and robust foundation. Stella strives to become the go-to destination for DeFi users to access maximum yield potential. Whatever on-chain strategies that users want to use on leverage (and safe enough to be supported), then Stella will support at 0% cost to borrow. The protocol is made up of two parts: Stella Strategy and Stella Lend. * Stella Strategy: Users can access multiple selections of leveraged strategies with 0% borrowing interest for the first time and get yields on leverage. * Stella Lend: Lenders can lend assets to the lending pools on Stella and get real yields. Yields generated from Stella Strategy are shared to lenders.

Stella News

-

Solana defies macro headwinds with strong revenue, even as weak jobs data spooks markets. Is this the future of crypto?

Aug 02, 2025 at 06:43 am

-

XRP/BTC faces potential volatility. Analyst predicts surge, then 90% crash! Is now the time to buckle up or bail out? Let's break down the technicals.

Aug 02, 2025 at 03:30 am

-

Recent events highlight the volatile intersection of Bitcoin, violent crime, and shifting investment strategies, creating a complex landscape for investors.

Aug 02, 2025 at 03:17 am

-

Exploring the intersection of Bitcoin's evolution, block size debates, and the spirit of Independence Day in the crypto world, with a New York twist.

Aug 02, 2025 at 03:01 am

-

Bitcoin's recent surge has analysts buzzing. Is this a temporary blip, or are we on the cusp of a major crypto upswing? Dive into the key trends and insights.

Aug 02, 2025 at 01:58 am

-

Explore how Strategy's Bitcoin bet led to a $10 billion profit and what it means for crypto strategy. Dive into trends, risks, and insights in this analysis.

Aug 01, 2025 at 09:46 pm

-

A look into the SEC's Project Crypto, Bitcoin's market dominance, and inflation's impact on crypto, offering insights for investors.

Aug 01, 2025 at 12:27 pm

-

Bitcoin's evolving landscape: whale movements, institutional influx, and the shift towards a more mature, less volatile market.

Aug 01, 2025 at 12:21 pm

-

A look at the latest trends in crypto, including American Bitcoin's Nasdaq listing, TRON's surge, and the ongoing bull cycle dynamics.

Aug 01, 2025 at 12:12 pm

Similar Coins

Twitter

GitHub

Close