-

-

EliteOptionsTrader

EliteOptionsTraderJul 15, 2025 at 12:16 am

-

Heisenberg

HeisenbergJul 14, 2025 at 11:35 am

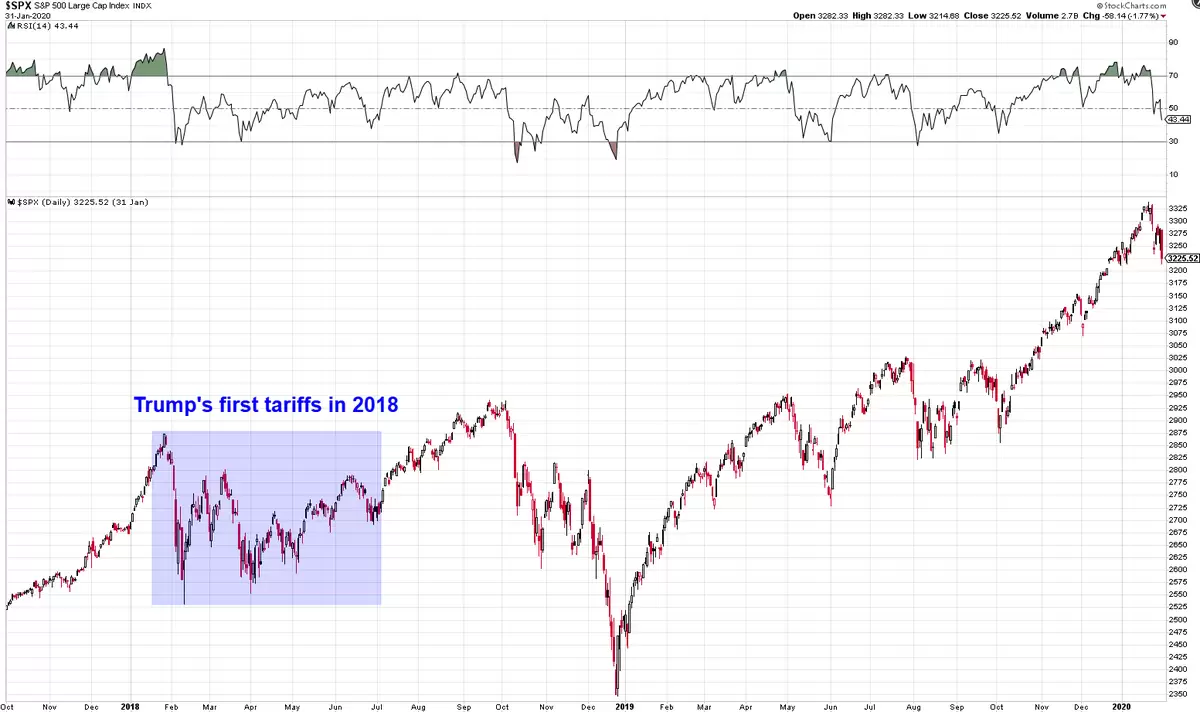

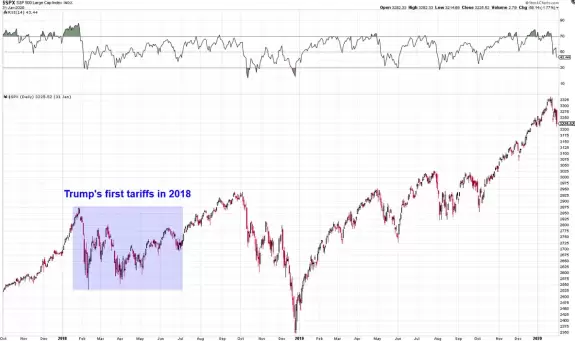

Just like 2018, $SPX easily reclaimed the ATH's after the initial tariffs 1.0. But then... Hopefully we don't get something like that back half of 2025. No way right?$SPX Blue print of Trump's first term tariffs talks and implementation in 2018. A lot of volatility both up and downside. Just to give you an idea.

-

Heisenberg

HeisenbergJul 14, 2025 at 07:48 am

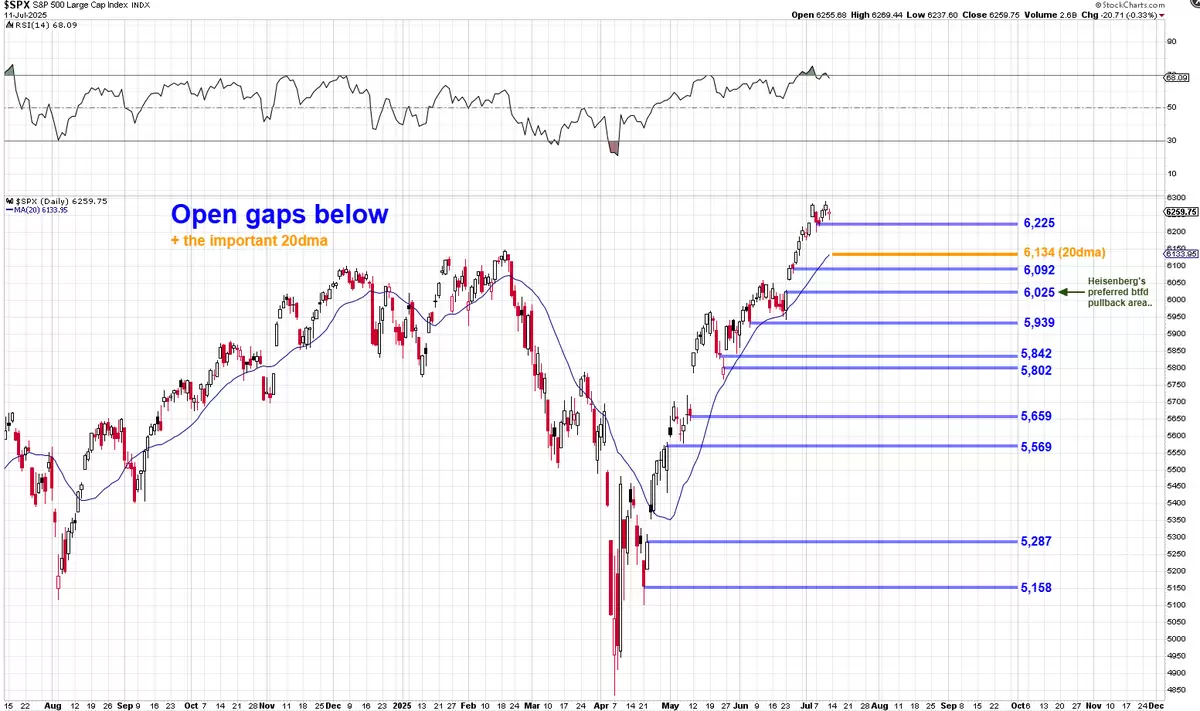

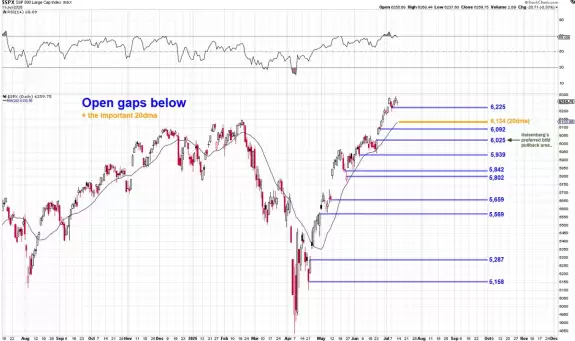

$SPX Open gaps below. Not all gaps fill below. And some can view runaway gap highers as a bullish sign. Personally I would like to see the 20dma get tested and then possibly the 6,025 gap get filled to land right at the all important 6,000 mark for a BTFD moment. But even

-

-

ionicXBT

ionicXBTJul 13, 2025 at 02:47 pm

-

EliteOptionsTrader

EliteOptionsTraderJul 13, 2025 at 01:00 am

-

CyclesFan

CyclesFanJul 13, 2025 at 12:49 am

$SPX - Since the new ATH in 2024 there have been only 2 significant declines. The 9.7% decline last summer at the 1.618 ext. of the 2022 bear market, and the 21% crash this year at the 2.0 ext. Therefore, there's unlikely to be a 10%+ decline until the 2.618 ext. around 7000.

- Exaverse Roars into the Roguelike Scene: A Dinosaur Adventure Awaits!

- Feb 05,2026 at 12:00am

- Big Apple Bites: AI Forecasts Staggering Ethereum Price Record as Market Navigates Volatile Waters

- Feb 04,2026 at 11:00pm

- Unlock Your Edge: The Ultimate Guide to MEXC Referral Code, USDT Bonus, and Fee Discounts

- Feb 04,2026 at 10:32pm

- Navigating the New York Minute: Crypto Exchange Fees in 2026, Globally Unpacked

- Feb 04,2026 at 10:24pm

- Bitcoin's Technical Analyst Warns of Potential Price Drop Amid Market Jitters

- Feb 04,2026 at 09:52pm

- Big Apple Crunch: Bitcoin Mining Faces Profit Crisis as Block Time Spikes and the Difficulty Dial Gets a Hard Reset

- Feb 04,2026 at 09:02pm