|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin (BTC) price holds above $100,000, driven by "risk-on" sentiment after the CBOE Volatility Index (VIX) dropped to 20.

May 14, 2025 at 06:02 am

The Bitcoin Bull Score Index surged to 80, and the Fear & Greed Index suggests growing optimism, with historical patterns indicating potential for further price gains.

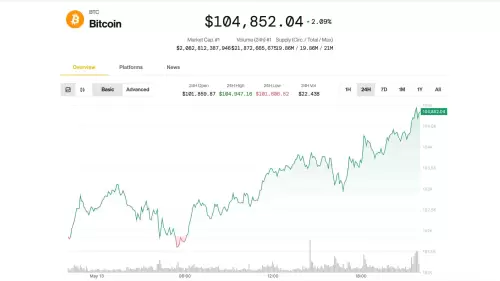

Bitcoin (BTC) price continues to consolidate higher above $100,000 following a drop in the CBOE Volatility Index (VIX) to its 30-year average of 20.

This compares to a peak of 60 earlier in 2025.

The decline in VIX follows a US-China trade deal on May 12, which saw a 90-day tariff pause and a 115% reduction in both countries.

This agreement has led to a “risk-on” sentiment, boosting Bitcoin and equities as investors prefer higher-risk assets, according to Bitcoin network economist Timothy Peterson. The analyst said,

“The good news continues to roll in with the CBOE Volatility Index (VIX) dropping to 20, which is about the 30-year average for VIX, last seen in early 2021. As VIX dropped below 25, my model Accuracy increased to 95% in predicting the direction of Bitcoin at the 100-day time horizon. VIX closed today at 19.38. My model predicts Up at this VIX level for the 100-day time horizon, which is a new model Accuracy high since Accuracy bottomed in early 2024 at 33%. At this VIX level, my model predicts that Bitcoin will continue trending up at the 100-day time horizon, continuing the recent pattern of VIX below 25 predicting further advances in Bitcoin.”

The US Consumer Price Index (CPI) inflation rate dropped to 2.3% year-over-year in April 2025, the lowest since February 2021, down from 2.4% in March and below consensus forecasts of 2.4%. This marks the third consecutive month of slowing CPI inflation.

This softer-than-expected CPI reading signals easing inflationary pressure, potentially increasing the likelihood of Federal Reserve interest rate cuts in 2025, assuming other economic indicators align.

With respect to the current macroeconomic dynamics—lower volatility, cooling inflation, and a trade war truce- it creates favorable market conditions for Bitcoin.

Earlier this month, Peterson noted that BTC could reach $135,000 within 100 days, citing a drop in the CBOE Volatility Index (VIX) from 55 to 25, signaling a “risk-on” environment. With 95% accuracy, his model links low VIX levels to increased investor confidence in riskier assets like Bitcoin.

Bitcoin bull score index surges to yearly high

After posting one of its least bullish phases in two years during April, Bitcoin sentiment flipped drastically to its highest reading in 2025. Data from CryptoQuant indicated a dramatic rise in the Bitcoin Bull Score Index, soaring from 20 to 80.

This shift, driven by rising spot demand outpacing supply, reflects patterns observed after the April 2024 halving, suggesting Bitcoin could be poised for further gains.

The Bitcoin Bull Score Index is a metric that combines several indicators to gauge the relative bullishness or bearishness of the market.

It takes into account factors such as price momentum, technical indicators, and on-chain metrics to provide a comprehensive view of the prevailing sentiment and trends.

The Fear & Greed Index also suggests growing optimism, currently at 53.3% and heating up slowly, according to Bitcoin researcher Axel Adler Jr.

The analyst discussed the possibility of a market “upswing,” expressing hope for a successful test and surpassing Bitcoin’s all-time high near $110,000.

However, he noted that the index remains in the "neutral" zone and has not yet reached the "overloaded" zone above 80%.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- Ruvi (RUV) Could Easily Outshine Avalanche (AVAX) as the Next Big Thing in Crypto

- May 14, 2025 at 11:40 am

- Disclaimer: The below article is sponsored, and the views in it do not represent those of ZyCrypto. Readers should conduct independent research before taking any actions related to the project mentioned in this piece. This article should not be regarded as investment advice.

-

-

-

-