-

-

Bucket Protocol

Bucket ProtocolMay 25, 2025 at 12:13 pm

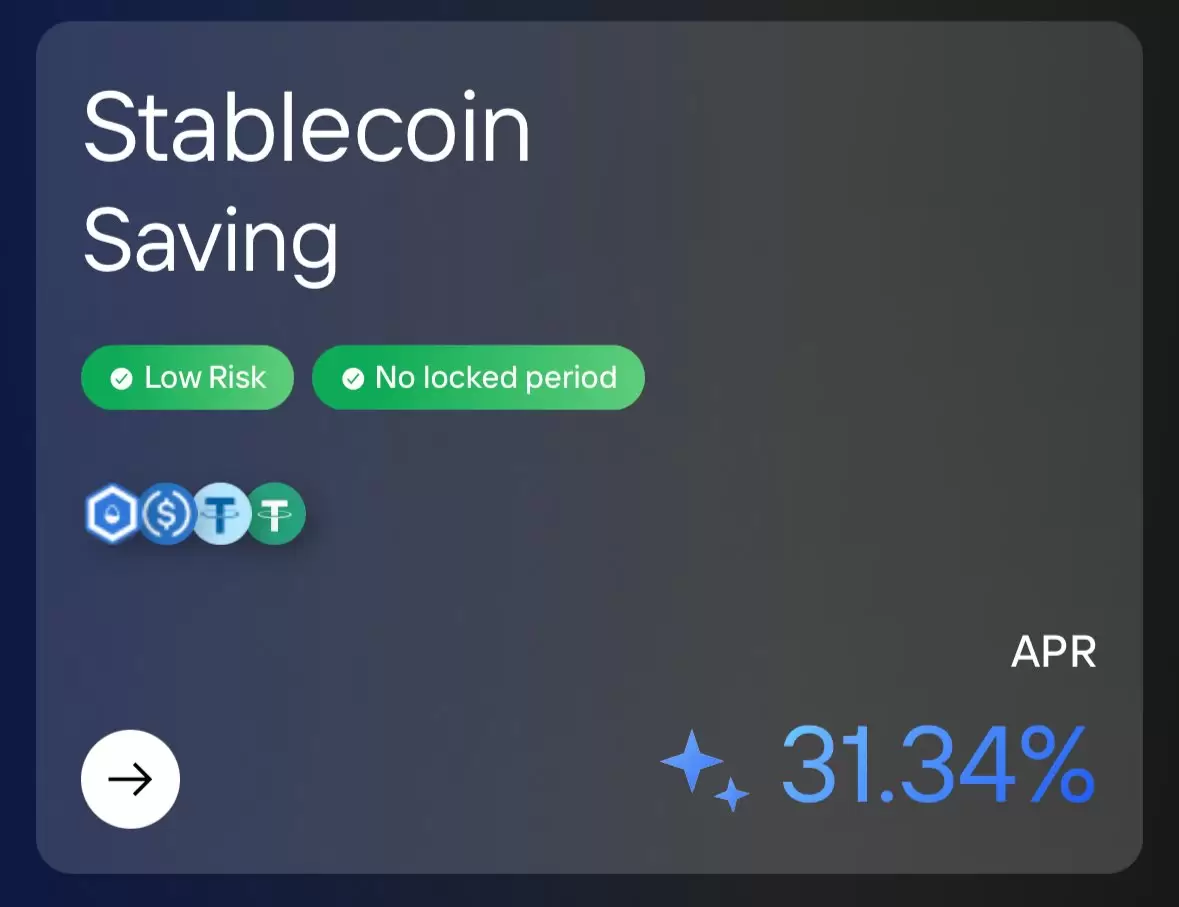

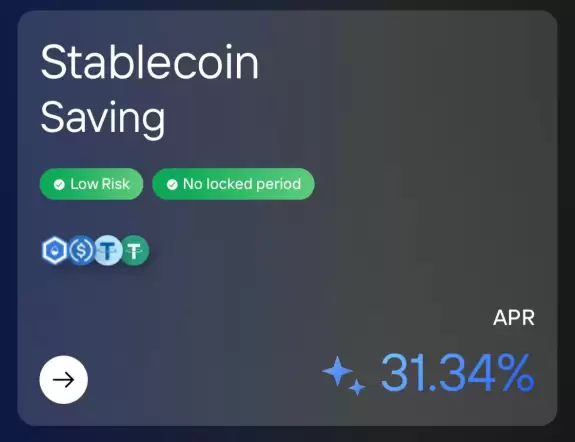

Vibe earning with Bucket for 30%+ APR in $SUI by depositing your stablecoins. (BUCK, USDC, USDT, AUSD) The ecosystem isn’t slowing down — and neither is Bucket. We’ve surpassed $125M+ in TVL since launch, and still holding strong above $100M. This momentum is real.

-

BitcoinHabebe

BitcoinHabebeSep 20, 2025 at 12:02 am

I expect $MYX to continue further down towards 10-11$ area. Thats where i suggest we close our shorts for a possible reversal. Currently our $MYX Short is 35% in Profit. Green circle is where i shared a long 75%Red circle is where i shared a short 35%

Insane profits$MYX With a Habebe God candle of 75%

. I started accumulating low leverage shorts (2-3x) from now & will DCA if it goes higher til 24-26$. I think it cant go higher than there. x.com/bitcoinhabebe/…

-

Xeusthegreat (♟,♟)

Xeusthegreat (♟,♟)Oct 14, 2025 at 03:27 am

-

-

-

-

-

-

BATMAN⚡

BATMAN⚡Jun 14, 2025 at 02:32 am

Just forget the noise, $BNB is still holding strong. Even with market uncertainty, BNB structure is clean after respecting the trendline and bouncing off major support, now eyeing a breakout above $700. If bulls step in, this could be the part of a bigger move to $800+ in

- Pepperstone's Bold Dive: Low-Fee Crypto Platform Redefines Trading Down Under

- Feb 12,2026 at 11:32pm

- Crypto's New Frontier: Meme Tokens and AI Coins Surge Ahead of Bitcoin

- Feb 12,2026 at 11:25pm

- France Unlocks Crypto Potential: Lombard Loans Pave Way for Digital Asset Liquidity

- Feb 12,2026 at 11:22pm

- Buck Bucks Up: New 10% Token Yield and Automatic Rewards Redefine Digital Savings

- Feb 12,2026 at 11:00pm

- Coinbase Takes a Tumble: Downgrades, CEO Selling, and the Crypto Winter Chill

- Feb 12,2026 at 10:49pm

- Crypto VC Funding Surges Past $2 Billion as Institutions Solidify Infrastructure Bets

- Feb 12,2026 at 10:38pm

-

RAIN Trade Now

RAIN Trade Now$0.007852

113.00%

-

PIPPIN Trade Now

PIPPIN Trade Now$0.06097

51.96%

-

PARTI Trade Now

PARTI Trade Now$0.1396

42.04%

-

WAVES Trade Now

WAVES Trade Now$0.9141

41.69%

-

ARC Trade Now

ARC Trade Now$0.04302

35.73%

-

HONEY Trade Now

HONEY Trade Now$0.01029

21.80%

-

KAS Trade Now

KAS Trade Now$0.04959

21.52%

-

AURA Trade Now

AURA Trade Now$0.04599

20.05%

-

PIEVERSE Trade Now

PIEVERSE Trade Now$0.5317

19.48%

-

IOST Trade Now

IOST Trade Now$0.002021

18.80%