-

-

-

-

CM

CMApr 16, 2025 at 09:40 am

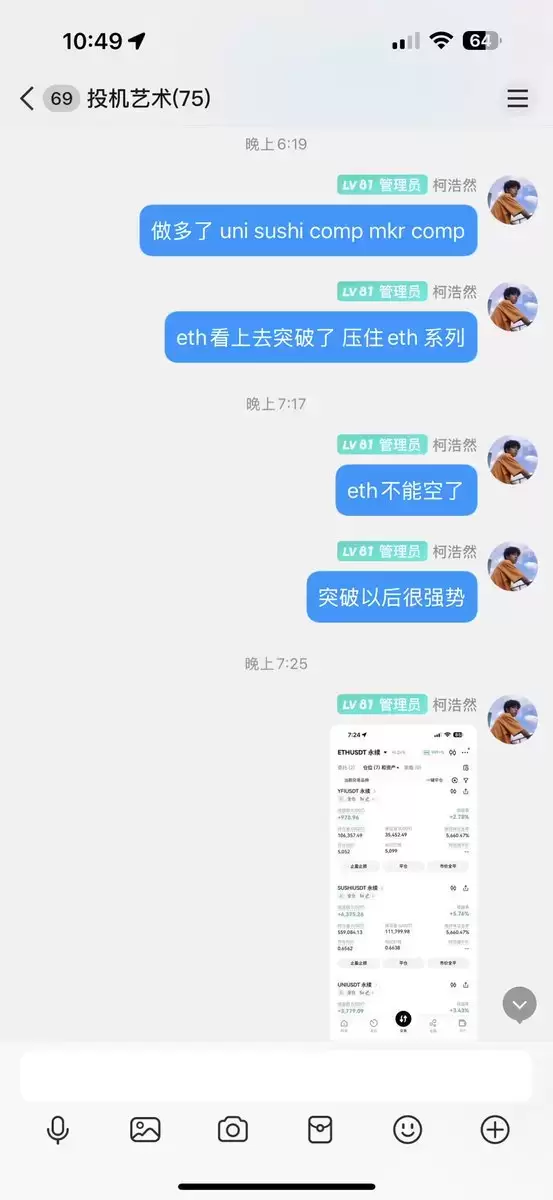

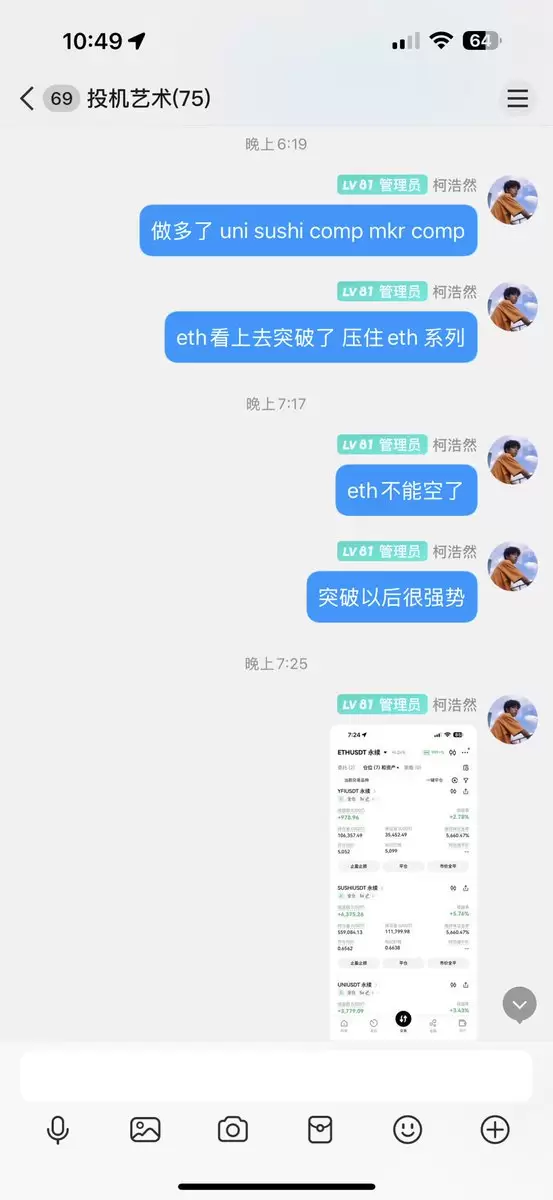

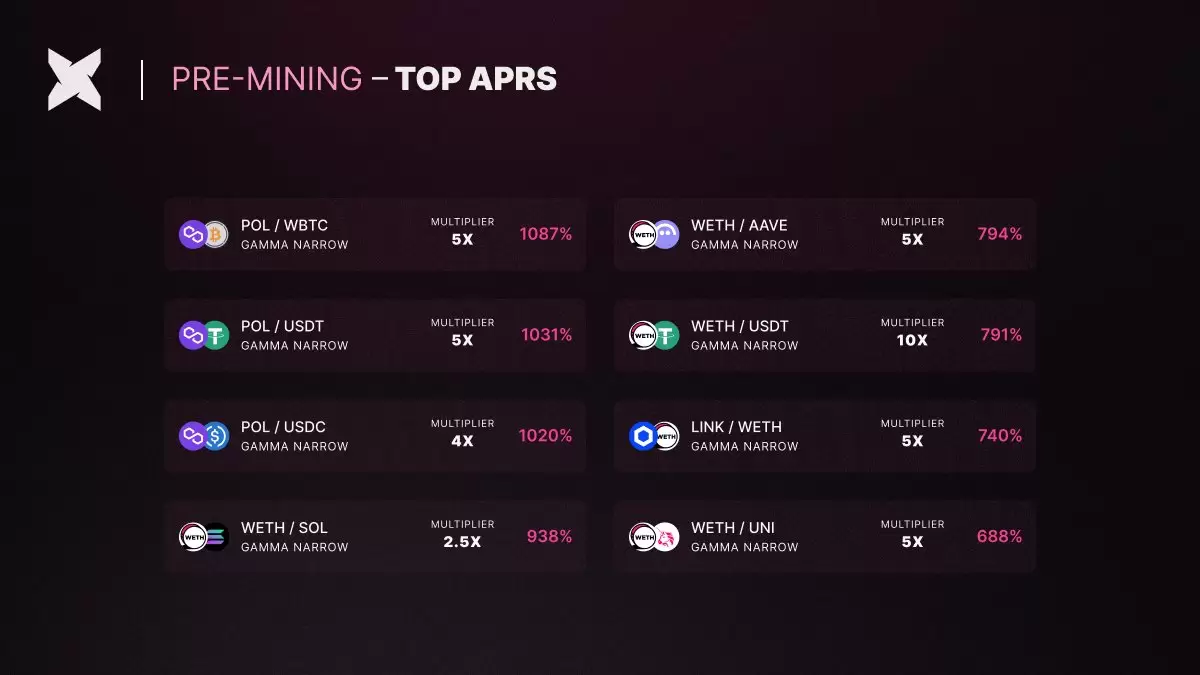

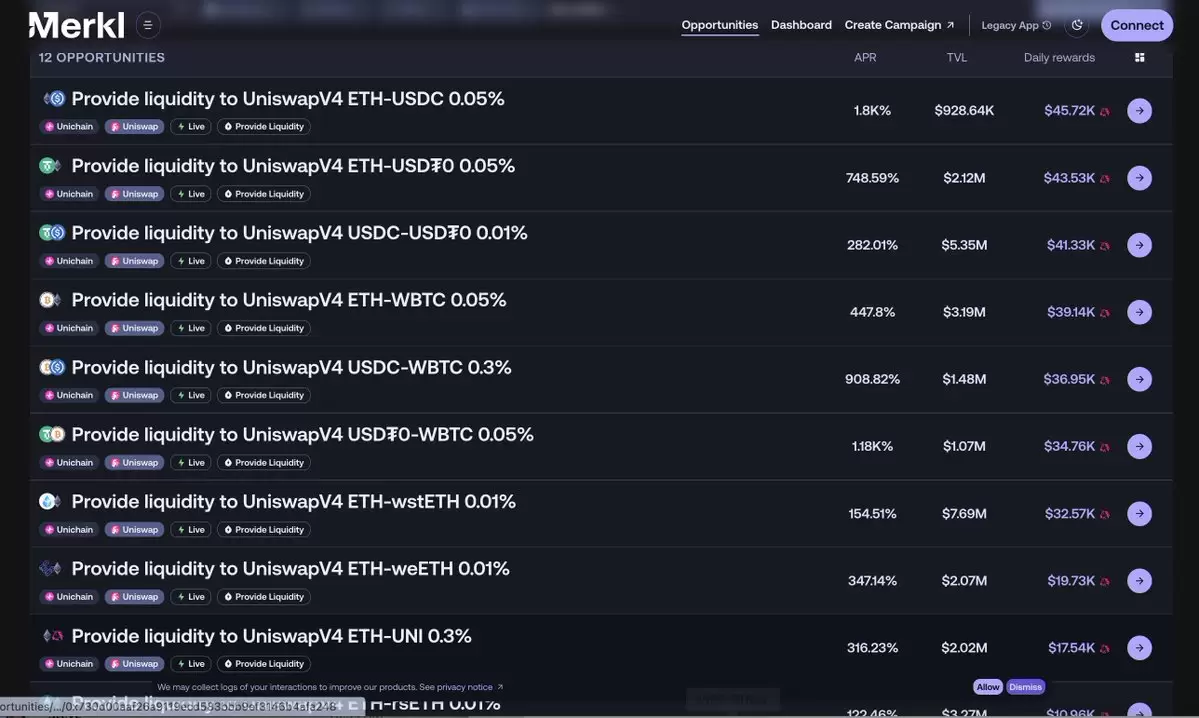

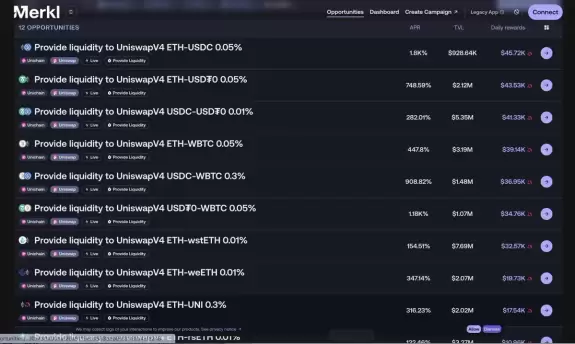

last night $UNI The mine has been opened, and the first wave of DeFi OG funds have already rushed in. If you plan to dig now, you need to pay attention to several details: (1) Rewards are distributed through Merkl, updated every few hours; (2) Merkl's TVL and APR are inaccurate, because it only captures the data at that time point, so the actual APR needs to be calculated by yourself; (3) The reward algorithm is mainly based on Fee's contribution (accounting for 98%); (4) After 5 years of Uni, $UNI can be used to mining liquidity again. Last time, UNI was launched in 2020 to conduct initial emissions through 4 pools, and this time it was to start Unichain to guide liquidity. This time, the 12 pools are all mainstream assets, including ETH, LST, WBTC, stablecoins, and altcoins. I don’t know why I love COMP so much. Although there are many doubts in the governance theory forum, sending money is indeed the most direct and effective way. x.com/LidoFinance/st…

-

Santisa

SantisaApr 16, 2025 at 04:53 am

-

Lsp

LspApr 16, 2025 at 12:59 am

Forgot to dig last time When is it? The official mine, the years are good, the time is limited to two weeks, and you need to ETH cross-chain bridge for putting on LP GAS: https://unichain.org/bridge Data board https://app.merkl.xyz/?chain=130 Reward 6 hours once every 5 m, equivalent value $UNI Subsidy for two weeks #DEFI #UNICHAIN

-

-

- Trump's Fed Chair Pick: Kevin Warsh Steps Up, Wall Street Watches

- Jan 30,2026 at 07:59pm

- Bitcoin's Digital Gold Dream Tested As Market Shifts And New Cryptocurrencies Catch Fire

- Jan 30,2026 at 07:50pm

- Binance Doubles Down: SAFU Fund Shifts Entirely to Bitcoin, Signaling Deep Conviction

- Jan 30,2026 at 07:45pm

- Chevron's Q4 Results Show EPS Beat Despite Revenue Shortfall, Eyes on Future Growth

- Jan 30,2026 at 07:38pm

- Bitcoin's 2026 Mega Move: Navigating Volatility Towards a New Era

- Jan 30,2026 at 07:31pm

- Cardano (ADA) Price Outlook: Navigating the Trenches of a Potential 2026 Bear Market

- Jan 30,2026 at 07:15pm

![[4K 60fps] epilogue by SubStra (The Demon Route, 1 Coin) [4K 60fps] epilogue by SubStra (The Demon Route, 1 Coin)](/uploads/2026/01/30/cryptocurrencies-news/videos/origin_697c08ce4555f_image_500_375.webp)