|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特幣公牛分數指數飆升至80,而恐懼和貪婪指數表明樂觀情緒越來越樂觀,歷史模式表明潛在的價格上漲。

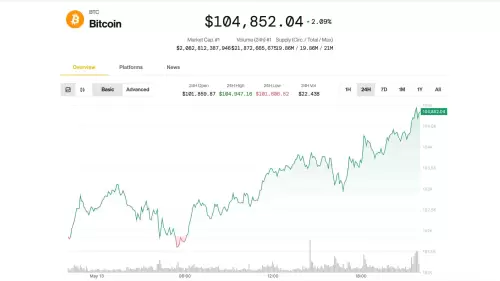

Bitcoin (BTC) price continues to consolidate higher above $100,000 following a drop in the CBOE Volatility Index (VIX) to its 30-year average of 20.

比特幣(BTC)的價格在CBOE波動率指數(VIX)下降到其30年的平均20年後,比特幣(BTC)的價格繼續鞏固高於100,000美元。

This compares to a peak of 60 earlier in 2025.

相比之下,2025年前早些時候的峰值為60。

The decline in VIX follows a US-China trade deal on May 12, which saw a 90-day tariff pause and a 115% reduction in both countries.

VIX的下降是在5月12日的美國 - 中國貿易協議之後,兩國的關稅停頓了90天,降低了115%。

This agreement has led to a “risk-on” sentiment, boosting Bitcoin and equities as investors prefer higher-risk assets, according to Bitcoin network economist Timothy Peterson. The analyst said,

比特幣網絡經濟學家蒂莫西·彼得森(Timothy Peterson)表示,該協議導致了“風險”情緒,增加了比特幣和股票,因為投資者更喜歡高風險的資產。分析師說,

“The good news continues to roll in with the CBOE Volatility Index (VIX) dropping to 20, which is about the 30-year average for VIX, last seen in early 2021. As VIX dropped below 25, my model Accuracy increased to 95% in predicting the direction of Bitcoin at the 100-day time horizon. VIX closed today at 19.38. My model predicts Up at this VIX level for the 100-day time horizon, which is a new model Accuracy high since Accuracy bottomed in early 2024 at 33%. At this VIX level, my model predicts that Bitcoin will continue trending up at the 100-day time horizon, continuing the recent pattern of VIX below 25 predicting further advances in Bitcoin.”

“好消息繼續隨著CBOE波動率指數(VIX)的降至20,大約是VIX的30年平均值,最後一次出現在2021年初。隨著VIX降至25次以下,我的模型準確度下降到95%,在預測100天的比特幣方向時,我的模型在19.38的範圍中都可以預測100級。由於精度在2024年初以33%的速度觸底,因此我的模型預測,比特幣將繼續在100天的時間範圍內呈上升趨勢,延續了低於25的VIX的最新模式。

The US Consumer Price Index (CPI) inflation rate dropped to 2.3% year-over-year in April 2025, the lowest since February 2021, down from 2.4% in March and below consensus forecasts of 2.4%. This marks the third consecutive month of slowing CPI inflation.

美國消費者價格指數(CPI)通貨膨脹率在2025年4月同比同比下降,這是2021年2月以來最低的,低於3月的2.4%,低於共識預測為2.4%。這標誌著CPI通貨膨脹率連續第三個月。

This softer-than-expected CPI reading signals easing inflationary pressure, potentially increasing the likelihood of Federal Reserve interest rate cuts in 2025, assuming other economic indicators align.

假設其他經濟指標與其他經濟指標保持一致,那麼這種比預期的CPI閱讀信號降低了通貨膨脹壓力,可能會增加降低美聯儲降低利率的可能性。

With respect to the current macroeconomic dynamics—lower volatility, cooling inflation, and a trade war truce- it creates favorable market conditions for Bitcoin.

關於當前的宏觀經濟動態(較低的波動,冷卻通貨膨脹和貿易戰役),它為比特幣創造了有利的市場條件。

Earlier this month, Peterson noted that BTC could reach $135,000 within 100 days, citing a drop in the CBOE Volatility Index (VIX) from 55 to 25, signaling a “risk-on” environment. With 95% accuracy, his model links low VIX levels to increased investor confidence in riskier assets like Bitcoin.

彼得森(Peterson)本月早些時候指出,BTC在100天內可以達到135,000美元,理由是CBOE波動率指數(VIX)從55降至25,這表明“風險啟用”環境。他的模型憑藉95%的精度,將低VIX水平聯繫起來,以提高投資者對比特幣等風險較高的資產的信心。

Bitcoin bull score index surges to yearly high

比特幣公牛得分指數飆升至每年高

After posting one of its least bullish phases in two years during April, Bitcoin sentiment flipped drastically to its highest reading in 2025. Data from CryptoQuant indicated a dramatic rise in the Bitcoin Bull Score Index, soaring from 20 to 80.

在四月份的兩年內發布了最小看漲的階段之一之後,比特幣情緒在2025年急劇上升至最高讀數。加密素養的數據表明,比特幣牛公牛得分指數的急劇上升,從20到80飆升至80。

This shift, driven by rising spot demand outpacing supply, reflects patterns observed after the April 2024 halving, suggesting Bitcoin could be poised for further gains.

這一轉變是由於現場需求上升的供應供應量的上升,反映了2024年4月減半後觀察到的模式,這表明比特幣可以得到進一步的收益。

The Bitcoin Bull Score Index is a metric that combines several indicators to gauge the relative bullishness or bearishness of the market.

比特幣公牛分數指數是一個指標,結合了幾個指標,以評估市場的相對看漲或看跌。

It takes into account factors such as price momentum, technical indicators, and on-chain metrics to provide a comprehensive view of the prevailing sentiment and trends.

它考慮了價格勢頭,技術指標和鏈界指標等因素,以全面地看待現行情感和趨勢。

The Fear & Greed Index also suggests growing optimism, currently at 53.3% and heating up slowly, according to Bitcoin researcher Axel Adler Jr.

比特幣研究人員Axel Adler Jr表示,恐懼和貪婪指數還表明,目前為53.3%的樂觀情緒,目前為53.3%,加熱緩慢。

The analyst discussed the possibility of a market “upswing,” expressing hope for a successful test and surpassing Bitcoin’s all-time high near $110,000.

分析師討論了市場“上升”的可能性,這對成功的測試表達了希望,並超過了比特幣的歷史高處接近110,000美元。

However, he noted that the index remains in the "neutral" zone and has not yet reached the "overloaded" zone above 80%.

但是,他指出,該指數保留在“中性”區域,尚未達到80%以上的“超載”區域。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 雅芳價格與鏈上活動一起飆升

- 2025-05-14 11:50:13

- 雪崩的原住民令牌隨著鏈上活動的激增而同時升起。阿瓦克斯在上週能夠維持25%的增長

-

- 一條加密鯨已將2.4億美元轉移到binance

- 2025-05-14 11:50:13

- 該投資者的活動很重要,因為它引起了加密社區的關注。首先,它強調了對集中式交流和Defi市場的鯨魚興趣的日益增長。

-

- 當關鍵技術指標表明看漲勢頭轉移時,XRP價格似乎有望進行重大突破

- 2025-05-14 11:45:17

- 隨機相對強度指數(RSI)現在正在爬出超售區,這表明了山寨幣的潛在上升趨勢延續。

-

-

-

- 比特幣(BTC)的價格在星期二上漲了104,000美元以上

- 2025-05-14 11:40:13

- 憑藉歡迎的新通貨膨脹數據,特朗普總統對金融市場的看漲前景,以及Coinbase納入標準普爾500指數

-

-

- 下一個美國PPI數據發布只有幾個小時的路程。這導致加密市場的波動性增加。

- 2025-05-14 11:35:14

- 考慮到短期目標,這可能以積極的方式影響加密貨幣和股票市場。

-