-

-

VirtualBacon

VirtualBaconJul 30, 2025 at 01:13 am

BlackRock and JPMorgan aren’t buying $ETH for the hype, they’re here for RWA and stablecoins. Larry Fink has been clear: he wants to tokenize stocks and build funds on Ethereum. Jamie Dimon’s even softening his stance post-Genius Act. Institutions have picked their ETH -

-

Lucky

LuckyJul 30, 2025 at 12:13 am

-

Byzantine General

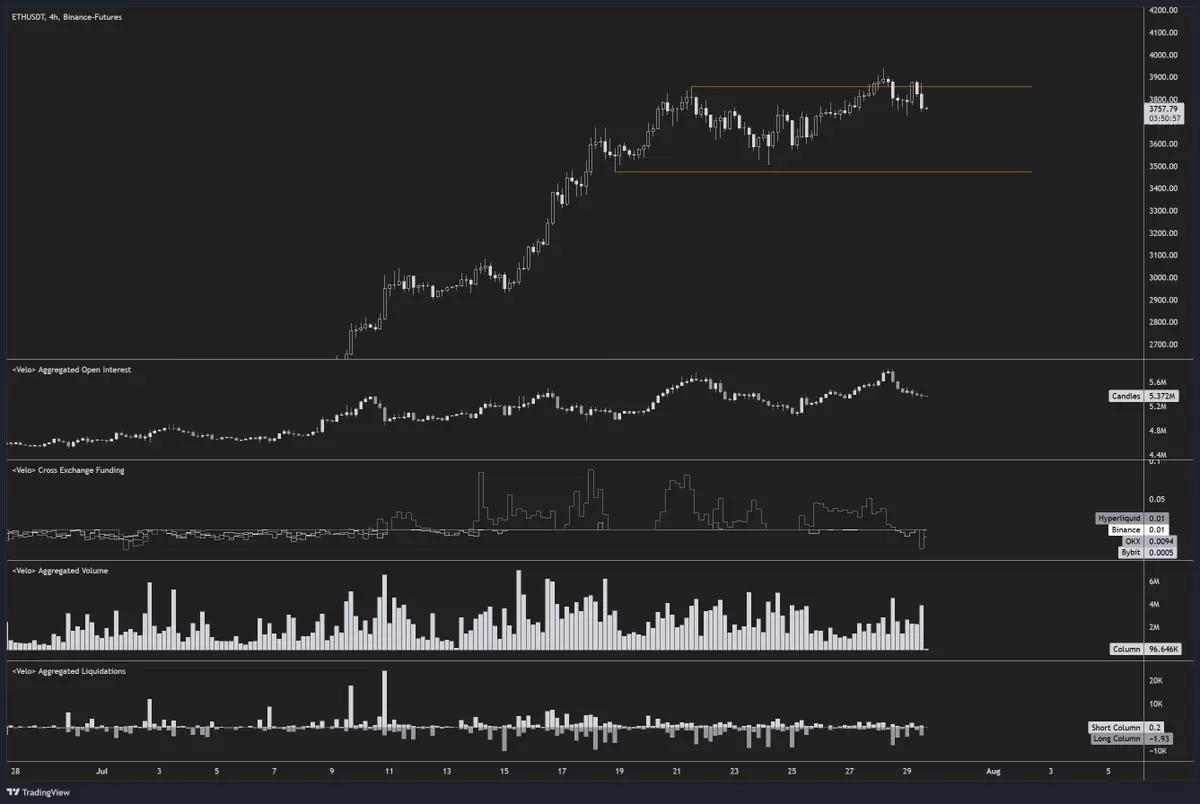

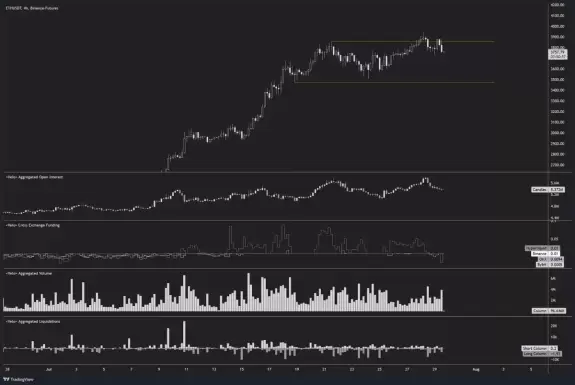

Byzantine GeneralJul 30, 2025 at 12:10 am

I still stand by the idea that short term $ETH moves towards the bottom of the range around 3500. And since most of the market has been tied to ETH PA recently (and not BTC) I expect alts to go down with ETH. Once we reach 3500-ish you want to have filled bids on alts again.

-

-

-

Michaël van de Poppe

Michaël van de PoppeJul 29, 2025 at 06:32 pm

I assumed we'd had a slightly deeper correction on $ETH. Didn't happen. In that case, I think we'll be seeing another run upwards, the target is quite clear: the high at $4,100. I think we'll sweep that level and consolidate for a little. Up we go.

- Midnight Mainnet Rollout Signals New Era for Privacy-Focused Blockchain and Cryptocurrency Landscape

- Feb 12,2026 at 07:59pm

- House Democrats Grill SEC Chair Over Justin Sun, Trump Ties, and Lingering Crypto Fraud Questions

- Feb 12,2026 at 07:58pm

- Fair Play & Foresight: The New Blueprint for Business Idea, ICO Launching

- Feb 12,2026 at 07:53pm

- Platinum Token of Affection: Business News and Emotional Resonance This Valentine's

- Feb 12,2026 at 07:40pm

- Espresso's Next Shot: Binance Spot Listing Brews Excitement for Token Holders

- Feb 12,2026 at 07:16pm

- BlockDAG Holders Hunt for 300% Crypto Bonus as Remittix PayFi Platform Nears Launch

- Feb 12,2026 at 07:12pm